Polkadot’s native crypto DOT finally found favor with the bulls in November after months of sustained sell pressure.

However, the bears are back again doing their thing this month judging by pullback that occurred from its recent peak.

DOT price peaked at $11.64 on 4 December and has since dipped by over 35% to its recent low of $7.5 on 9 December. This pullback signaled that heavy profit-taking ensued after the November rally.

More importantly, the recent pullback dropped into an important Fibonacci level. It came in between the 0.618 and 0.5 Fibonacci price levels, based on its November lows to its recent top this month.

DOT sell pressure has notably cooled off since it entered the Fibonacci zone. This is because it is in this zone where the bulls are likely to regain their momentum. This suggests that DOT re-accumulation had already resumed.

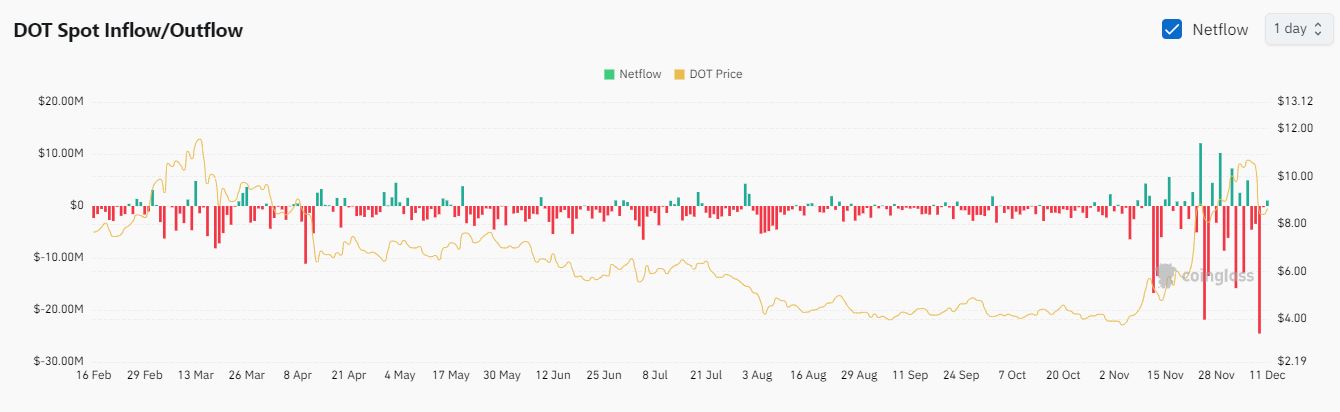

DOT Spot Outflows Intensified This Week

While bullish momentum is expected with the recent dip into the Fibonacci zone, prospects of sell pressure remained strong. DOT spot outflows were significant since the start of December.

Spot outflows peaked at $24.52 million on 9 December. The highest spot outflows observed in 2024. However, they cooled off in the last 2 days.

This was in line with the massive spike in sell pressure observed during the same day for DOT price.

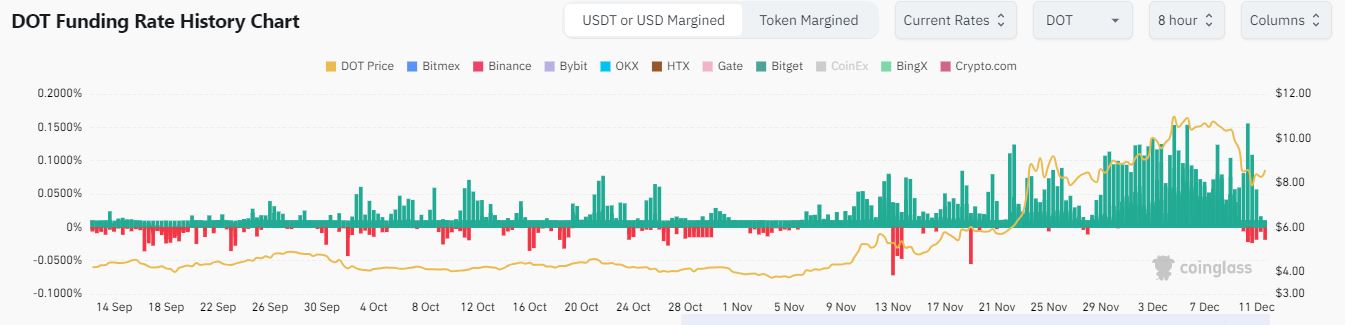

DOT spot flows were also in line with the condition in the derivatives segment. Open interest dropped considerably over the last few days.

It is worth noting that DOT spot flows turned positive again in the last 24 hours.

There was also an uptick in negative funding rates. This confirmed that derivatives had shifted especially in the last 2 days, in favor of shorts.

The shorts vs longs ratio on Coinglass may have signaled the changing sentiment among investors. This was evident by the sudden shift in the ratio in the last 2 days. Shorts were dominant at almost 56% on 9 September as the height of sell pressure.

Ever since DOT price dipped into the Fibonacci ratio, the number of longs surged significantly. Longs were dominant at 51.22% on 11 December, reflecting the recent price uptick and changing sentiment.

Traders saw the recent dip as an opportunity for significant gains especially since the market is in the season of new highs. DOT price, at its press time level, offered a 30% uptick to its recent local high.

Polkadot Price Prediction

But what are the odds that the price could rally to those highs this week? Well, it turns out that the recent wave of sell pressure has dampened market sentiment.

For context, the crypto fear and greed index hovered at 74 at press time, down from 78 the previous day.

Further decline in market sentiment means investors will shy away from injecting liquidity back into coin like DOT, despite bullish signs.

On the other hand, DOT price could decouple from the overall market sentiment if it finds enough favor with the bulls.

If such an outcome occurs, then it could resume its bullish surge as was the case in November.

thecoinrepublic.com

thecoinrepublic.com