Cardano has been seeing an impressive amount of interest from large holders as it defied the market-wide turbulence with a price hike.

As expected, Cardano (ADA) went on a rally to an 18-month high of $0.80 early Wednesday. ADA’s bullish momentum surfaced while the broader crypto market witnessed a decline — the global cryptocurrency market cap fell 1.2% in the past 24 hours to $3.22 trillion, according to CoinGecko data.

Cardano is up 4.1% over the past day and is trading at $0.79 at the time of writing. Its daily trading volume increased by 24%, reaching $2.27 billion.

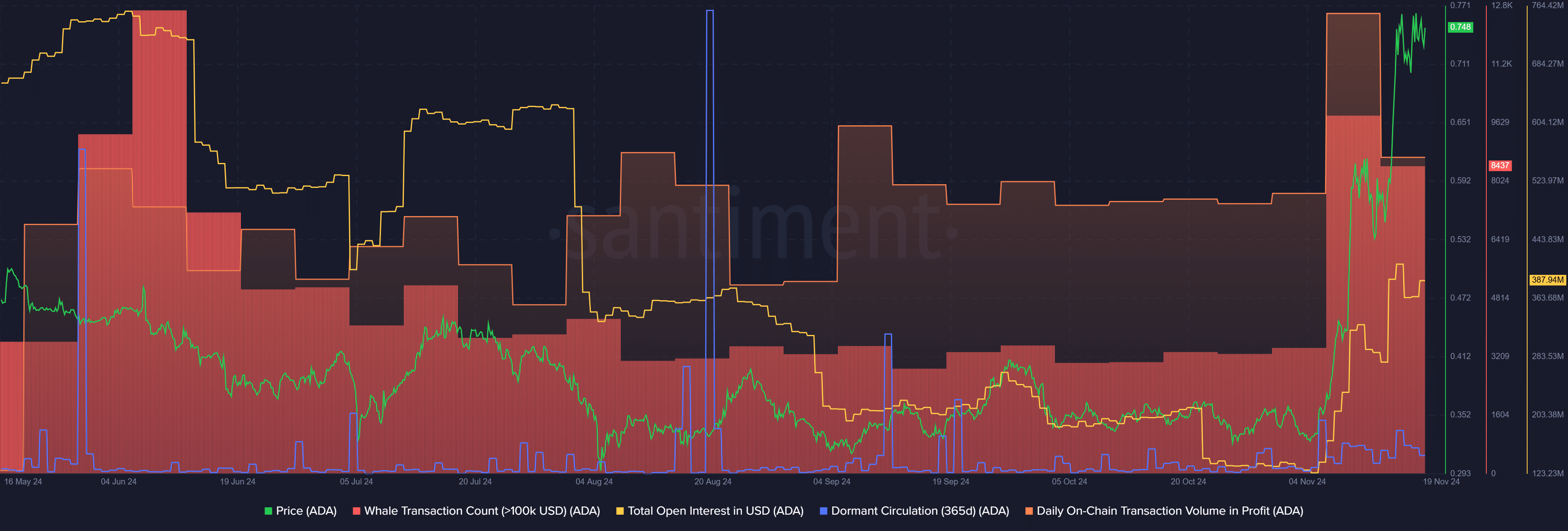

The surge came thanks to an impressive rise in Cardano’s whale activity. Large transactions consisting of at least $100,000 worth of ADA reached 9,824 last week, marking a five-month high, according to data provided by Santiment.

Moreover, the Cardano total open interest also broke the $400 million barrier for the first time since early August, per Santiment data. The indicator shows increased interest from derivatives traders.

Despite the price surge, long-term Cardano holders with positive returns have declined. Data from the market intelligence platform shows that the asset’s one-year dormant circulation dropped from 69.3 million ADA on Nov. 16 to 30.5 million ADA on Tuesday.

Similarly, the weekly on-chain transaction volume in profit also plunged from 36.4 billion ADA to 29.6 billion ADA over the last two weeks.

This shift in the investors’ movements suggests that the profit-taking trend has cooled down at this point as ADA holders might be eying a further upside.

However, it’s important to note that the increasing trading volume, whale transactions and open interest could put Cardano in the highly volatile zone. The rise of the Ukraine-Russia conflict could also add to the market volatility.