Toncoin (TON) price has decreased by 10% over the last 30 days as the Telegram-native cryptocurrency continues to experience tough times. During that period, Toncoin’s loss was a fall from a peak of $5.54 to $4.76.

However, on-chain analysis shows that TON might have reached a stage where the altcoin might not experience a deeper correction

Toncoin Hits Strong Support Level

The major indicator suggesting that Toncoin’s loss could shrink is the In/Out of Money Around Price (IOMAP). The IOMAP classifies addresses based on those making money at the current price, those out of money, and the breakeven point.

Typically, when the on-chain cost basis is lower than the current price, then an address is in profit. On the other hand, if the current value is higher than the average purchase price, then an address is out of the money.

With this data, traders can spot support and resistance. When the cluster of volume is higher in the price range, the support or resistance in the region is strong. For Toncoin, about 2.44 million addresses bought about 600 million tokens between $4.69 and $4.84 and are currently holding unrealized profits.

This volume exceeds that of holders facing losses between $4.84 and $5.58. Therefore, if buying pressure intensifies, TON’s price could surge to $5.58.

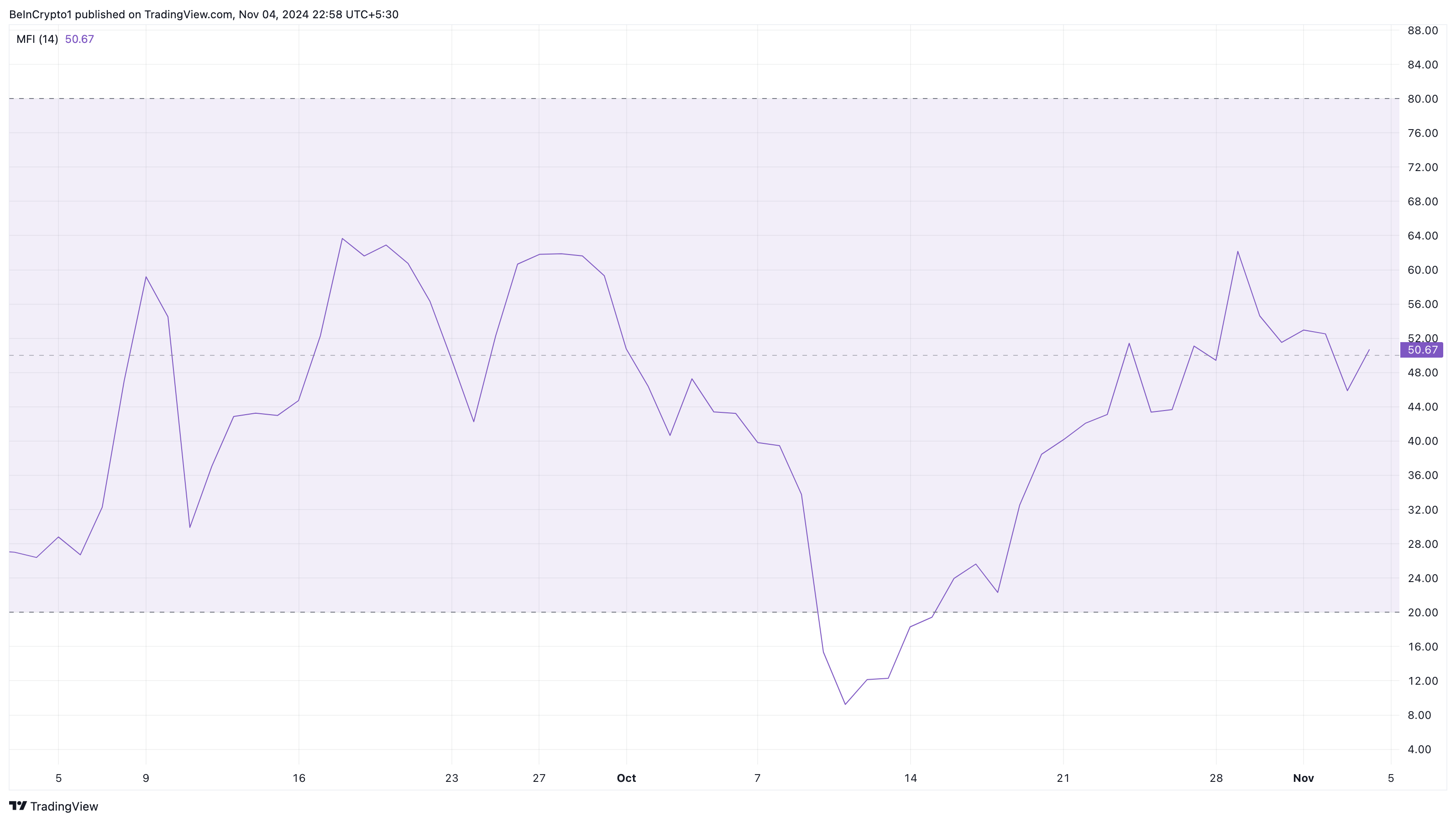

Additionally, the Money Flow Index (MFI) supports this potential bounce. This oscillator gauges buying and selling pressure, with rising MFI values indicating stronger buying interest and declining values reflecting increased selling pressure.

On the daily chart, the MFI has recently crossed above the 50.00 midpoint. This shift signals that market participants are accumulating more Toncoin, which could lead to a price increase.

TON Price Prediction: Bulls Target $5.78

Another look at the daily TON/USD chart shows that bulls have formed strong support at $4.67. This support was vital to the altcoin’s 24% rally in September, which reduced Toncoin’s loss and helped it hit $5.80.

This time, it could be the same playbook repeating itself. If that is the case, then cryptocurrency’s value might soon experience a significant bounce. Should that be the case, then TON could climb to $5.78 in the short term.

On the other hand, bearish pressure might render this thesis null and void. Therefore, if bulls lose their guard in defending the $4.76 support, this prediction could be invalidated, and TON could decline to $4.45.

beincrypto.com

beincrypto.com