Sui Network (SUI) gained the spotlight in the cryptocurrency landscape as one of the fastest-growing cryptocurrencies this cycle. This week, Grayscale announced the Grayscale SUI Trust, while Circle natively deployed its dollar stablecoin, USDC, on the Sui Network.

With remarkable Web3 technology and tokenomics highly weighted to benefit institutional early private investors, SUI has earned the market’s attention. Now, Finbold is looking for insights into its native token’s next price movements and potential entry or exit points.

In particular, a recent analysis by TradingView’s reputable cryptocurrency trader, pejman_zwin, sheds light on SUI’s price prediction and future. The trader highlighted key support and resistance levels, arguing that a major correction will soon hit SUI’s price.

SUI price analysis

According to the analyst, SUI may experience a 20% surge to a potential reversal zone above the $2.30 resistance. After that, however, SUI may experience a 40% correction down to a support zone between $1.40 and $1.20.

Notably, the analysis also considers the Elliott Wave theory. This theory currently places SUI at a low-time frame (LTF) fifth impulsive wave at $1.98. Meanwhile, being at a high-time frame (HTF) third impulsive wave and the upcoming correction playing the fourth corrective wave role.

In summary, this means that, despite the predicted 40% correction, pejman_zwin believes SUI will expand one more time above resistance. Therefore, the $1.40 price is an appealing target for accumulating more SUI while previously offloading at around $2.30.

Sui fundamental analysis

Sui technology stands out by offering high scalability, transaction efficiency, and security – challenging Solana’s (SOL) market share. Similarly to other Ethereum rivals like MultiversX (EGLD), SUI offers an object-centric model with native assets tokens, leveraging security.

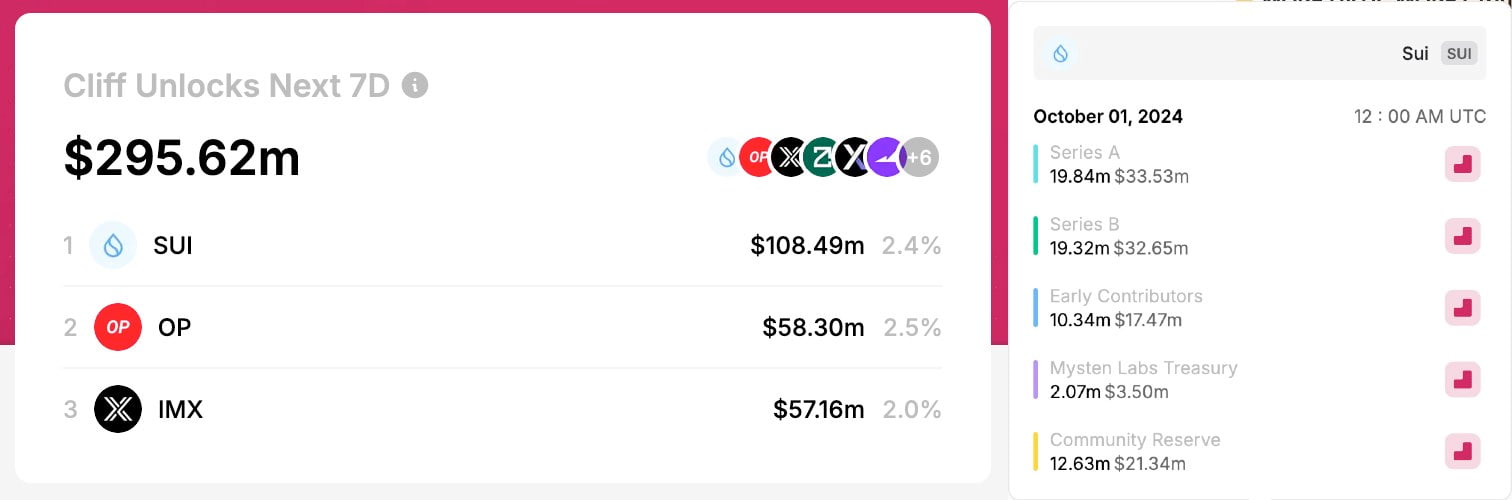

However, SUI has aggressive tokenomics with significant upcoming unlocks that are highly weighted toward private investors from early funding rounds. As Finbold reported, Sui Network unlocked over $100 million in previously staked tokens, which were already paying yields to VCs. The market should expect more of these massive unlocks every month from now on.

With high upcoming unlocks and also large linear inflation through staking, SUI has a proportionally high fully diluted value (FDV), which may impact its growth as more tokens are issued or released in the market, diluting its holders’ value.

Grayscale’s and Circle’s support to the Sui Network

On the other hand, this economic strategy benefited Sui by allowing crypto institutions to benefit financially from its growth. With that, relevant players like Circle, Coinbase, and Grayscale, having a vested interest in SUI, have moved to foment its ecosystem and increase its value.

In this context, Circle now provides native USDC native on top of the Sui blockchain, bringing additional liquidity to the ecosystem. The move surprised many investors from other cryptocurrencies older than Sui, still waiting for a native USDC deployment.

Furthermore, Grayscale announced the Grayscale Sui Trust, offering institutional derivative exposure to SUI.

“Grayscale Sui Trust is open to eligible accredited investors seeking exposure to $SUI, a third-generation blockchain designed to help address scalability and transaction costs.”

– Grayscale

In closing, the Sui Network offers opportunities and risks worth considering as this cryptocurrency market cycle develops. Investors should find attractive exit and entry points as SUI is still a low market cap coin with high expected volatility, requiring caution.

finbold.com

finbold.com