The uptrend that dominated the market in recent weeks hit a roadblock last week, with the global crypto market losing $70 billion in a correction to $2.28 trillion.

This correction coincided with Bitcoin (BTC) closing the week at the lower spectrum of the $67,000 mark, dragging the broader market down. However, some altcoins demonstrated resilience.

Here are our picks for the top cryptocurrencies to watch this week following noteworthy price movements last week:

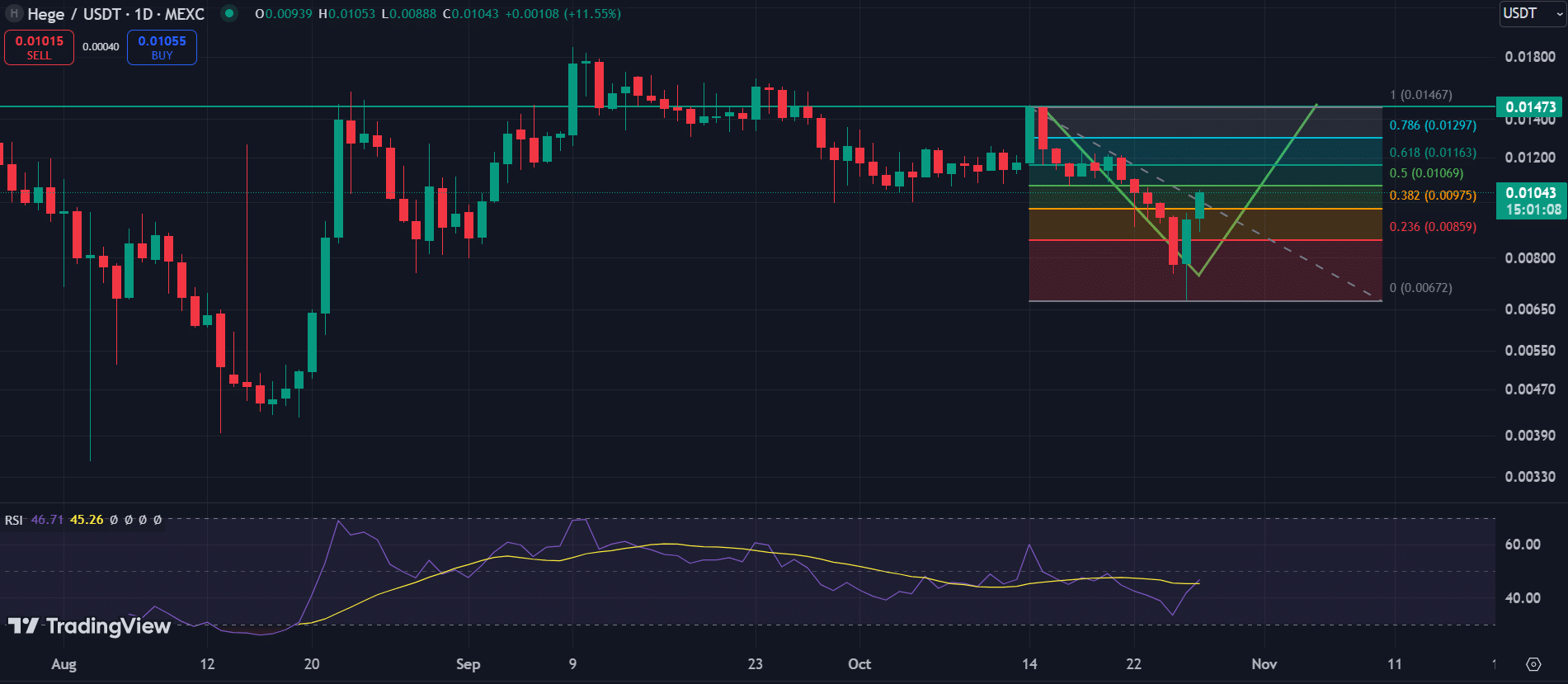

HEGE on a recovery push

Hege (HEGE) initially succumbed to the week’s bearish pressure, but eventually staged a recovery at the close of the week.

Despite this late rebound push, Hege ended last week beneath the $0.01 mark, slumping by nearly 18%. This marked the first time it traded below $0.01 this month.

Its recovery came on Saturday, gaining 20% that day. The uptrend has spilled into the new week, with an additional 10.70% gain this morning.

Hege’s rebound appears to be forming a V bottom pattern, which could complete with a rally to $0.0147, the previous top.

Interestingly, the asset’s RSI currently sits at 46.71. This position confirms that HEGE still has massive room for more upsurge, but it needs to maintain the $0.01 level to sustain the recovery this week.

A drop below Fib. 0.382 ($0.00975) could trigger a new downturn.

Hege is a meme cryptocurrency that launched in April. It revolves around a storytelling concept involving a character navigating financial struggles and seeking redemption.

SOL bucks the trend

Solana (SOL) bucked the negative trend in the market, closing last week with a 7% gain while the rest of the market dropped. SOL ended the week above $170 despite starting below $160.

A CCI of 111.50 suggests Solana’s momentum is strong, with the uptrend likely to continue amid whale accumulation. However, caution is advised, as the CCI is now close to overbought territories.

Should a correction ensue this week, the $159.46 level, which previously acted as resistance, represents the first robust support. A slip below this level would bring the Pivot level at $144.76 into play.

If the selling pressure breaches this Pivot point, the momentum could flip bearish. In such a scenario, Solana’s next support levels are $128.80, $118.94, and $102.98.

SAFE spikes 55%

Like Solana, Safe (SAFE) set its own path last week, ignoring the direction of the broader market. The altcoin’s biggest push came on Oct. 24, when it spiked 40.54%, its largest intraday gain this year, following Upbit’s listing.

SAFE sustained the gains the following day, gaining by another 11.52%. Despite a mild retracement on Saturday, the asset closed the week with a 55% increase at $1.468.

SAFE maintains its bullish momentum, with the +DI of the Directional Moving Index currently at 39.6, while the ADX sits at 40.5. Meanwhile, the -DI currently trades at 8.8, suggesting a slowdown in the bearish push.

However, the recent correction has spilled into the new week, with Safe shedding 6.81% of its value today. Amid the drop, the Fib. 0.618 level ($1.269) could serve as the next line of defense, with a steeper drop threatening to bring $1.11 into the picture.

In 2022, Safe was spun out from Gnosis, a well-known Ethereum-based decentralized platform. The separation occurred as part of a strategic move to establish Safe as an independent entity, allowing it to focus more narrowly on its multisignature wallet technology and decentralized infrastructure.