The recent price action of Solana-based Raydium (RAY) has caught investor attention, as the decentralized exchange (DEX) token has maintained an uptrend, achieving a seven-month high.

Raydium’s performance signals growing interest in the Solana ecosystem. This ongoing momentum hints at the potential for RAY to reach even higher levels if market support continues.

Raydium Overtakes Ethereum

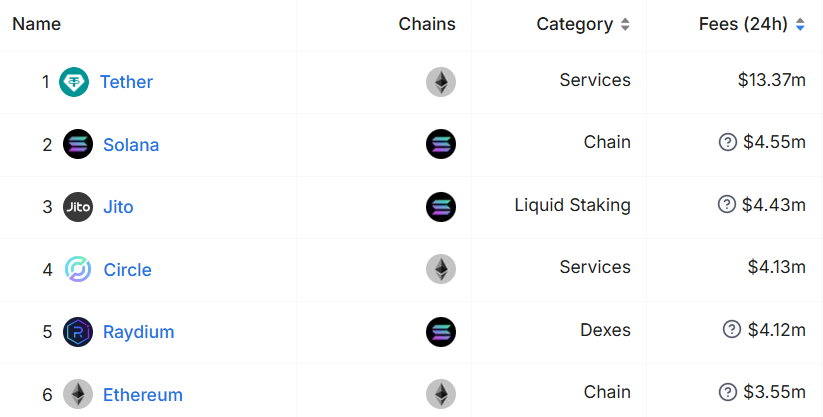

Solana DEX Raydium recently surpassed Ethereum in fees collected over a 24-hour period, a notable achievement that highlights its rising activity. Fees on Raydium are generated from swaps on the platform, and a higher volume of swaps translates to increased fee collection.

In the last 24 hours, Raydium collected $4.12 million in fees, surpassing Ethereum, which collected $3.55 million. This level of activity reflects the growing popularity of Raydium among DeFi users. The higher fee collection could indicate bullish sentiment as traders seek efficient, high-speed platforms. This surge in activity could potentially lead to upward pressure on the RAY token, which investors are carefully monitoring.

Read More: What Is Raydium (RAY)?

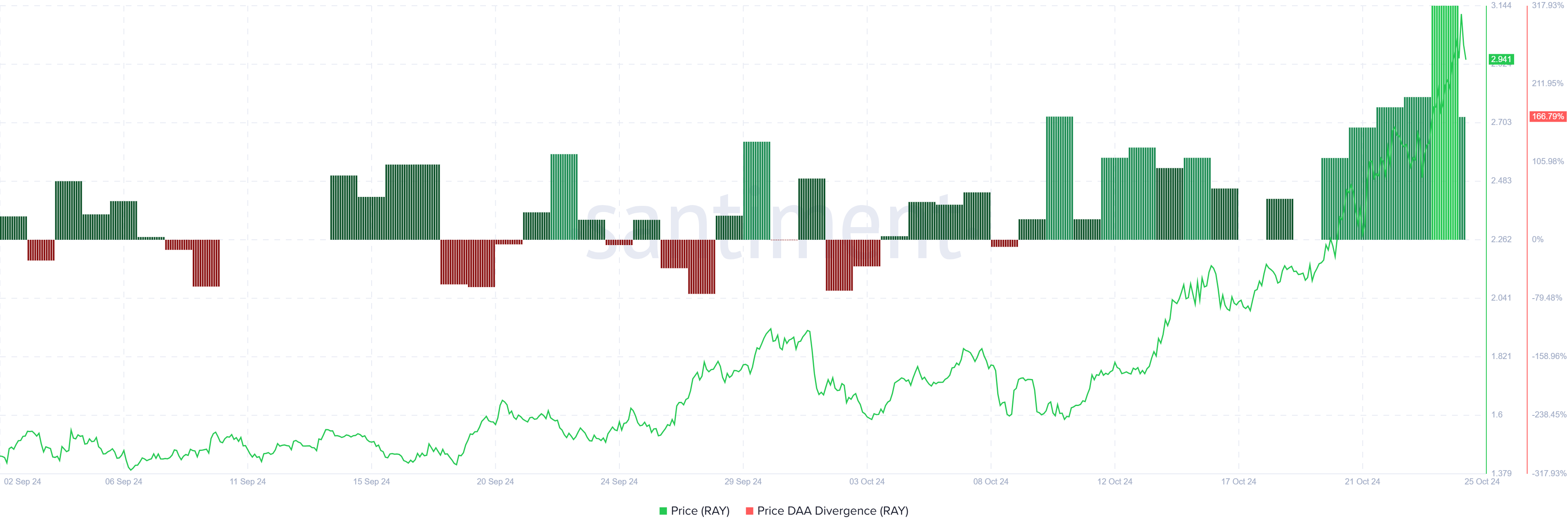

Furthermore, the broader macro momentum for Raydium is currently optimistic, with the price DAA (daily active addresses) divergence signaling a buy. The increased participation rate among users, coupled with the recent price uptrend, points to stronger market support. Investors are reinforcing this trend, which boosts the strength of the rally and suggests that RAY could sustain its positive movement over the medium term.

Increased investor participation in Raydium and its surging price contribute to a supportive market environment, with DAA divergence further fueling the uptrend. This alignment between price action and user engagement may provide the stability needed for RAY to tackle new resistance levels.

RAY Price Prediction: Reaching New Highs

RAY’s price has surged by 36% over the past week, trading at $2.94 and reaching a high not seen since mid-March. This uptick positions Raydium at a seven-month high, encouraging optimism about the token’s near-term growth.

However, to maintain these gains, RAY aims to breach the next resistance level at $3.33. This move could solidify its recent progress, with increased support from the factors mentioned above. If RAY reaches this level and sustains it, further upside could be on the horizon, provided investor sentiment remains strong.

Read More: A Complete Guide to P2P Decentralized Exchanges (DEXs)

Should profit-taking occur, RAY may experience a decline to $2.71, which could offer some stability amid a potential drawdown. However, a further drop below this level could reverse recent gains entirely, sending RAY down to $1.99 and potentially invalidating the current bullish outlook.

beincrypto.com

beincrypto.com