October was a meme token month, but several other important developments shaped the crypto market. Binance’s latest monthly market insights report showed the modest overall growth of 2.8% came with important infrastructure and liquidity developments.

The crypto market had a modest gain of 2.8% in October, but underneath that performance, several important trends ran their course. Bitcoin (BTC) led the Uptober trend, adding about 14% to its value, in four restrained weeks of trading before marking a new all-time high in November.

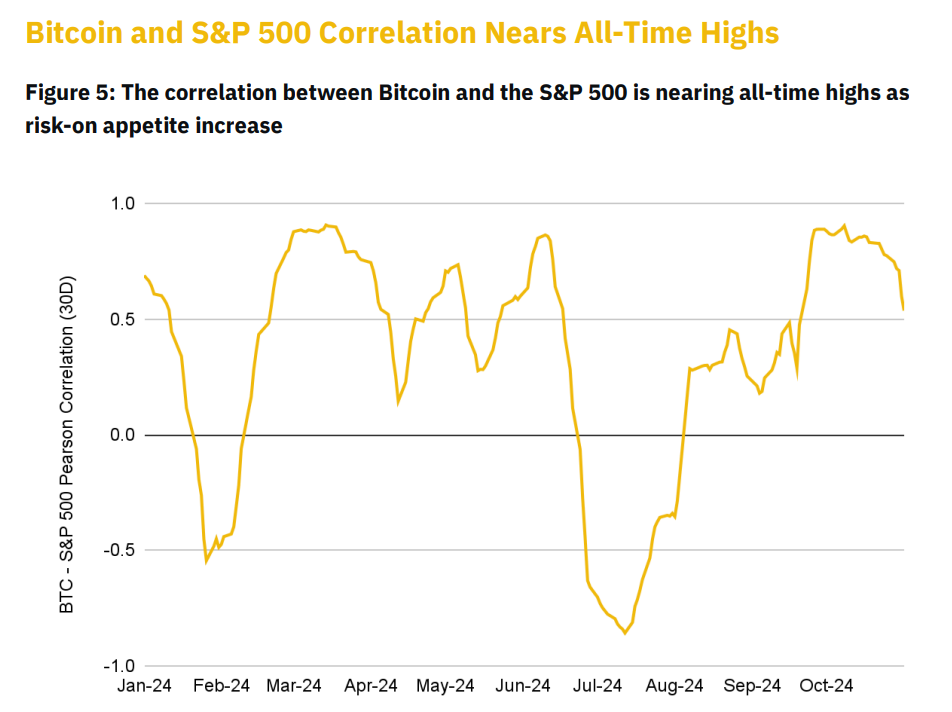

BTC moves alongside S&P 500

BTC broke away from its traditionally weak correlation to US equity indices. In the years before, BTC appeared as a hedge against traditional market volatility and a source of additional upside during economic stagnation.

In October, the trend reversed and BTC showed one of the strongest correlations with the S&P 500. Binance’s analysts consider the shift as a sign of evolving investor sentiment, where BTC is both a risk-on asset, and in extreme cases, a hedge against uncertainty.

One of the chief reasons was the inclusion of BTC in traditional finance, and the inflows into ETFs. For the whole of October, inflows totaled $5.45B, with most funds going through BlackRock’s investment vehicle.

The effect of memes lifted DOGE and SOL

In October, DOGE rose as a leader among altcoins and even most meme tokens. DOGE surged by 33.1%, setting up the stage for an even bigger rally above $0.20. DOGE rose after mentions of Elon Musk’s proposed Department of Government Efficiency (D.O.G.E), mentioned during Donald Trump’s rally in New York at the end of October.

Additionally, DOGE was added to Robinhood Crypto Europe, allowing direct transactions. DOGE remains one of the most widely traded assets, still holding potential for wide adoption.

The appeal of memes also boosted Solana (SOL), which achieved a net gain of 9.7% in October. SOL extended its rally, building on the slower gains, to trade at $187.76. SOL outperformed ETH, which ended the month with a small loss. BNB also slowed down, on a dwindling NFT market and changed user behaviors.

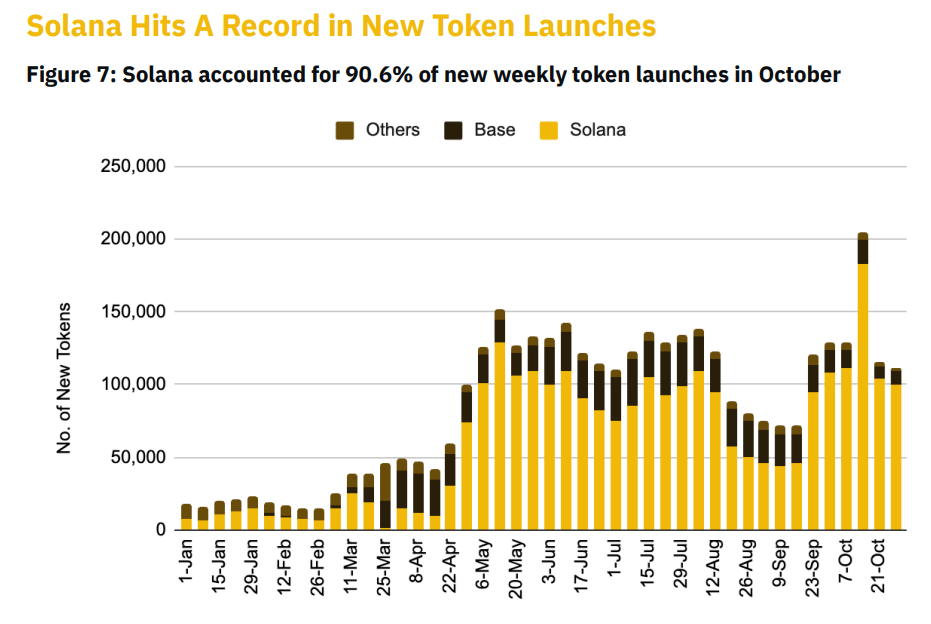

Solana felt the effect of Pump.fun, which reawakened with new records in daily token creation. After a slow month in September, the launch platform posted record earnings, while helping to launch a new batch of successful tokens. The Solana chain hit a record in new token launches, establishing a consistent dominance to other chains. Ethereum was too expensive for the rapid-trading meme token frenzy, while Base was reluctant to allow full-on betting on risky tokens.

The free creation of tokens on Pump.fun meant Solana captured 90.6% of new token creation on a weekly basis. Solana carries 2.7M new tokens in the year to date, out of 3.7M new assets created in total. Most of those memes have minimal trading activity, but the market has shown a capability of building up assets with up to 500M market capitalization. Solana carries 72.6% of the tokens generated in 2024, compared to 19.3% for Base.

Meme tokens also made up the majority of outperforming assets in October. Four out of five top performers were meme assets, both on a monthly basis and in the year to date. Meme trading is also taking up a larger share compared to the top 50 altcoins by market capitalization. As of October, the share of meme volumes expanded to 12%, from around 6% in 2024. Binance’s observation coincides with the recent trend of memes increasing their share of total market capitalization. On certain days in October, meme coins have taken up to 20% of exchange volumes, displacing other altcoins, which failed to deliver an Uptober rally.

Binance’s research noted meme tokens raised demand by appealing to popular Internet themes and images. At the same time, some assets were built around cabals, which manipulated the price and undermined trust.

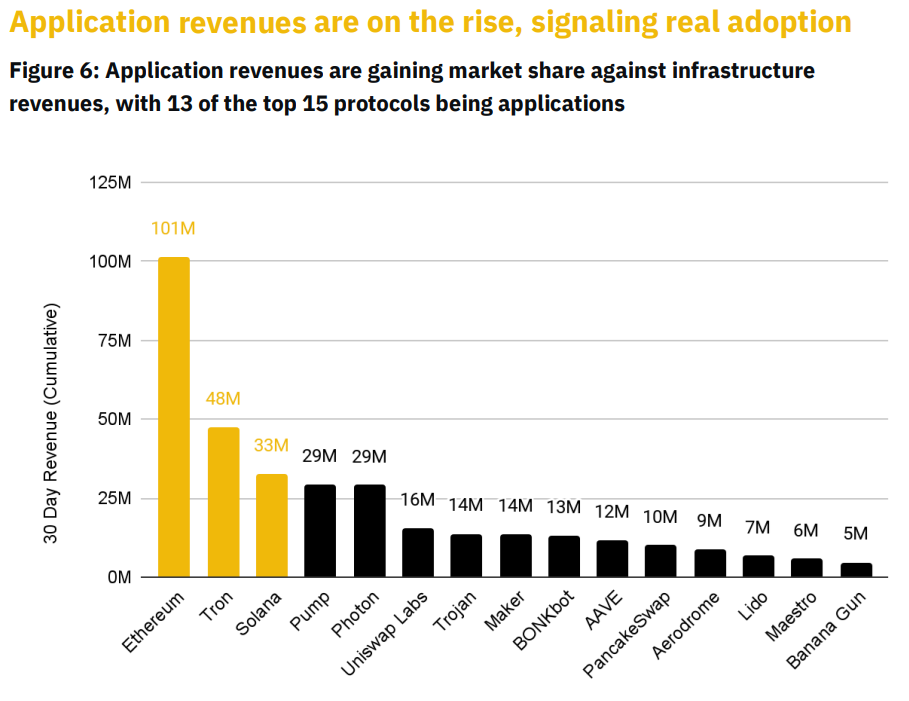

Crypto economy shifts to fee-generating apps

Binance noted revenues were on the rise in October, signaling real adoption. Most fees were retained by apps, and did not return to the underlying protocols. Pump.fun was one example, retaining and trading its fees, only paying a small part to Solana.

Out of the 15 highest revenue-earning entities, 13 are applications. Ethereum, Solana and TRON still retain fees, but the other big winners were platforms and apps that facilitate trading.

Revenues earned by on-chain applications have been increasing, potentially signaling an increase in user adoption. Currently, out of the 15 highest revenue earning chains and applications, 13 are applications. This could be an early indication that a significant proportion of industry-wide revenue will accrue to applications rather than the underlying infrastructure.

cryptopolitan.com

cryptopolitan.com