Chainlink ($LINK) has quietly transformed from a DeFi oracle provider into one of the most critical pieces of infrastructure in the blockchain economy. With the launch of the Chainlink Reserve and the expansion of Payment Abstraction, $LINK now has a built-in demand engine fueled by enterprise adoption and onchain service usage. At the same time, its price action is heating up, with $LINK breaking above $20 and pushing toward the key $25 resistance. The big question now is whether these fundamentals and technical signals can carry $LINK to the next milestone at $30.

Why the Chainlink Reserve Matters?

The Chainlink Reserve is designed to funnel both onchain and offchain revenue directly into $LINK, supporting long-term growth. This is made possible by Payment Abstraction, a system that allows enterprises and users to pay in their preferred tokens or stablecoins, which are then automatically converted to $LINK. With offchain enterprise revenue now flowing into the Reserve, Chainlink has effectively built a demand engine that constantly absorbs $LINK supply.

This upgrade positions Chainlink differently from other networks that rely only on transaction fees. By tying enterprise adoption and tokenization infrastructure directly to $LINK accumulation, the Reserve acts as both a stabilizer and a growth driver for the token.

Chainlink Price Prediction: $LINK Price Action

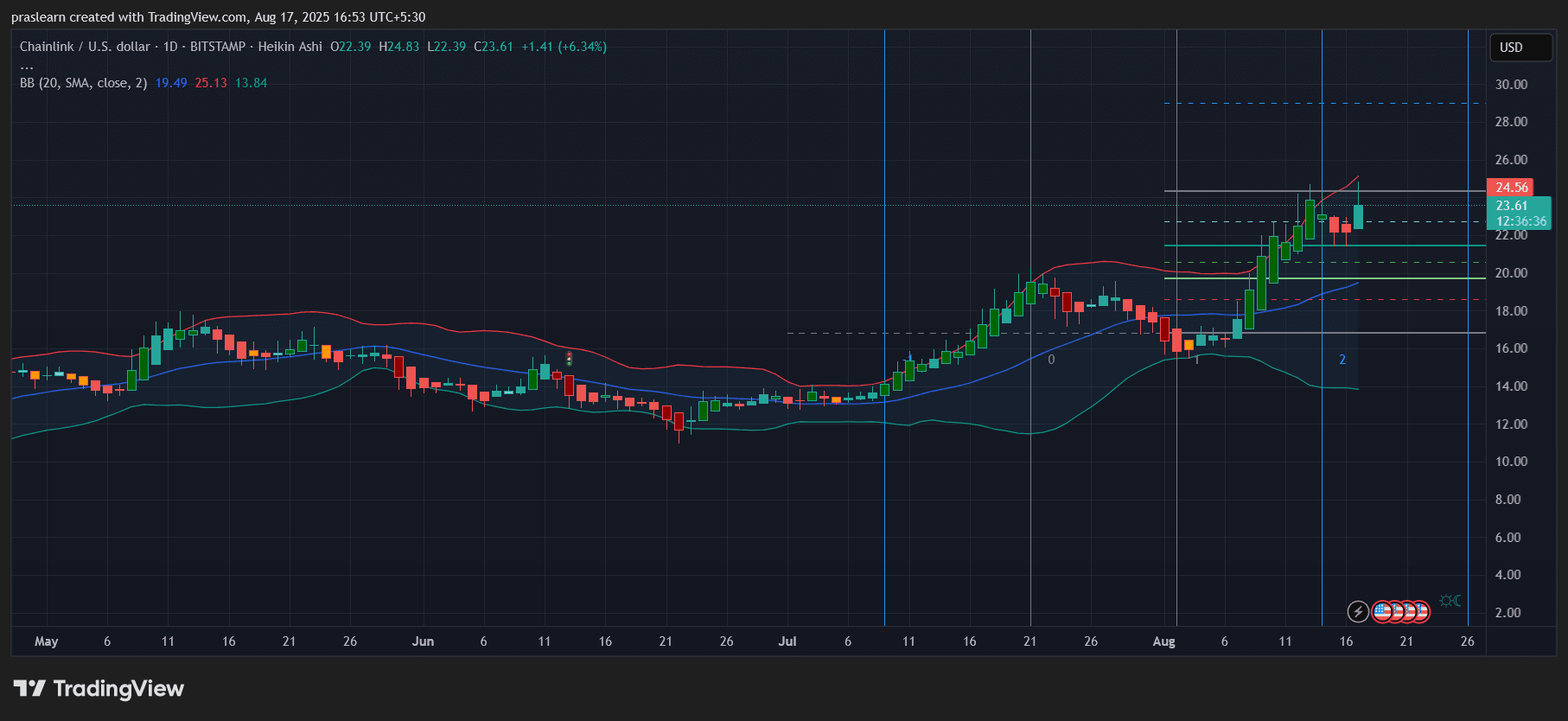

Looking at the daily chart, $LINK is trading at $23.61, up 6.34% on the day. A strong rally from early August pushed price through the psychological $20 barrier, marking a clear breakout from its prior consolidation.

The Bollinger Bands (BB) show widening volatility, with price hugging the upper band near $25.13, signaling bullish momentum but also short-term overextension. The recent wick rejection at $24.83 suggests profit-taking near resistance.

Key levels to watch:

- Immediate support: $22.00 (mid-range consolidation zone)

- Critical support: $19.50 (20-day SMA, bottom of BB range)

- Resistance zone: $25.50–26.00 (upper band and Fib extension)

- Breakout target: $30.00 (major psychological and Fib projection)

As long as $LINK holds above $22, momentum favors bulls. A close above $25 would likely set the stage for a run toward $28–30.

Chainlink’s Expanding Role Beyond Oracles

Chainlink is no longer just about price feeds. With over 2,000 oracles powering 60+ blockchains and securing $80B+ in value, Chainlink is now an institutional-grade infrastructure layer. Its Cross-Chain Interoperability Protocol (CCIP), automation tools, and compliance-ready features give it a unique position to power tokenized assets—a market projected in the trillions.

Where rivals offer fragmented services, Chainlink delivers a modular, unified platform. This integrated ecosystem makes it easier for enterprises to adopt blockchain solutions at scale while keeping compliance and privacy intact. The net effect: sustained demand for $LINK.

Chainlink Price Prediction: What to Expect Next for $LINK Price?

The $LINK rally is backed by both fundamentals and technicals:

- Bullish case: If adoption momentum and Reserve-driven demand persist, $LINK could push toward $28–30 in the coming weeks.

- Neutral case: Consolidation between $22–25 while traders wait for clearer signals.

- Bearish risk: A breakdown below $19.50 could pull $LINK back into the mid-teens, though fundamentals make this scenario less likely in the short term.

With Payment Abstraction tying enterprise revenue directly to $LINK demand, the token has a structural advantage compared to other altcoins. The next decisive breakout above $25 will be crucial for confirming a new leg higher.

$LINK’s fundamentals through the Chainlink Reserve are stronger than ever, while the chart signals momentum toward $30 if resistance breaks. Traders should watch the $22 support and $25 resistance closely for the next big move.

cryptoticker.io

cryptoticker.io