As 2024 nears its close, the cryptocurrency market is once again showcasing its dynamic and volatile nature, capturing the attention of traders and investors navigating shifting trends.

Following a sluggish start to the month, the global market has rebounded sharply, with Bitcoin (BTC) surging to a new all-time high of $108,268, sparking renewed optimism across the digital asset space, despite experiencing a slight pullback.

As uncertainty continues to loom over traditional financial markets, the crypto space appears poised on the brink of a massive bull cycle.

This ongoing bullish sentiment is particularly beneficial for several cryptocurrencies approaching significant market cap milestones, including the notable $10 billion mark.

Finbold has identified two digital assets—Aave (AAVE) and NEAR Protocol (NEAR)—as strong contenders to surpass this threshold. These projections are driven not only by the continuation of the broader bull run but also by the impact of high supply inflation, which could propel market cap growth even if price movements remain relatively moderate.

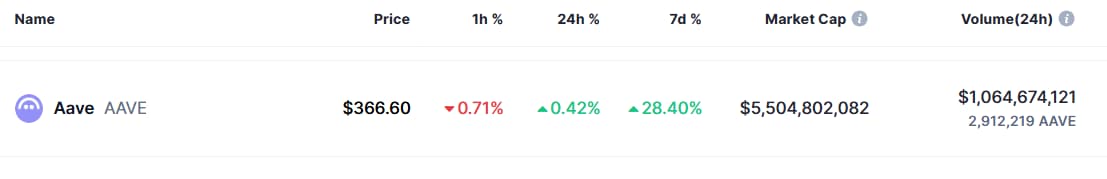

Aave (AAVE)

AAVE is emerging as a top contender to reach a $10 billion market cap in 2025, backed by its dominance in decentralized finance (DeFi), expanding partnerships, and surging investor interest.

Currently holding 45% of the DeFi lending market share, Aave remains the undisputed leader, supported by a total value locked (TVL) of $22.4 billion, nearly matching the combined TVL of other major lending protocols, as per DeFiLlama.

The protocol’s growth is further fueled by key partnerships, including its integration with Linea, a Consensys-backed zk-rollup network, which promises lower transaction fees and improved scalability, two critical factors for attracting new users.

Additionally, collaborations with Balancer v3 and deployments on Ethereum (ETH) to enable borrowing and lending for ETH, Wrapped Bitcoin (WBTC), and major stablecoins like USDC and USDT have significantly boosted liquidity and utility, making Aave a top choice for borrowing and lending.

Coupled with the broader crypto market rebound, Bitcoin’s march past key milestones, Aave’s strong fundamentals, and ongoing expansion position it to potentially double its current $5.5 billion market cap, placing the $10 billion mark well within reach.

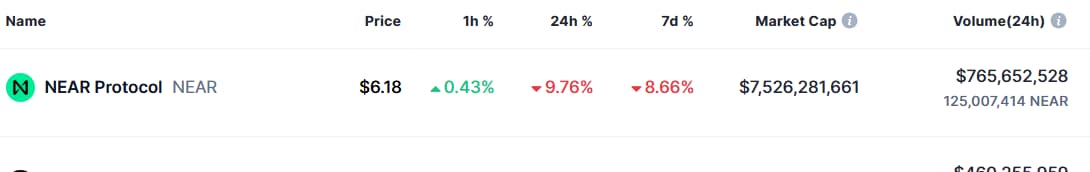

NEAR Protocol (NEAR)

NEAR Protocol’s path to a $10 billion market cap hinges on its underlying market strength and improving investor sentiment. Despite a 5.56% decline in derivatives trading volume to $635.54 million and a 10.9% drop in open interest to $356.57 million, key indicators reveal a bullish undertone.

The long/short ratio across major exchanges like Binance and OKX remains firmly positive, with Binance’s top trader long/short ratio at 4.72 and OKX at 2.52, reflecting strong buy-side confidence.

Additionally, NEAR’s recent liquidations favor long positions, with $2.05 million in liquidated longs in the past 24 hours compared to only $66.96K in shorts, highlighting persistent bullish momentum despite short-term market caution.

NEAR’s robust DeFi and AI-driven use cases, coupled with investor accumulation near key support levels, suggest a breakout. Analysts are expecting a bounce back from the $6 level, followed by a pump toward $8 to $9, which could potentially push its market cap to the $10 billion mark.

For investors and traders, both assets offer compelling entry points supported by strong fundamentals and technical indicators.

Watching key levels, trading volumes, and ecosystem updates will be crucial for maximizing gains as AAVE and NEAR approach their next growth phase.

Featured image via Shutterstock.

finbold.com

finbold.com