SAFE, the native token of Safe Wallet surged 72% over the last day after it secured a listing on Upbit and its wallet went multichain.

Safe (SAFE) surged to $1.65, marking a 115% increase from its September low after a “god candle” propelled the token from $0.94 to $1.70, pushing its market cap to $805 million. Despite this recent rally, SAFE remains 53.6% below its all-time high of $3.56, reached in April.

SAFE’s price rally occurred in a high-volume environment. Its daily trading volume was up 425% hovering over $114 million much higher than the $4 million seen on Oct. 24 morning.

The main driving force behind the recent rally was the token’s listing on South Korea’s largest cryptocurrency exchange, Upbit on Oct. 24, with introduced trading pairs for the token in Korean Won (KRW), Bitcoin (BTC), and Tether (USDT).

A listing on a major cryptocurrency exchange like Upbit often leads to a surge in the listed asset’s price, as it provides exposure to a new market where increased buying interest from fresh investors can drive its price higher.

According to an Oct. 24 X post by on-chain insights platform Spot On Chain, there’s been a spike in wallets buying SAFE since its Upbit listing. The top five first-time buyers alone have purchased 1.356 million SAFE ($2.24 million) from OKX, Bybit, and Uniswap, collectively gaining $150,000.

Further, Safe Wallet’s recent shift to a multichain environment has also fueled momentum by enhancing usability across over 15 networks. Users can now enjoy a unified wallet experience with a single deployment, a consistent address across chains, and gas-free transactions on major Layer 2 networks, which may have contributed to the increased demand for SAFE.

Price correction expected

Despite the recent spike in SAFE’s price, it is worth noting that such rallies following an exchange listing often face a reversal as investors sell to lock in profits.

One community member Crypto Academic pointed to a similar situation with Injective’s token (INJ), which spiked after its Upbit listing only to see a sharp drop the next day. Crypto Academic cautioned that, as a stronger altcoin, INJ still faced substantial profit-taking, suggesting SAFE could experience a similar outcome.

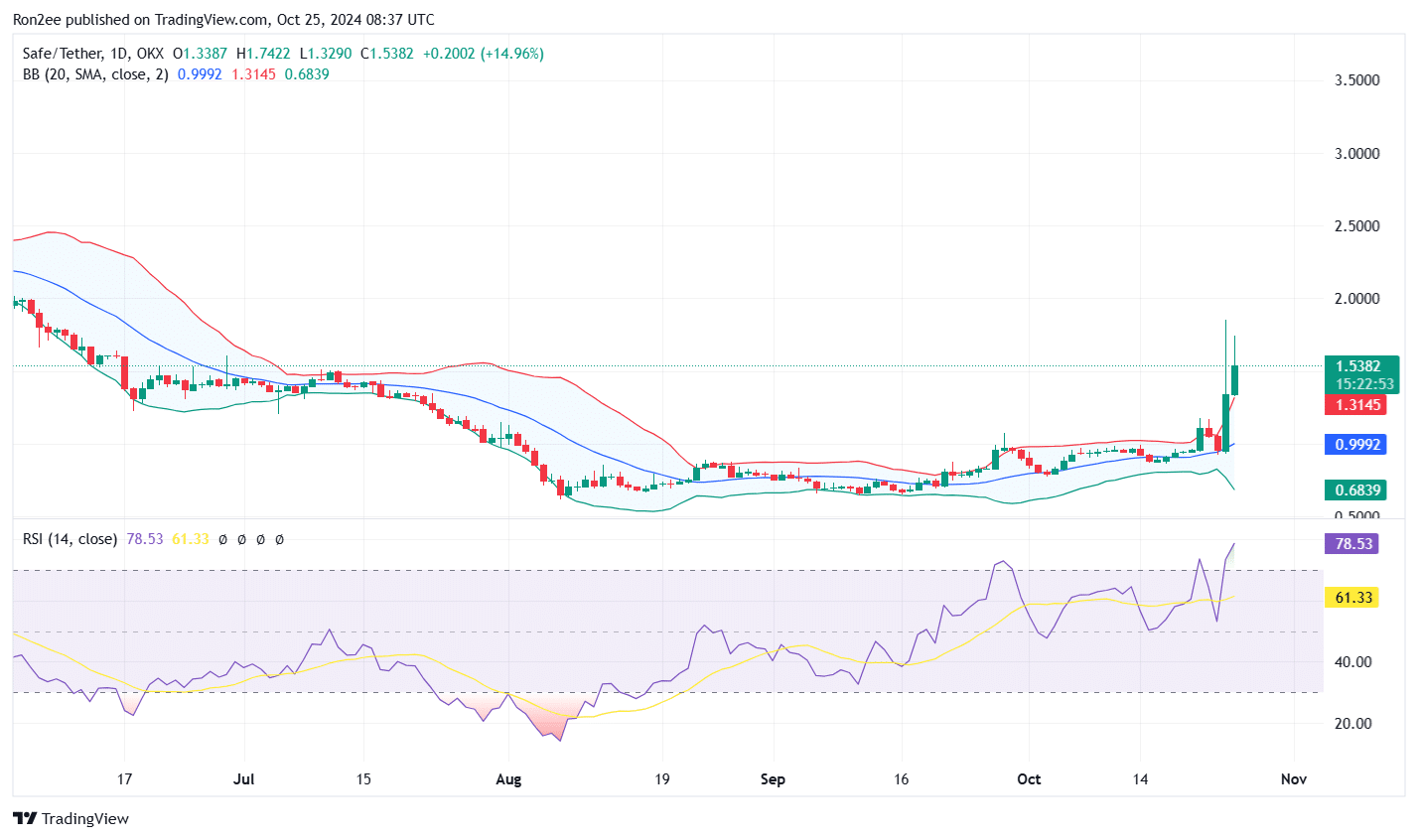

Technical indicators also suggest a potential pullback in SAFE’s price, as it was positioned above the upper Bollinger Band at the time of writing, with the Relative Strength Index at 78, well above the overbought threshold.

In the event of a trend reversal, the altcoin will likely find support around the $0.9992 level, which aligns with the middle Bollinger Band on the 1-day SAFE/USDT price chart.