Hyperliquid, Bitget token and Movement added between 25% and 50% to their value this week. The three tokens have extended their gains in the past hour.

Amidst Bitcoin’s (BTC) crash under the $100,000 mark and market-wide correction in altcoins, these tokens hold on to their recent gains. An analysis of technical indicators shows it is likely that Hyperliquid (HYPE), Bitget token (BGB) and Movement (MOVE) extend their rally.

Table of Contents

Bitcoin decline does not fade these altcoin gains

Bitcoin slipped to a low of $92,232 on Friday after a steep correction from its $100,000 milestone. Bitcoin’s decline led to a market-wide correction in altcoins across categories on Thursday and Friday.

Even as the crypto market endured a bloodbath, Hyperliquid, Bitget token, and Movement held on to their gains over the past seven days.

Bitcoin’s decline is likely short-lived, and on-chain metrics paint a bullish picture for BTC.

BTC is likely entering the latter stages of its bull run; some on-chain indicators point to a cooling or slight overheating, with most metrics signalling a significant upside in 2025. The $100,000 milestone has emerged as a key resistance level for Bitcoin, and the cycle top is likely to emerge between $150,000 and $200,000.

HYPE, BGB and MOVE post double-digit rallies

HYPE hovers around $30 at the time of writing. The decentralized layer-1 blockchain specializes in trading and has amassed $2.191 billion in total value of locked assets, according to DeFiLlama data.

HYPE is currently 45% below its all-time high at $42.252. If the Layer 1 token enters price discovery, it could rally towards $60.491, the 161.8% Fibonacci retracement of the rally from the December 10 low to the December 12 peak, as seen in the 4-hour price chart.

The Relative strength index reads 62 and is sloping upwards. The moving average convergence divergence, a key momentum indicator, flashes red histogram bars under the neutral line. However, traders need to keep their eyes peeled as the MACD line prepares to cross above the signal line. This move could signal a shift in underlying momentum from negative to positive.

HYPE/USDT">

HYPE/USDT"> HYPE could find support in the Fair value gap between $20.250 and $20.600.

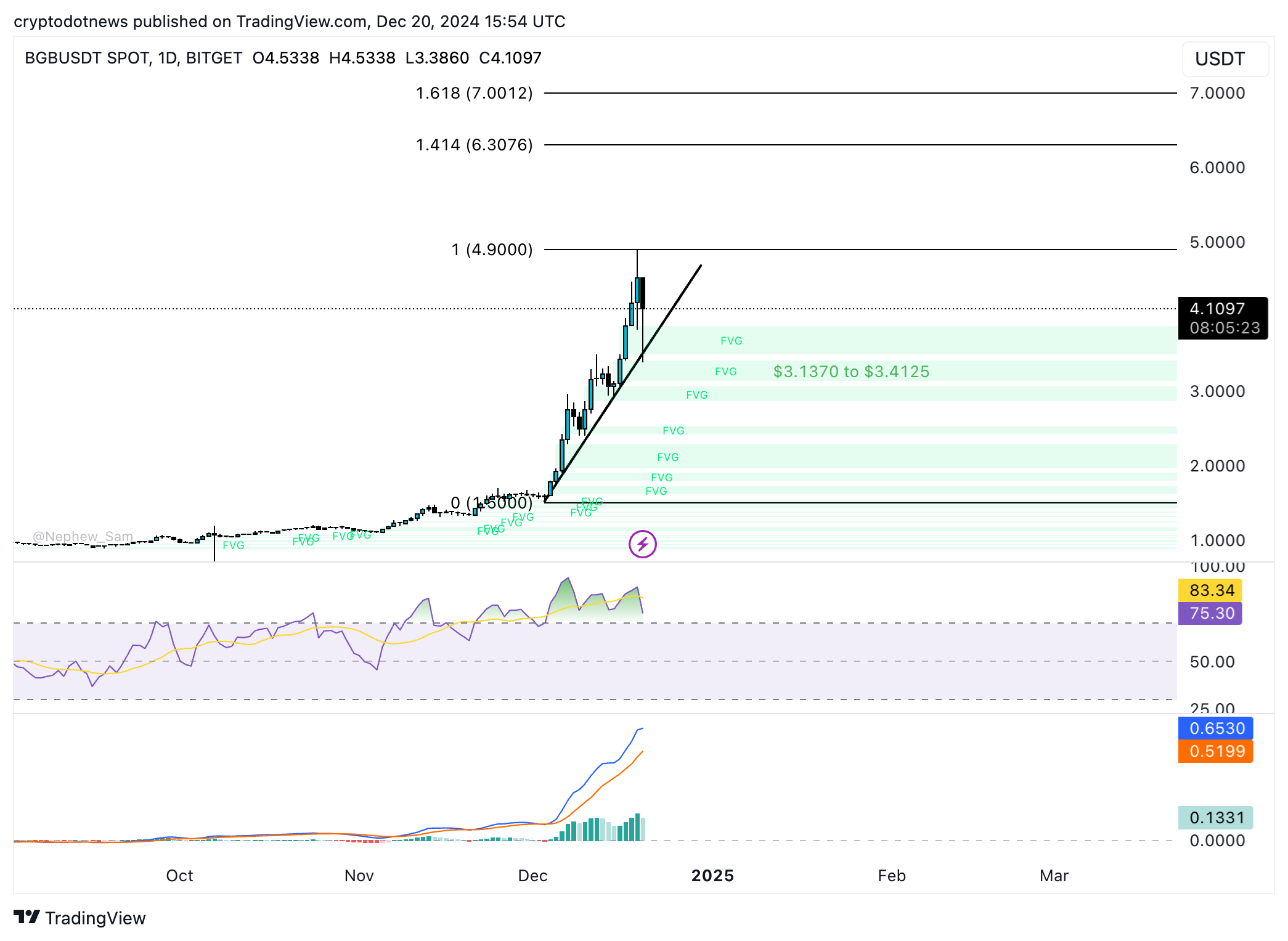

Bitget token (BGB) competes with exchange tokens like OKB of OKX and BNB of Binance. The token surged to an all-time high of $4.90 on Thursday, marking an increase of over 520% in the past 12 months.

In December, BGB climbed from $1.50 to its current high, indicating a monthly gain exceeding 100%.

BGB’s technical indicators remain bullish, however traders need to be cautious before adding to their positions in BGB since RSI is above 70 and shows that the token is overvalued.

If there is a correction, BGB could find support in the zone between $3.1370 and $3.4125, an FVG on the daily price chart.

Movement (MOVE) is the native token of the Layer 2 network built on Ethereum to boost scalability and introduce advanced features for users. MOVE gained nearly 25% in the past seven days, according to CoinGecko data.

The MOVE/USDT 4-hour price chart on Binance shows two key zones for MOVE: the resistance between $0.8891 and $0.9038 and the support zone between $0.6509 and $0.6836. Technical indicators on MOVE’s price chart support the thesis for further gains in the Layer 2 token.

MOVE hit its all-time high on December 10, following its listing on Binance, at $1.4100. Since then, MOVE corrected and started its recovery on Wednesday.

Derivatives traders make moves in the altcoins

Data from Coinglass shows that open interest in HYPE is up nearly 75% in the past 24 hours. The token is gaining relevance among market participants after adding to its value in the past week. Open interest in Hyperliquid exceeds $42 million.

Interestingly, the BGB token seems to have lost its relevance among traders, and OI is down 33.38%, down to $46.85 million. The long/short ratio is 0.8258, under 1, meaning there are more short positions than long, and traders are likely bearish on the token.

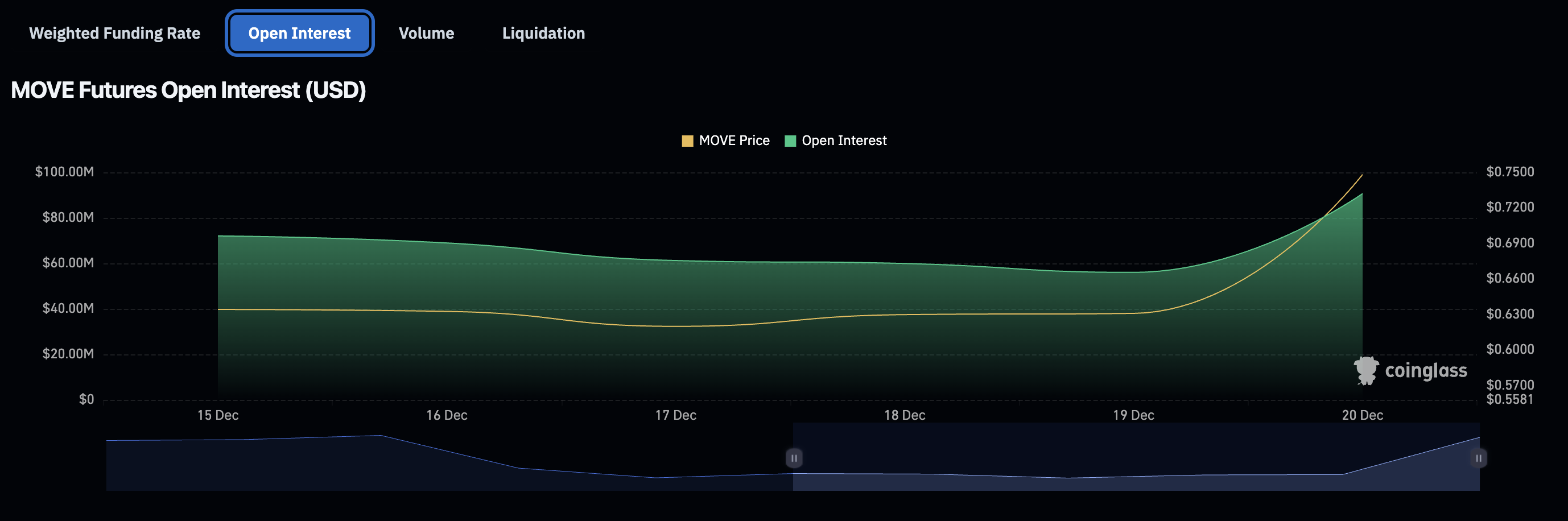

Derivatives traders are bullish on MOVE, and there is an excess of long positions since the long/short ratio exceeds 1 on Binance and OKX. The OI climbed 18% and exceeds $101 million, according to Coinglass data.

Strategic considerations

If the inflow of institutional funds to Bitcoin ETFs slows down, Bitcoin could be faced with a further correction before the end of 2024. A decline in BTC typically negatively affects altcoins and tokens across all categories.

Traders need to be cautious of adding to their long positions. Recent gains in tokens like HYPE, MOVE and BGB could be erased in the event of a flash crash or market-wide bloodbath, as the one noted on Wednesday and Thursday this week.

Bitcoin is back above $97,000 on Friday, and a return above the $100,000 mark could support extended price rallies in altcoins.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.