This is a segment from the Empire newsletter. To read full editions, subscribe.

When Cobie was tweeting about his pyramid-shaped philosophy on building the perfect crypto portfolio — you listened.

Maybe you even saw the benefit of spreading your capital across bitcoin, ether and solana in a 50/35/15 split. Depending on the execution, those strategies would’ve easily paid off during the bull market to date.

It still probably hurts to know that they’ve been blown out of the water by Milady and Pudgy NFTs.

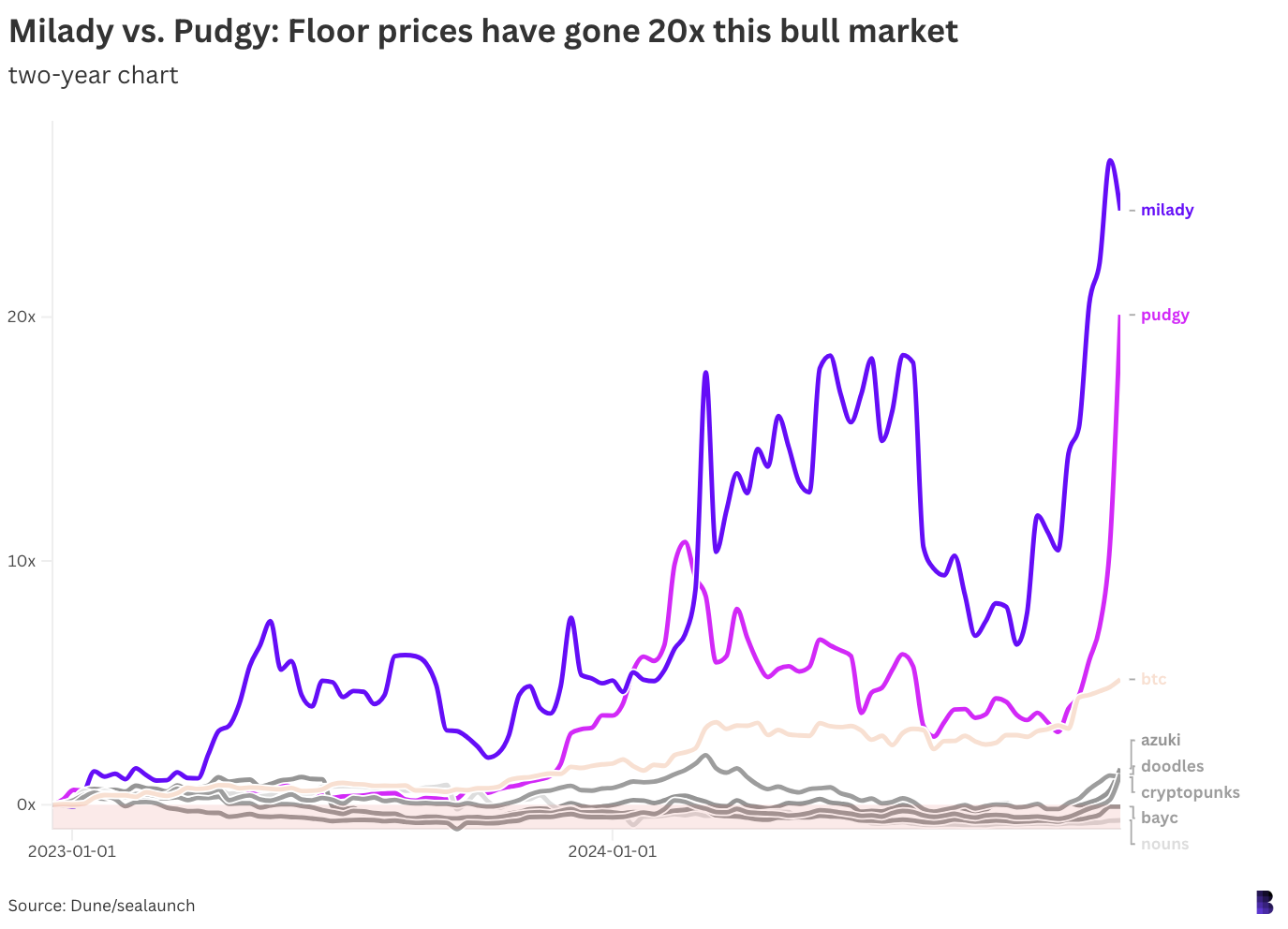

USD-denominated floor prices for both NFT collections have now gone more than 20x since December 2022.

The cheapest Miladys went for the ETH equivalent of $890 back then — today they go for $22,570.

At the same time, Pudgys have exploded from $5,070 to $106,900. Floor Pudgys are now technically more expensive than bitcoin, although with far less supply.

BTC has meanwhile managed around 6x and ETH 3x, while SOL is currently at 18.5x.

Then again, you can’t buy stuffed collectible bitcoins at Walmart.

Of course, NFT markets are far smaller and less liquid than major coins. They tend to undergo outsized pumps when volume suddenly picks up.

Most of the gains have come in the past month or so: There were only about 1,000 Pudgy trades in the past week and 1,900 in the past month. 400 and 1,240 for Miladys.

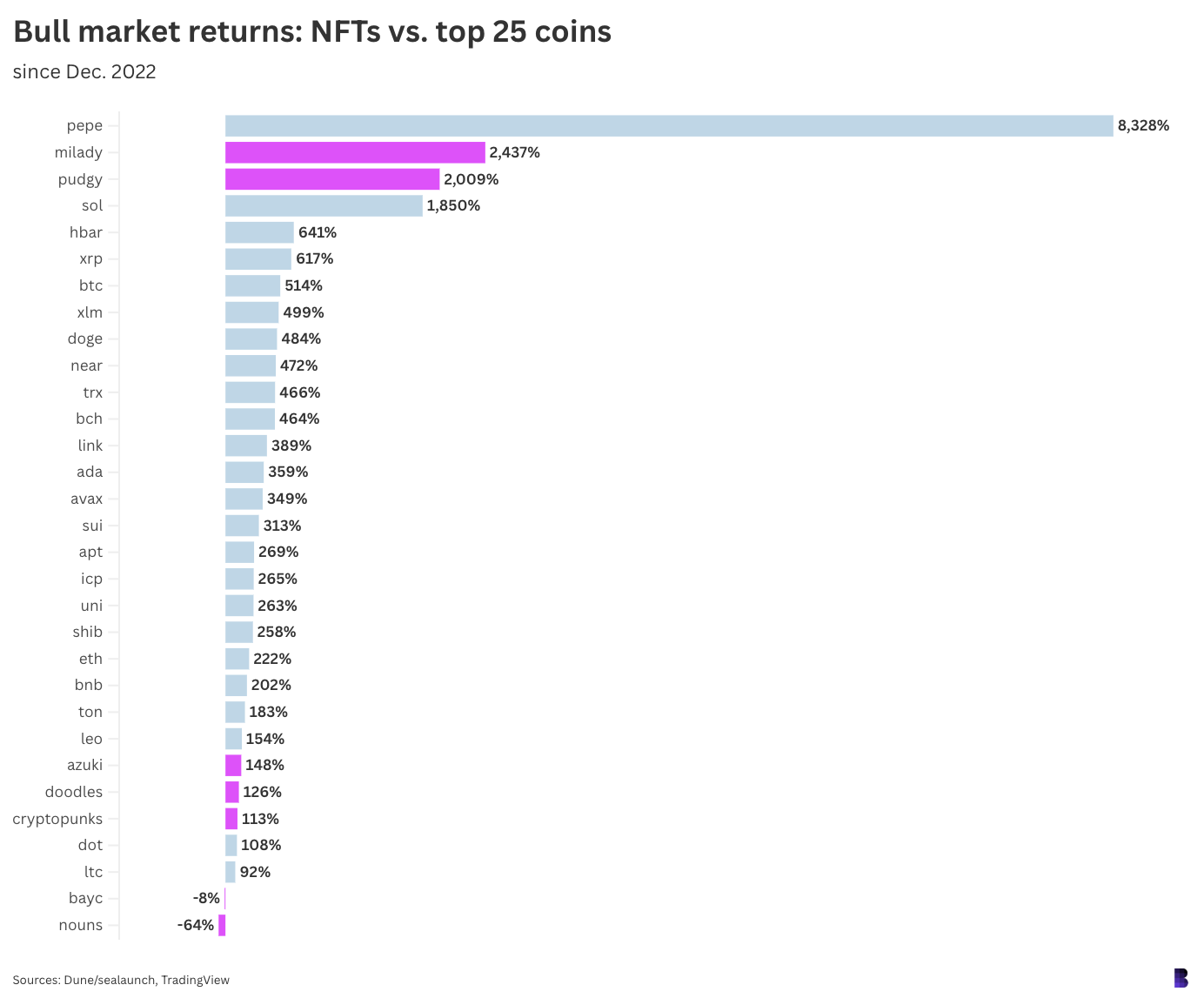

In any case, there’s no denying that floor Miladys and Pudgys are now two of the best-performing crypto assets in this bull market.

Only one top-25 coin has outperformed them: PEPE.

Floor prices for Azuki, Doodles and CryptoPunks have still more than doubled, but that’s less than most major coins excluding LTC and DOT.

Bored Apes and Nouns have even lost value against the US dollar.

Still, if you were searching for indicators of how silly the next bull market phase could get, look no further.

blockworks.co

blockworks.co