Bittensor (TAO) is bearish and in a state of correction after a continuous period of upward trend in the market. The latest increase of the network’s worth has led to various discussions about the future course of $TAO. Market analyst Bitcoin Buddha predicts may reach a new all-time high.

The market is at the crossroad. The traders are waiting for the price to test the support and resistance levels to define the direction of this token.

The #Bittensor network continues to expand, and the $TAO price is reflecting this growth. 👀

— Bitcoin Buddha (@Bitcoin_Buddah) October 22, 2024

Just a few days ago, many were hoping for a dip to load up on, and they are afraid to grab some.

I believe that any dips will be quickly absorbed, and $TAO will surely reach a new… pic.twitter.com/mqvocxLYpv

TAO trended in a descending channel between February and June, suggesting that bears dominated it. However, this pattern was fully reversed during mid-June when the token began to break out from the channel and entered the bullish phase.

Following the breakout, TAO began forming a symmetrical triangle in September. It was characterized by lower highs and higher lows, suggesting indecision among traders.

This symmetrical pattern transforms into an upward movement. The current TAO price action near $547 point to a test of resistance in this area. Analysts believe that if bulls manage to hold the price above $547 for a close, especially on high turnover, it could open the way for new gains.

On the other hand, the support levels are established at $500, $400, and $300 where potential declines might be swiftly managed going by current market trends as buyers are likely to show up in large numbers at these levels.

Bittensor (TAO): Support and Resistance Levels in Focus

TAO’s key resistance levels are currently positioned at $547, $650, and $800. The price has been oscillating very close to $547. If it breaks and sustains above this level, it will free the path to $650.

There is every possibility of this token moving towards $800 as some technical analysts have predicted in the event that the upward trend will persist. On the other hand if the price fails to break through the $547 level then the price will likely trend downwards to touch the support levels of $500 or below.

For the bulls, they are keen on the break of the upper trendline that depicts the symmetrical triangle, as a bullish signal. However, a price break below the lower trendline may intensify the bearish trend and the price will retest the lower support levels.

Increased Trading Activity and Market Sentiment

Recent data indicates heightened trading activity for TAO, with the 24-hour trading volume recorded at $150.6 million. However, the token has experienced a slight price decline of -0.87% in the past 24 hours and -8.91% over the last week.

At press time, TAO traded at $548.27, as per Coingecko data. Moreover, Bittensor’s market cap stood at $4.05 billion, with a circulating supply of 7.4 million TAO.

Despite this short-term dip, overall sentiment remains optimistic due to the network’s continued growth and strong demand for the token.

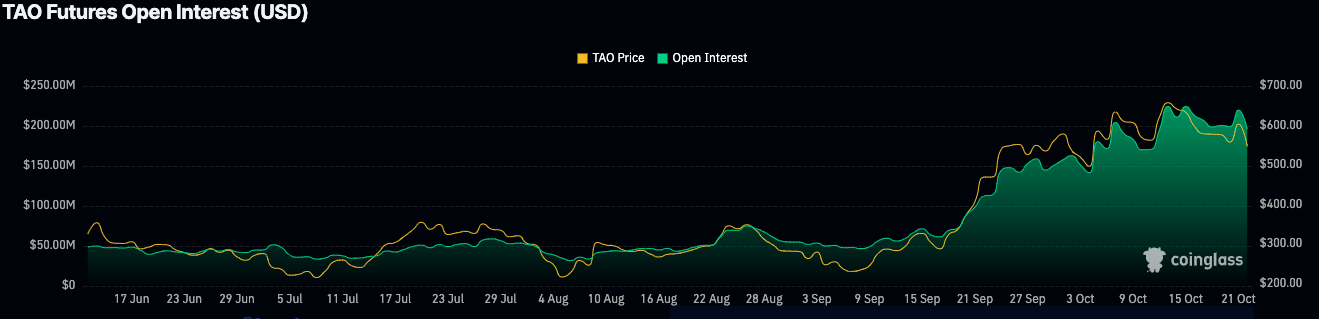

According to Coinglass data, TAO futures trading volume has recently declined by 32.31% to $197.14 million, and open interest by 3.19% to $194.03 million. This reduction of futures activity might suggest that traders are being short-term oriented.

However, the overall upward trend of the open interest since mid-September indicates expansion of the market participation, suggesting that traders are positioning themselves for potential price movements.

The recent increase in open interest correlates with price fluctuations noted in October as a sign of increased speculative activity.

thecoinrepublic.com

thecoinrepublic.com