Chainlink price is poised for explosive growth as SWIFT and Coinbase adopt its CCIP technology to bridge traditional finance with blockchain.

With a golden cross confirming a long-term uptrend, analysts speculated $LINK could target $800 in the next market cycle.

Coinbase Adopts Chainlink CCIP to Drive Institutional Digital Asset Growth

To bolster institutional adoption of assets, Coinbase has integrated Chainlink’s Cross-Chain Interoperability Protocol (CCIP).

The CCIP creates secure and compliant tokenized asset solutions that connect traditional finance with blockchain technology.

Simply put, this collaboration shows Coinbase as a forerunner in fostering blockchain’s adoption by real-world financial systems.

Its goal is to attract banks, asset issuers, and financial institutions to build on its scalable tokenized asset solution.

.@coinbase’s Project Diamond integrates the Chainlink standard to accelerate digital asset adoption.

— Chainlink (@chainlink) December 10, 2024

Institutions will be able to leverage Chainlink to manage the full lifecycle of tokenized assets on the Project Diamond platform.https://t.co/wTkQEphaQt pic.twitter.com/S2BYy7NWCH

As part of CCIP, Chainlink is teaming up with major institutions such as Swift and Fidelity in order to enhance its position within the trillion-dollar Real World Asset (RWA) market space.

This forms infrastructure that solves the inherent problem of interoperability between a growing number of blockchain-based financial systems.

Because $LINK is utilized in the ecosystem, we can expect this collaboration to greatly benefit it.

Should further adoption occur, analysts predict a rise in the adoption that could continue to push Chainlink price towards its higher targets, which some see reaching $800 if institutions also picks up.

The step was part of a larger transition financial systems were going through, intertwining blockchain technology and legacy asset management.

SWIFT Partners With Chainlink to Revolutionize Finance, $LINK Poised for Growth

Next year, SWIFT is slated to use Chainlink to integrate decentralized and centralized financial systems.

With this integration, secure and interoperable data transfers between traditional financial networks and blockchain platforms will be supported.

Given that SWIFT processes a whopping $150 trillion of transaction volume annually, such adoption of Chainlink’s technology is a big deal.

SWIFT is going live with $LINK next year and your $50-100 price targets will be blown out of the water. ETH almost hit a $600B market cap last cycle. SWIFT does $150T per year in volume. $LINK is going to a $500B+ market cap this cycle. pic.twitter.com/W26oEJhotM

— nicu (@nicucrypto) December 10, 2024

Demand for $LINK tokens, required for Chainlink’s decentralized ecosystem, is expected to sharply increase in partnership.

According to analysts, this collaboration can take Chainlink’s market cap towards a speculative $500 billion, competing with Ethereum’s previous cycle top.

This adoption could result in increased adoption of $LINK as a key asset of both traditional and decentralized financial worlds.

Beyond their effect on price, integration of the above could result in a standard tokenized asset system between financial institutions.

This development could set to loosen up massive liquidity and speed the adoption of blockchain technologies by large institutions.

Chainlink’s collaboration with SWIFT bolsters the increasing significance of decentralized solutions in disrupting the financial industry.

Chainlink price: 50-Day SMA Crossing Above 200-Day SMA Sparks Optimism

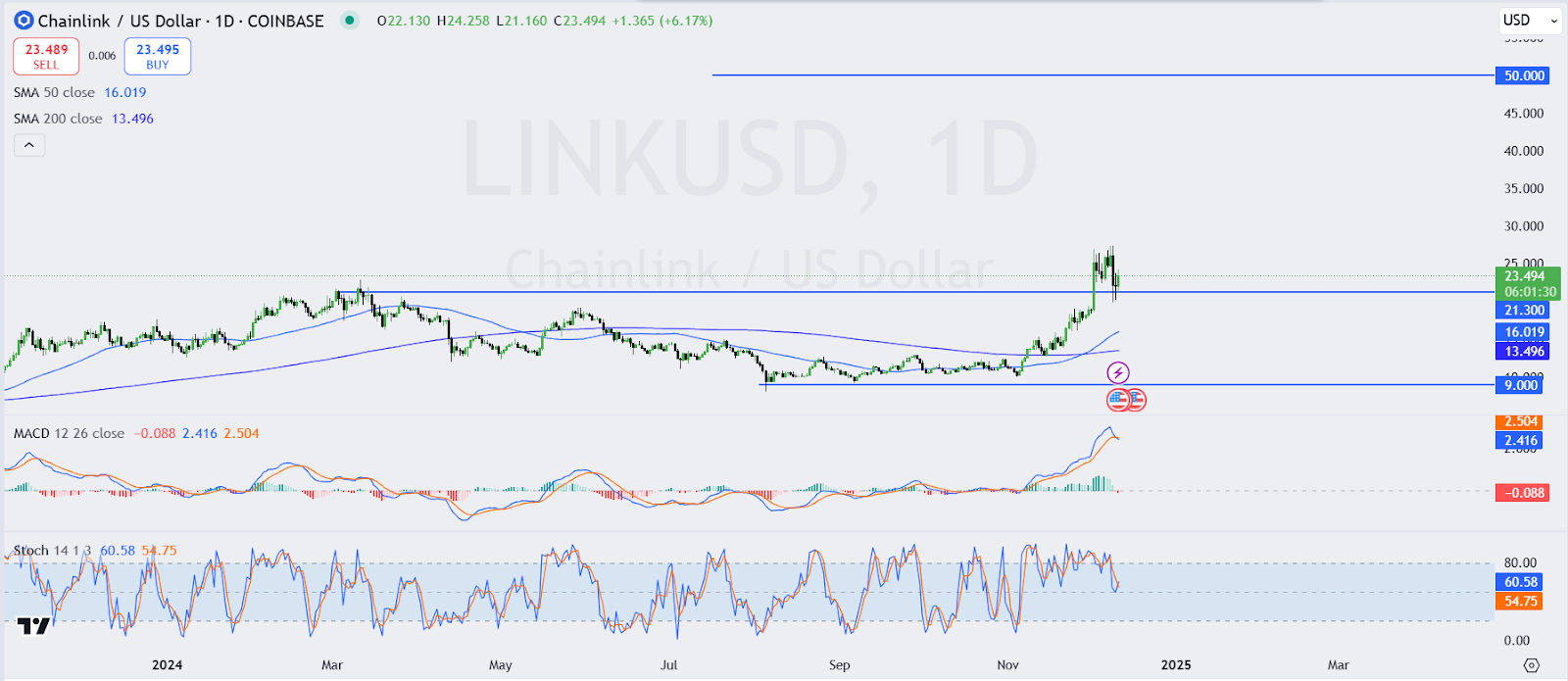

A golden cross formed on the 50-day SMA crossing above the 200-day SMA on the Chainlink price daily chart, which was a bullish signal.

This crossover confirmed bullish momentum on the long term and reinforced the belief of Chainlink’s bullish price trend.

$LINK price also showed support levels at $21.300, $16.019, and $13.496, so it provided price movements with a base.

Looking at the momentum indicators, the MACD was positive but declining and contracting, implying decreasing bullish momentum.

The stochastic oscillator was in neutral territory indicating the market was neither overbought nor oversold.

As per these indicators, $LINK`s price was in consolidation and needs to wait for further price action.

If $LINK stayed above $21.30, bulls could likely aim to push through $30.00 or higher yet.

Nevertheless, a drop below could see prices extend downward towards the 50-day SMA at 16.019 or even to the 200-day SMA at 13.496 next.

thecoinrepublic.com

thecoinrepublic.com