As we learned thanks to data from CoinGlass, the volume of cryptocurrency position liquidations on the derivatives market over the last 24 hours totaled more than $111.44 million.

However, despite the impressive size, what is more interesting is the imbalance of liquidations seen in popular meme cryptocurrency Dogecoin (DOGE).

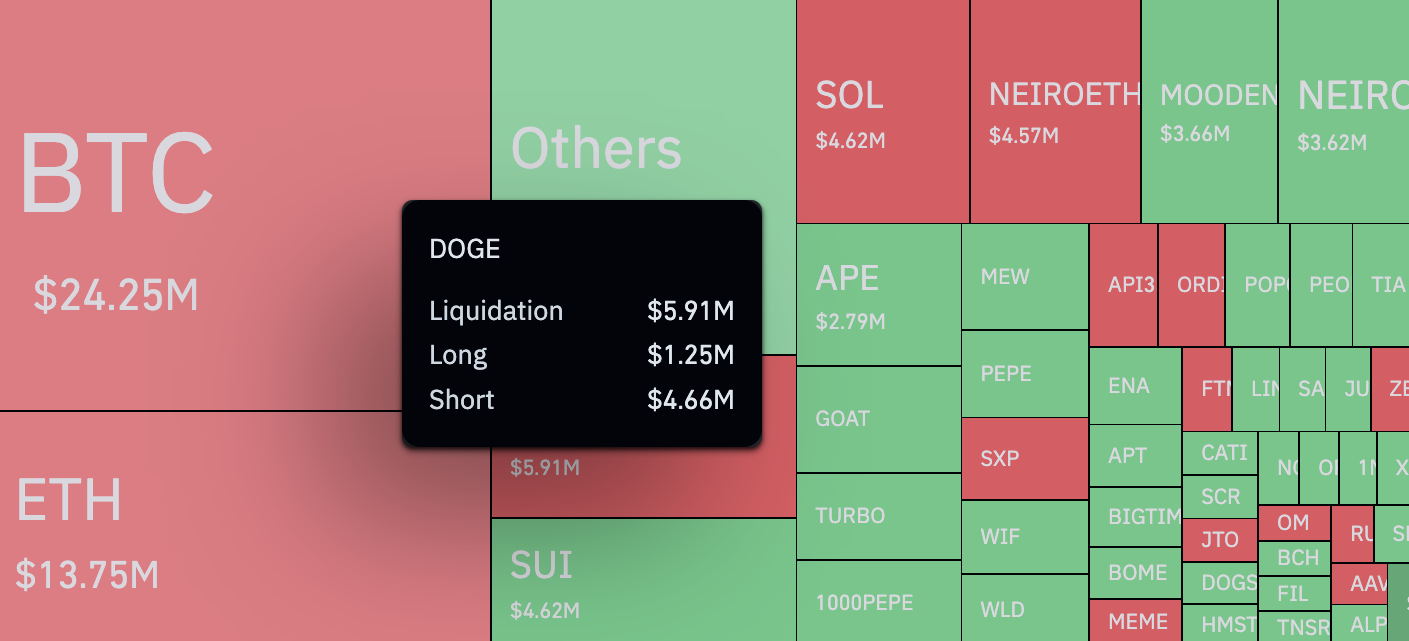

During the period under review, the volume of DOGE liquidations totaled $5.91 million. However, $1.25 million of this is the liquidation of long positions, while 4.66% of the rest is the liquidation of short positions.

Thus, we can state that the volume of liquidated positions of the bears, who believed that the price of Dogecoin should fall, was almost four times higher than that of the bulls.

Dogecoin (DOGE): Price outlook

What is fascinating, in the midst of the decline of the cryptocurrency market last weekend, is that many market participants expected that this was not the end and started to open short positions, which eventually led to such unequal dynamics.

The reality turned out to be different, and Dogecoin, for example, not only fully recovered from Friday's drop but also reached higher price levels on the back of 15.62% growth.

Amid all this turmoil, even though Friday's drop severely hampered bulls' plans, the liquidation layout came to an almost even keel. We can say that the cryptocurrency market is now in a state of uncertainty.

However, this is not the case for Dogecoin, where the bulls have clearly pulled the rope to their side.

u.today

u.today