Mantra’s price rally started to lose momentum as some whales began selling their tokens after it became highly overbought.

Mantra (OM) token rose to a record high of $4.5260 on Monday before pulling back slightly to $4.3. It remains one of the best-performing cryptocurrencies, having soared by almost 20,000% over the past 12 months. This surge has brought its market cap to $3.8 billion.

Mantra’s rally followed a teaser from its developers about an important upcoming announcement. While no specific details were provided, speculation suggests the news could involve a significant partnership with a large company.

This anticipated announcement comes a month after Mantra launched its mainnet, enabling developers to build tokenized projects in industries such as real estate and finance. While similar capabilities exist on other blockchains like Ethereum and Solana, Mantra has positioned itself as a leading chain for these sectors.

There are signs that some Mantra whales have started selling their tokens. One whale transferred OM tokens worth $1.3 million to Binance, while another sent tokens valued at $534,000 to OKX.

Altogether, data compiled by LlamaFeed shows that tokens worth over $10 million in the last 24 hours. The biggest of these sellers was one who sold tokens worth $3.6 million and paid a transaction fee of $0.82.

Data from Nansen indicates that the volume of Mantra tokens on exchanges increased by nearly 10% in the past seven days to over $158 million. Currently, 17.8% of all OM tokens are held on exchanges, an increase of 1.52% from the previous week.

Mantra price gets overbought

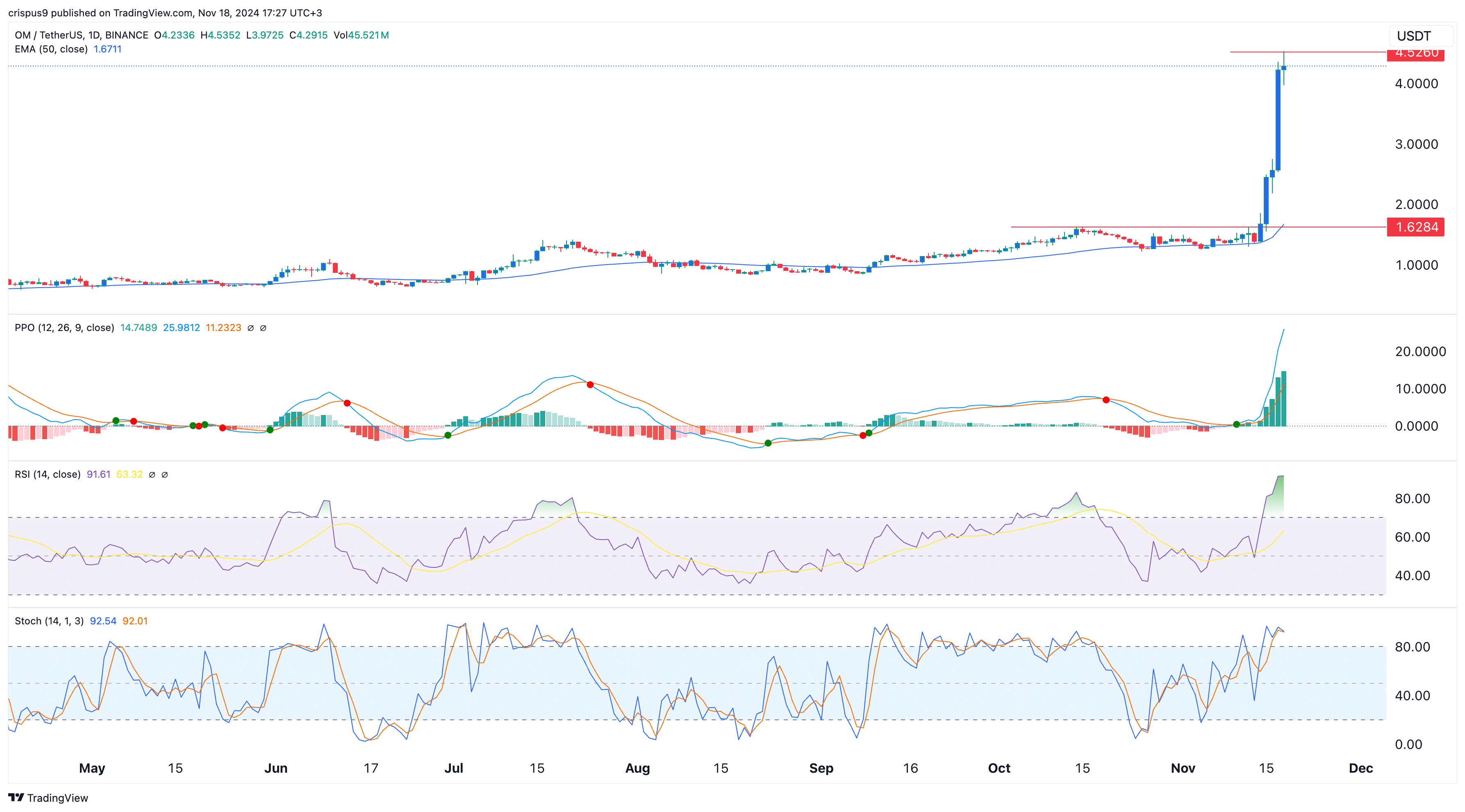

OM token prices have gone parabolic in recent days. On the daily chart, the Relative Strength Index has surged to an extremely overbought level of 92. Similarly, the Stochastic Oscillator has reached 92, and the Percentage Price Oscillator has spiked.

As a result, there is a high likelihood of a significant drop in the token’s price as momentum fades. If this occurs, Mantra’s price could decline to as low as $1.6, which was its highest level on October 15—a 62% drop from its current price.