Due to a notable increase in large transactions, Dogecoin has drawn interest from traders and investors. On-chain data indicates that there were 1,600 large transactions over the course of the last 24 hours, totaling 11.12 billion DOGE in volume. This is a significant rise over the seven-day low of 8.25 billion DOGE, suggesting that big investors, or whales, are becoming more interested.

This increase in activity indicates a greater emphasis on Dogecoin and could portend a reversal soon. The volume of big transactions might indicate that whales are building up DOGE or getting ready for big movements. A price change could result from a surge of this size, which usually draws more traders.

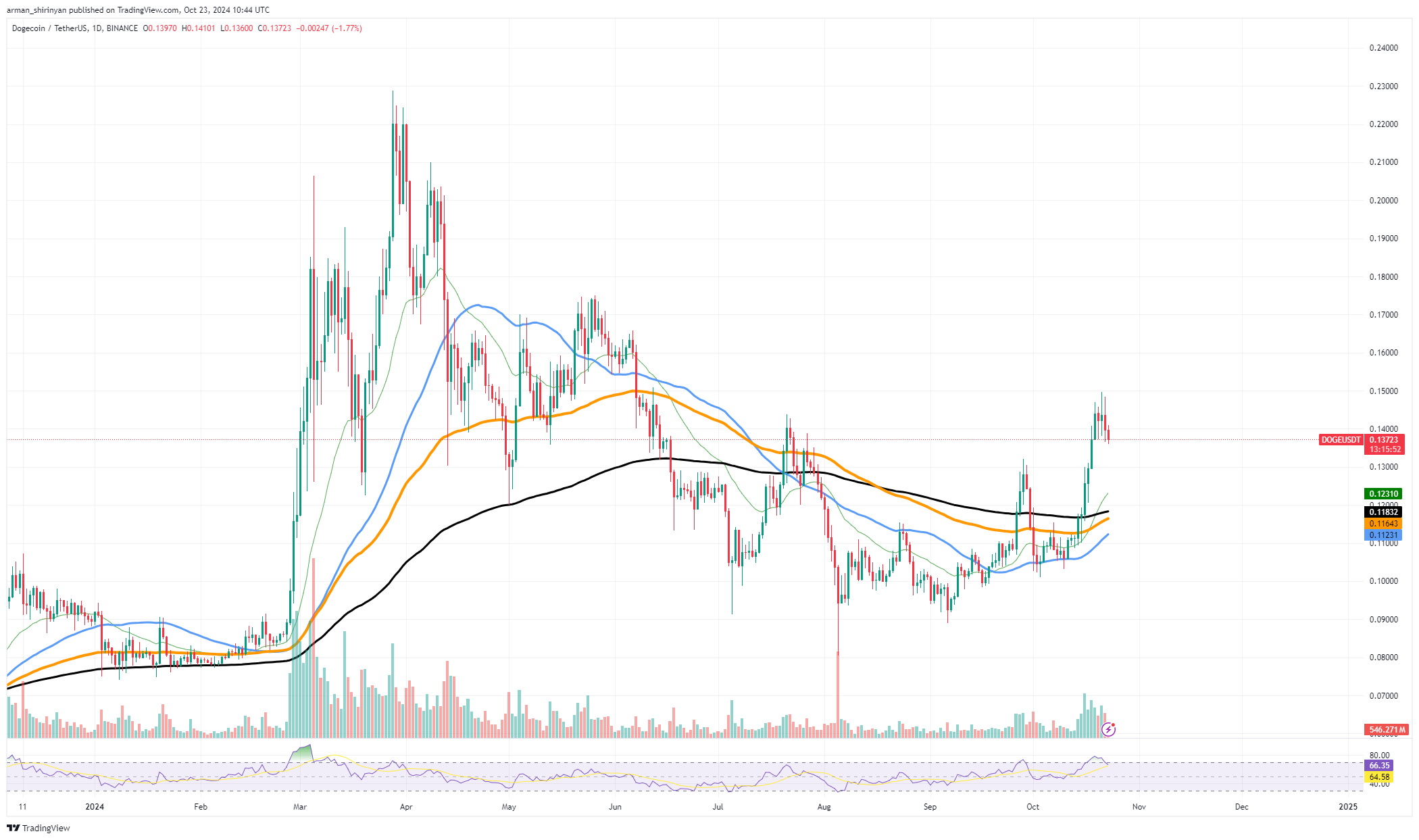

However, after peaking at about $0.15, Dogecoin is currently undergoing a minor retracement, according to the price chart. The asset is currently holding above critical levels, but it is crucial to keep a careful eye on the support zones.

It is important to keep an eye on three important levels: $0.123, $0.118 and $0.111. It might stop additional price declines and lay the groundwork for a bullish recovery if DOGE can keep support above these levels. The asset might lose momentum and a more substantial correction might occur, however, if the current trend were to wane and DOGE dropped below these levels.

Dogecoin must surpass the $0.15 level, which would indicate a more robust bullish reversal in order to exit its current range. The range between $0 and $20 may be the next significant resistance above that.

u.today

u.today