Dogecoin (DOGE) has experienced a dramatic price surge, pushing it to a 42-month high and solidifying its position as the leader among meme coins. This 100% rally over the past week has reignited investor interest, with many hoping for continued growth.

However, there are signs that DOGE’s price might soon face challenges, as the current momentum could shift.

Dogecoin Is Reaching Its Saturation

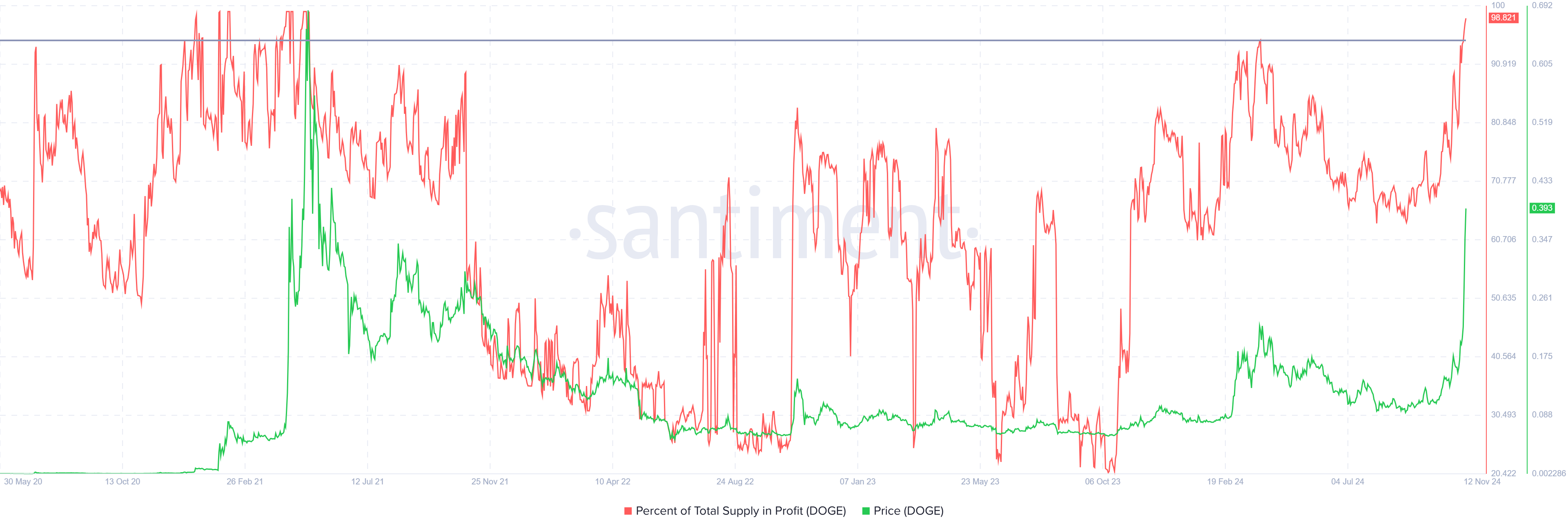

At present, approximately 98% of Dogecoin’s total supply is in profit, indicating significant gains for most investors. Historically, when over 95% of a coin’s supply is in profit, it signals a potential market top.

This pattern often precedes a price correction, as high-profit levels encourage investors to sell, triggering a pullback. Such profit-taking behavior could put downward pressure on DOGE’s price.

The current high profit levels among DOGE holders raise concerns about a potential reversal in the market. These widespread gains among holders suggest that the urge to lock in profits could soon outpace the desire for further gains, possibly leading to a shift in sentiment that favors selling over holding.

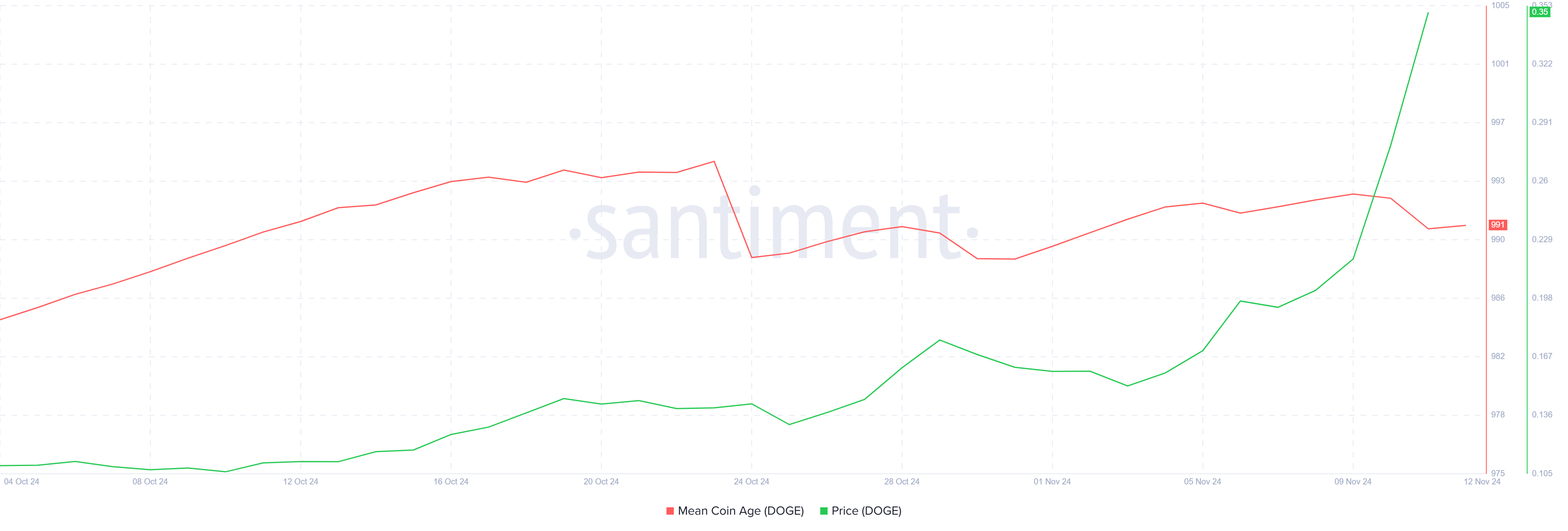

Dogecoin’s macro momentum is also showing signs of wavering, as indicated by the Mean Coin Age (MCA) metric. An uptick in MCA typically signals that long-term holders (LTHs) are refraining from moving their assets, reflecting a strong conviction to hold. However, Dogecoin’s MCA is currently declining, suggesting that some LTHs are moving or selling their holdings, which may add to the bearish outlook.

A decline in MCA usually indicates reduced confidence among holders, increasing the risk of a selloff. This shift aligns with other indicators of caution, as Dogecoin’s recent rally may be approaching an inflection point. If LTHs continue to offload their positions, DOGE’s upward momentum could falter.

DOGE Price Prediction: Aiming High

Dogecoin is currently trading at $0.39, up by 105% over the past five days. This rapid rise has pushed DOGE to its highest level in over three years, and the meme coin now aims to turn the $0.45 mark into a support level. Achieving this would provide DOGE with a stronger base for future growth.

However, profit-taking sentiment could stall this uptrend. Should selling pressure increase, DOGE may fall to $0.32 or even further to $0.28. Such a correction would confirm a bearish outlook and suggest that DOGE’s rally has reached a peak.

If the Dogecoin rally manages to breach and hold above the $0.45 barrier, it could continue its upward trend. This would likely propel DOGE toward $0.50, dispelling concerns of a pullback and reinforcing the bullish momentum for further gains.

beincrypto.com

beincrypto.com