MICHI led the gains among the top 300 cryptocurrencies on Nov. 4, deviating from the broader market downtrend.

The Solana-based meme coin jumped over 15% on the last day, bringing its weekly gains to 32.8%. Its market cap hit over $184 million, with a daily trading volume of around $16.8 million at the time of writing.

Michi (MICHI) rallied after it snagged a listing on the crypto exchange Gate.io, where the MICHI/USDT trading pair went live on Nov. 4. Listings on major centralized exchanges like Gate.io are perceived by traders as a bullish signal, sparking price jumps as they rush to capitalize on the community-driven hype.

On the same day, a community member observed that smart money investors holding at least 10k tokens picked up more than 4.43 million MICHI tokens over the past 24 hours. The investment is valued at over $1.48 million based on current prices.

Last week, a similar trend was observed among multiple whale addresses which were dollar-cost averaging into the meme coin.

With significant investments coming from large traders and smart money investors, several market commentators believe that Binance the world’s largest crypto exchange might soon consider listing MICHI on its platform further adding fuel to its ongoing rally. See below.

I think Binance @binance will just list $michi spot because $michi @michionsolana is the most decentralized memecoin. pic.twitter.com/IXpcN40SpT

— JC.5mbK (@Crypto_JCXX) November 4, 2024

Meanwhile, the number of MICHI holders has also been on the rise since late October. Data from Solscan shows that over 38,900 investors now hold the meme coin, up from 36,561 on Oct. 30, as reported by crypto.news.

Analyst MURAD took to X to highlight another positive for the meme coin, sharing a chart that showed MICHI as the top decentralized meme coin with the best distribution among its holders. An even distribution of the meme coin’s tokens among holders means no single entity has significant power to influence the market, reducing fears of volatility if a large holder decides to sell.

MICHI distanced itself from the top 298 altcoins which followed Bitcoin’s (BTC) drop to an intra-day low of $67,569, down from its weekly high of $73,295.

Bitcoin’s price began to pull back as the odds in favor of Republican presidential nominee Donald Trump winning the U.S. elections fell to 56.7% down from 66.9% on Oct. 30 per data on betting platform Polymarket.

What’s next for MICHI?

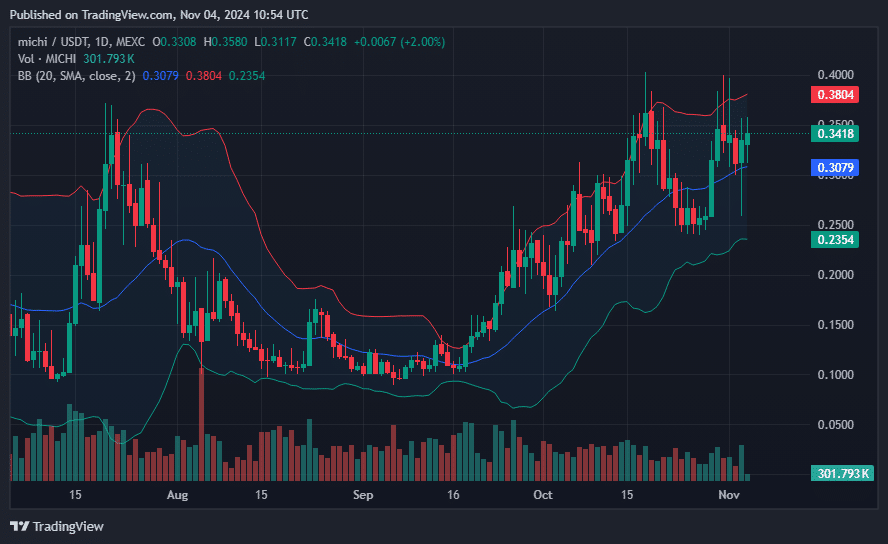

On the 1-day MICHI/USDT chart, a Relative Strength Index of 60 and an Average Directional Index of 33 indicate strong bullish sentiment that could lead to further gains for the meme coin in the short term.

MICHI was also positioned above the middle Bollinger Band 0.3079 as it was inching closer to the upper Bollinger Band at $0.3804. A break above the upper Bollinger band at $0.3814 could push the meme coin to retest its all-time high of $0.497 up a little over 42% from its current levels.

In the event of a price reversal from current levels, $0.3083 will act as the immediate support level, followed by $0.2350 as the next support.