As most cryptocurrencies reap from the post-election rally, XRP has yet to make a decisive move, continuing to trade in the now familiar territory below $0.60.

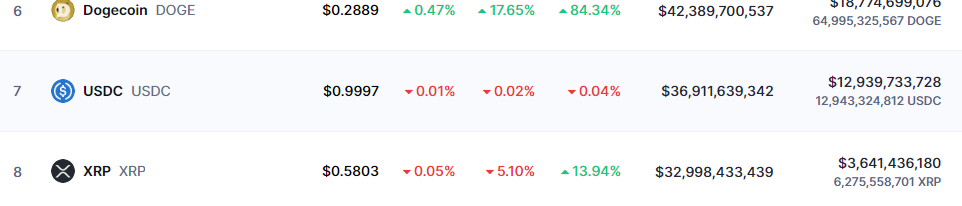

To put XRP’s sluggish movement into perspective, Dogecoin (DOGE) has flipped the token in terms of market capitalization, with the meme coin also targeting the $0.3 mark, according to CoinMarketCap data on November 11.

XRP’s path to $1

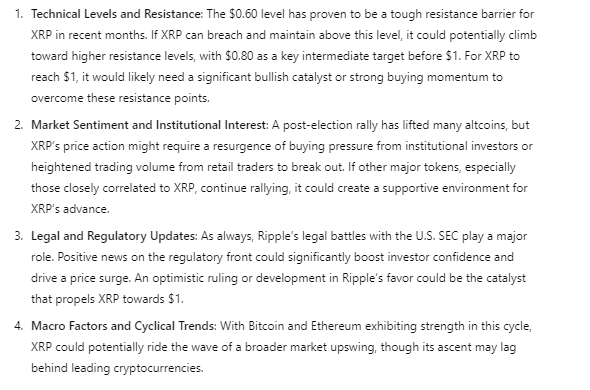

XRP has been consolidating below $0.60 for years, with the $1 level remaining a key target; attention is focused on whether XRP can reach this milestone in the current cycle.

To this end, Finbold consulted OpenAI’s ChatGPT-4o to gauge the token’s chances of claiming $1.

The AI tool noted that XRP could have a chance if it successfully breaches the $0.60 resistance and sustains its price above this level. Should the token target $0.80, it would be well-positioned to attempt a move towards $1.

Additionally, ChatGPT stated that regulatory outlooks, especially any legal developments between Ripple and the Securities and Exchange Commission (SEC), remain significant. Recent updates in the case have indicated a diminished likelihood of XRP being declared a security.

ChatGPT-4o also noted that a sustained bullish market sentiment will be essential for XRP’s ascendance.

XRP’s technical outlook

Meanwhile, a cryptocurrency trading expert with the pseudonym Crypto Crusaders in an X post on November 11 suggested there is room for XRP to break past the $1 mark. According to the expert, XRP is approaching a key breakout point near the end of a multi-year descending triangle formation.

The monthly Relative Strength Index (RSI), which has been down since 2018, is nearing a resistance level of around 50.20.

A break above this trendline could signal renewed bullish momentum and mark the end of XRP’s prolonged corrective phase, with an optimistic target of around $2.

XRP price analysis

As of press time, XRP was trading at $0.5789, down nearly 5% in the past 24 hours. On the weekly chart, however, the token remains up over 13%.

XRP’s technical setup shows the token trading above its 50-day and 200-day simple moving averages, signaling bullish momentum. Nevertheless, the 14-day RSI indicates overbought conditions, hinting at a potential pullback.

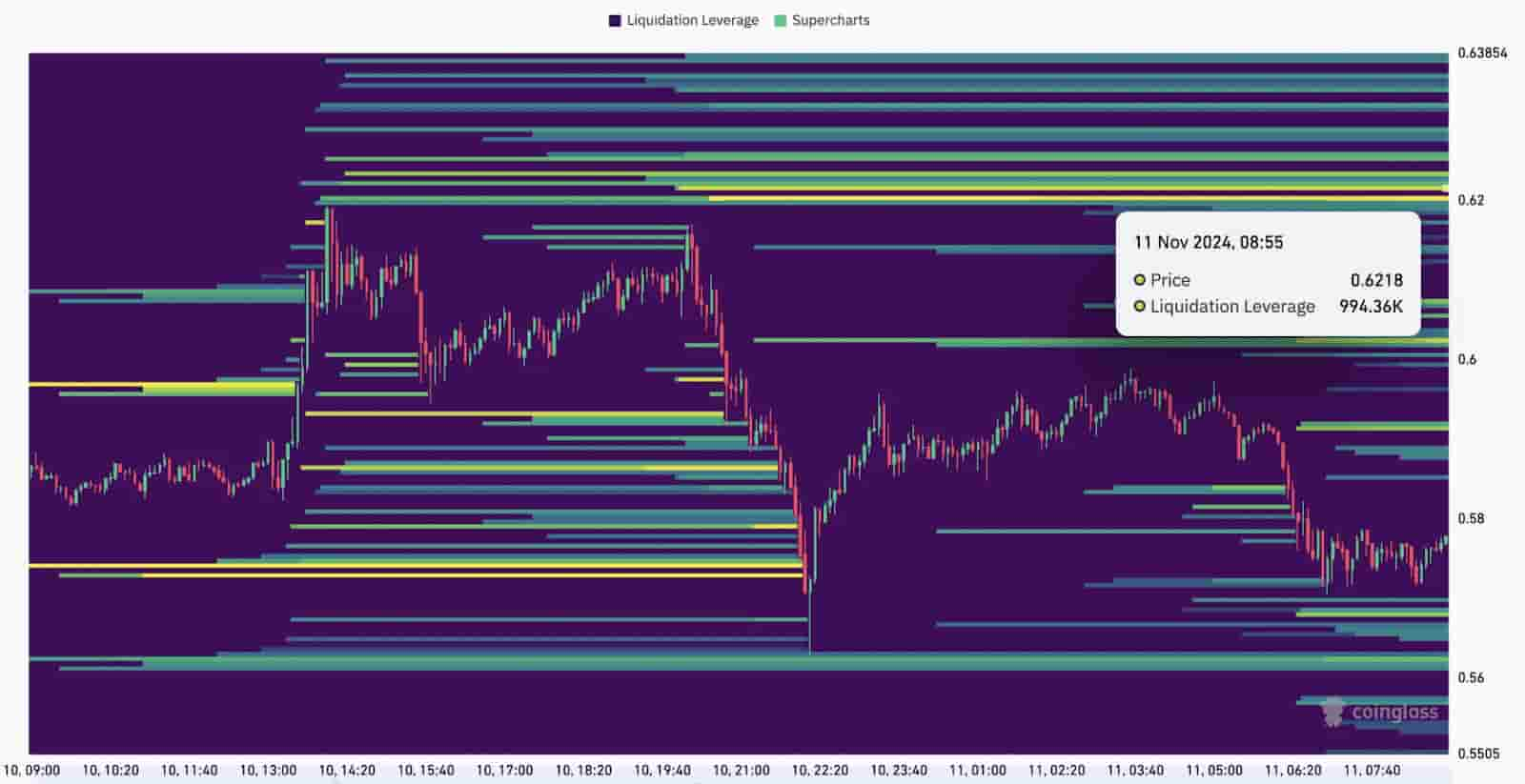

This recent price action follows a spike in leverage liquidations. Data from CoinGlass showed increased liquidation levels around $0.6218, with total liquidation leverage reaching 994.360 early on November 11.

The surge in liquidation levels occurred after XRP’s notable brief price increase above $0.60, suggesting heightened volatility and potential over-leveraged positions among traders around this resistance level.

In summary, part of XRP’s slowed rally has been linked to the Ripple lawsuit. With the Trump campaign signaling plans to implement favorable regulations, monitoring XRP’s response will be important. However, the main challenge remains to break the $0.60 resistance and claim it as support.

Featured image via Shutterstock

finbold.com

finbold.com