Solana’s native token, SOL, has climbed to a near three-month peak of $183.30, marking four weeks of steady gains in October’s “Uptober” rally. Outperforming Bitcoin and the broader altcoin market with a 15% surge, the cryptocurrency has taken the lead as the month’s top performer.

This price surge can be attributed to the strong network activity and growing demand for Solana’s DeFi and blockchain services, as data from The Block indicates a rise in active addresses. However, with the token now approaching critical resistance levels, the question looms: is a pullback on the horizon?

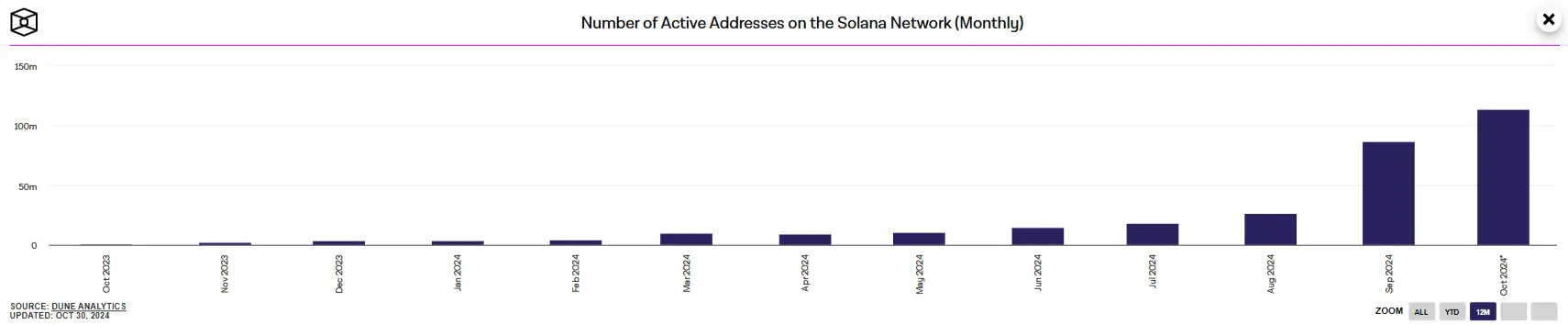

Monthly Active Addresses on Solana Reach New High

According to Dune analytics, the Solana network has observed a steady climb in the count of monthly active addresses, which reached 107.04 million in October. The data suggests a robust increase in user engagement, although the chart is still incomplete, as October has one day left.

Advertisement

Meanwhile, on a daily scale, the cryptocurrency recorded a slight dip from an October 23 peak of 5.91 million active addresses to approximately 5.39 million by October 28. Analysts attribute the October 22 spike to heightened activity around meme coins and decentralized exchange transactions on the network, which may have driven the surge in address activity on that particular day.

SOL’s Price Outlook and Key Levels to Watch

The market sentiment around the SOL token is riding high, with many traders viewing it as a serious contender to Ethereum in the long term. TradingView’s weekly chart observed that the cryptocurrency retested the $183 level, tapping the upper boundary of a symmetric triangle formation and aligning with the 78.1% Fibonacci extension—key resistance where previous gains have often pulled back.

Now hovering around $177.98, the SOL token stands at a critical juncture, eyeing a potential push toward the $200 mark. However, caution may be warranted, as a key metric signals possible overvaluation, potentially tapping the brakes on SOL’s rally. One such example is the Chaikin Money Flow (CMF), a gauge of buying versus selling pressure, which suggests the rally might be hitting overvaluation territory.

Positioned at 0.20, this indicator hints that Solana’s upward drive could face a pause, leaving traders to watch closely for signs of a pullback. Another cautionary signal comes from the Directional Movement Index (DMI), which currently leans bullish, with the +DI at 24.0890 outpacing the -DI at 16.8293.

Yet, with the ADX reading at a mere 16.0876, the trend’s strength appears weak, hinting that the SOL token may soon face a modest pullback before regaining momentum. In such a scenario, the cryptocurrency could dip to retest the $159-$152 fair value gap, potentially sweeping liquidity just below $159 before rebounding. Other key support zones include the 20-day and 50-day EMAs, positioned at $165.60 and $156.06, respectively, offering potential stabilizing points on the daily chart.

cryptonewsz.com

cryptonewsz.com