During Monday’s market session, the crypto market witnessed a notable downtick as Bitcoin dived 3.3% to plunge below the $100k mark. The $BTC’s struggle to sustain above this psychological level has initiated a consolidation phase in the altcoin market. Amid the uncertainty, the Chainlink price revealed the formation’s well-known bull-flag pattern, signaling the potential for $30 soon.

Currently, the $LINK price exchanges hands at $24.3, with an intraday loss of 6.6%. According to Coingecko, the global crypto market cap is at $3.86 Trillion, with an intraday gain of 0.8%. Meanwhile, the 24-hour trading volume is at $393 Billion.

Key Highlights:

- The chainlink price is 12% short from a bullish breakout from the bull-flag pattern.

- $LINK coin consolidation experiencing whale buying signals the potential for an extended uptrend.

- The $LINK buyers could witness an overhead supply pressure at $26.9 followed by $30 levels.

Chainlink Ecosystem Flourishes with Surge in User Engagement

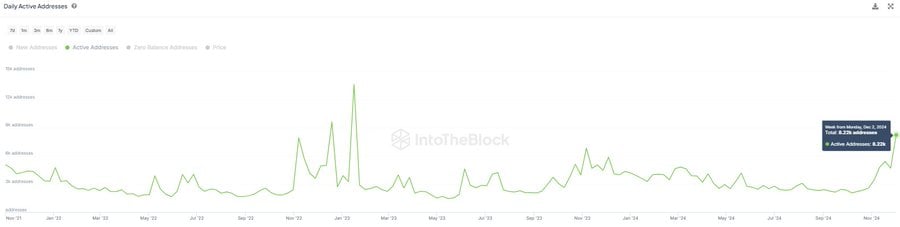

Chainlink, a decentralized Oracle network, has reported significant growth in its daily active addresses. According to data from IntoTheBlock, the platform is now averaging 8.22k active addresses daily, marking a staggering 142% increase compared to its performance a month ago.

This surge highlights a renewed interest in Chainlink’s ecosystem and indicates a robust rise in user engagement, signaling a positive trend for the project’s future trajectory.

Whale Accumulation Highlights Confidence in Chainlink Price Breakout

Advertisement

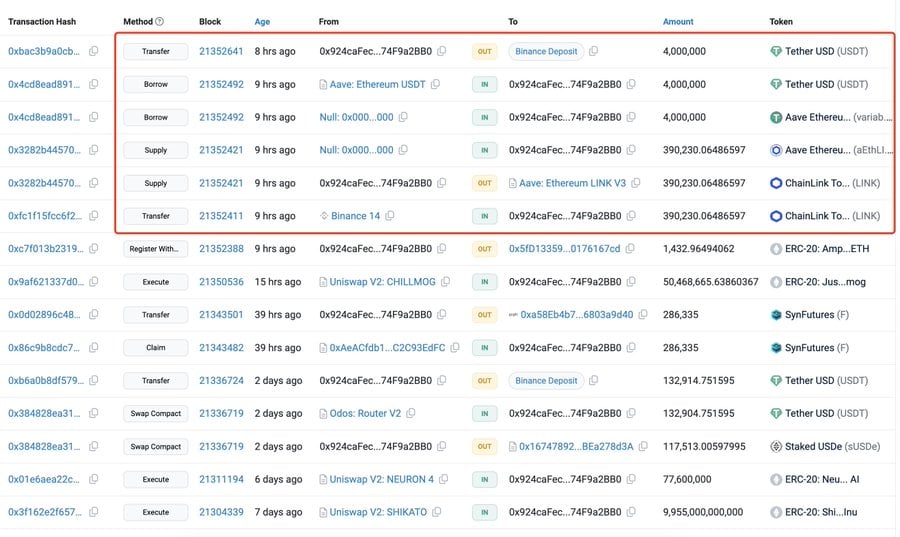

According to onchain data tracker Lookonchain, a crypto whale on Sunday bought 390,230 $LINK( worth approximately $9.68M ) from Binance exchange and deposited it to leading protocol $AAVE.

Later, this large holder borrowed 4 Million $USDT from $AAVE and deposited it to Binance, potentially to buy more $LINK tokens. This acclimation highlights the whale’s confidence in $LINK’s future momentum.

Historically, whale accumulation has coincided with market reversal or key breakout, indicating a dynamic moving near for chainlink price.

Bull-Flag Formation Hints at $LINK Rally to $36

Since last weekend, the Chainlink price has resonated within $27 and $22.7 horizontal levels. While the consolidation followed $BTC’s sideways action below $100k, the $LINK coin projecting rejection candles on either side indicates no clear initiation from buyers or sellers.

However, the altcoin revealed this lateral movement as the formation of a bull-flag pattern in a 4-hour chart. Theoretically, the pattern offers a temporary breather for buyers to rebuild exhausted momentum.

Thus, a potential breakout from the pattern overhead resistance will accelerate the buying pressure and drive a rally to $30, followed by the $36 level.

cryptonewsz.com

cryptonewsz.com