This is a segment from the Empire newsletter. To read full editions, subscribe.

If we’re trying to celebrate Christmas, then we need to bring out some green to even out the red this morning.

Kraken’s Thomas Perfumo already warned us last week that we could see some pullbacks ahead of the holidays, and that seems to be ringing true right now. Whether or not we see the selling countered is another story.

But I’m not actually here to talk about markets. Or, I should say, I’m not talking about what the markets are doing today.

Earlier this week, Coinbase Institutional released its market outlook for next year.

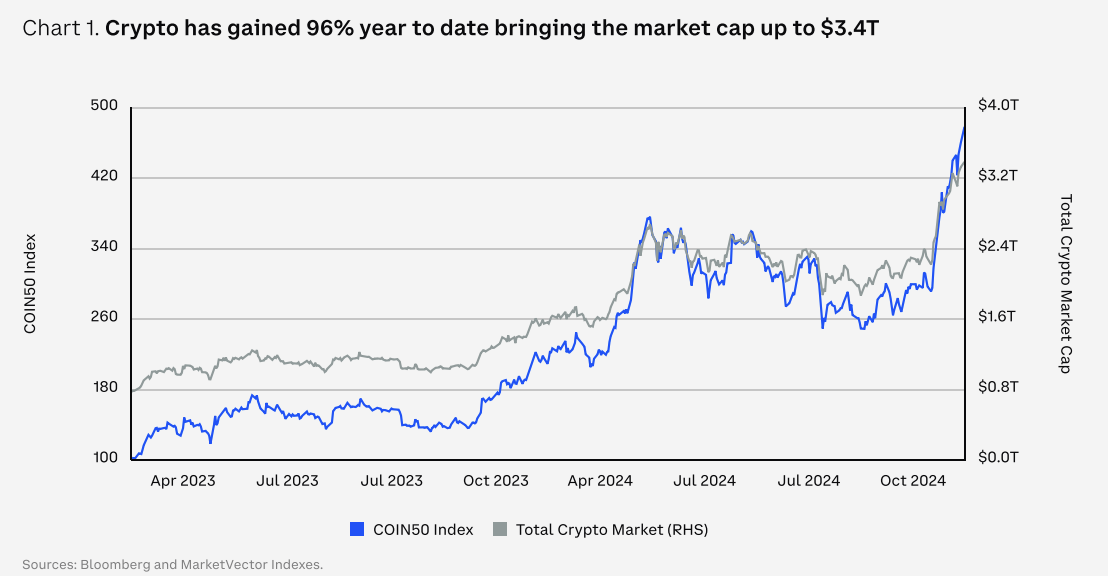

David Duong, head of research, pointed out in the note that the 2024 uptrend has shown some “stark” differences to previous cycles, but the overall landscape looks “promising” still.

VanEck, in its predictions, otherwise said it believes that the bull market’s going to carry on next year, peaking at around $180,000. After that, they expect a 30% retracement from bitcoin and altcoins could see double that.

“A recovery is likely in the fall, with major tokens regaining momentum and reclaiming previous all-time highs by the end of the year,” VanEck wrote.

But even if we see a decline, Coinbase Institutional came off pretty bullish in their note.

“As the regulatory and technological landscapes evolve, we expect to see substantial growth in the crypto ecosystem as wider adoption drives the industry closer to achieving its full potential. This will be a pivotal year. The breakthroughs and advancements of 2025 may very well help shape the long-term trajectory of the crypto industry for decades to come,” Duong wrote.

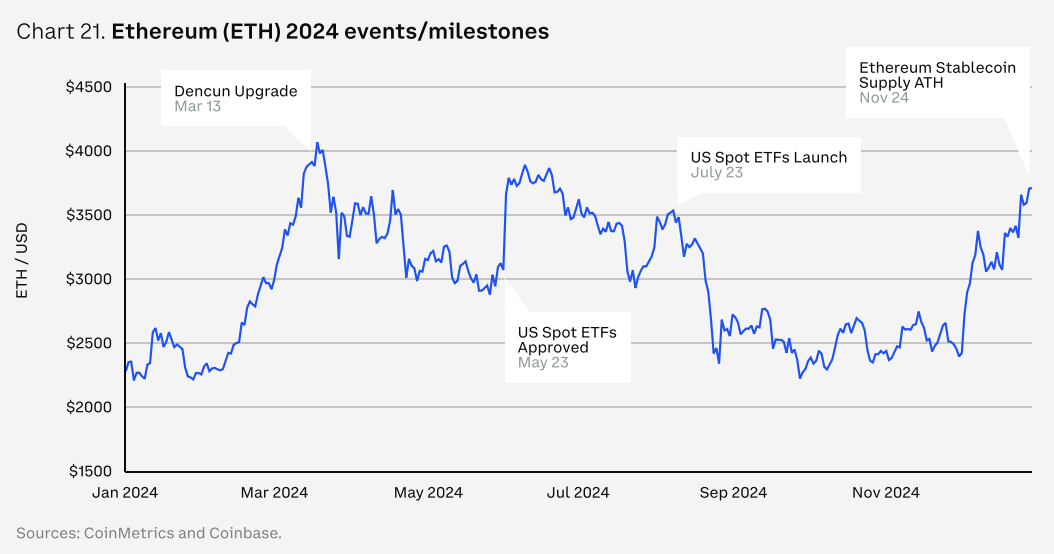

Let’s zoom in on a question I’ve asked a number of people now: Can ETH make a comeback next year?

ETH’s just been lagging behind, watching from the sidelines as both bitcoin and solana carve out new all-time highs.

In the long-term, Duong and his team think that the growth of the Ethereum L2 ecosystem is a “boon,” but it’s not clear right now if that’s going to be enough to aid ETH in the short to medium term.

21Shares, in their predictions report, thinks that Solana is going to continue to eat Ethereum’s lunch.

“While we don’t anticipate a full ‘flippening,’ Solana is primed to outperform and capture more market share from Ethereum through improved UX and infrastructure,” 21Shares analysts wrote.

They also think that Ethereum is primed for a “revenue renaissance” beginning next year.

“Web2 firms like Robinhood and PayPal, along with traditional finance entities like Visa, are likely to launch their own L2s, leveraging cost-efficiency and scalability to unlock new revenue streams and serve a growing demand for decentralized applications,” they said.

So maybe things aren’t looking so bad after all.

blockworks.co

blockworks.co