Shiba Inu Shiba Inu (SHIB) saw a massive 14,575% increase in its burn rate, removing 279 million tokens from circulation. This spike has fueled optimism among traders, driving SHIB’s price up by 1.49% to $0.00001878 in the past 24 hours.

🚨🚨#ShibaInuCoin Burn Rate Rockets 14570% Signaling $SHIB Price Rally To $1

— Shiba Inu (@ShibainuCoin) October 14, 2024

More than 279 million SHIB tokens removed from the initial supply.

Getting stronger in this bull run 🙌🏼🚀$SHIB #shibaArmy #Bone https://t.co/fr6TeuqHjx

Shiba Inu’s overall network activity is also up, with the total number of active addresses surging by 37.93% to reach 6,391, according to CryptoQuant data. As SHIB continues to gain attention, market analysts warn traders to stay vigilant as volatility remains high.

Token Burn Drives SHIB Price and Network Activity

SHIB’s recent token burn has notably influenced its market performance. The elimination of 279 million tokens from circulation has led to increased positive sentiment within the SHIB community. Moreover, SHIB’s network activity has experienced notable growth.

The number of active addresses rose by 37.93%, and transaction counts doubled to 7,083 in the last 24 hours. Additionally, SHIB’s trading volume reached 2.171 trillion tokens, signaling growing market interest and increasing buying pressure.

These developments pushed SHIB’s price higher by 3.43%, adding to its bullish momentum. As more tokens are burned, the scarcity factor continues to play a key role in boosting the coin’s price.

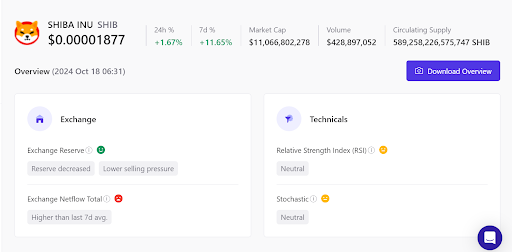

RSI and MACD Indicate Bullish Momentum

Technical indicators also point to SHIB’s ongoing bullish trend. The Relative Strength Index (RSI) is at 61.09, signaling moderate bullish momentum. Because it remains below the overbought threshold of 70, SHIB may have additional upside potential. The RSI’s upward trend indicates increasing strength in SHIB’s price action.

Besides, the Moving Average Convergence Divergence (MACD) indicator has shown a recent bullish crossover, with the MACD line (0.00000073) sitting above the signal line (0.00000072). Although the MACD histogram shows moderate bullish momentum, it suggests a potential increase in buying pressure as the price action progresses.

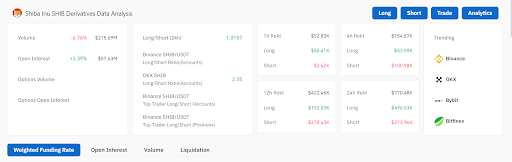

Derivatives Market Signals Cautious Optimism

SHIB’s derivatives market data presents a mixed picture. Open interest has climbed 2.39% to $57.63 million, showing traders’ rising interest. However, trading volume has decreased by 6.76%, suggesting a shift in market dynamics. Long positions slightly outweigh shorts on Binance, with a ratio of 1.0157, while OKX shows even stronger bullish sentiment with a ratio of 2.35.

However, traders should remain cautious as liquidations have surged, with $770,000 wiped out in the past 24 hours, mostly from over-leveraged long positions. This spike in liquidations underscores the ongoing volatility in SHIB’s market, suggesting that while optimism is high, the risk of a market shakeout remains.

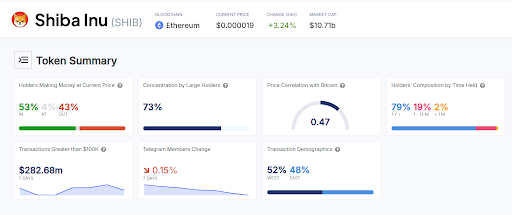

Whale Activity and Long-Term Holder Sentiment

Despite SHIB’s recent volatility, long-term holder confidence remains strong. About 53% of SHIB holders are in profit, and 79% have held onto their tokens for over a year. This suggests a substantial portion of the market remains confident in SHIB’s long-term potential.

Moreover, SHIB’s transaction activity remains robust, with $282.68 million in transactions over $100,000 conducted in the past week. But with 73% of SHIB’s supply concentrated in the hands of large holders (whales), the market remains vulnerable to sharp price swings driven by whale movements.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com