Cardano’s (ADA) price has increased by a modest 3.85% in the last 24 hours. This hike has brought back hopes that the altcoin could produce gains for investors who purchased the token at a higher value than its current price.

While optimism surrounds ADA’s potential growth, technical and on-chain data suggest that such ambitious profit targets might be unrealistic. Here is why.

Cardano Sets Holders Up for Disappointment

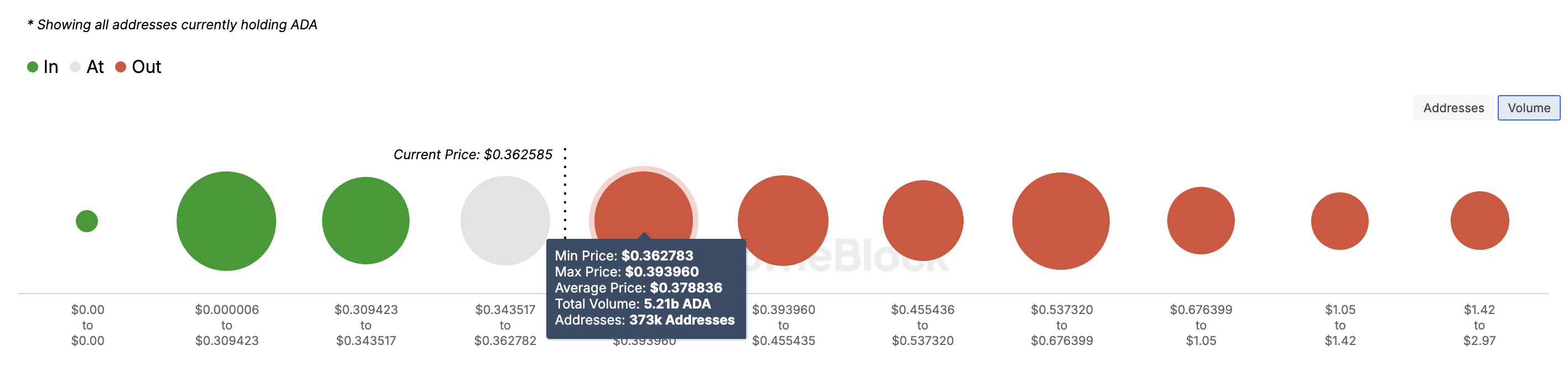

Cardano’s recent increase has ensured that the price did not pull back to $0.30. While it trades at $0.36, the Global In/Out of Money (GIOM) shows that those who accumulated ADA between $0.36 and $0.39 are still holding at a loss.

For context, the GIOM categorizes addresses and volumes based on their profitability. By showing this aggregate, the indicator can spot resistance and support areas that could either help accelerate the upswing or invalidate it.

Typically, the larger the volume (clusters), the stronger the support or resistance. As seen below, 373,000 addresses that accumulated 5.21 billion ADA at an average price of $0.37 are out of the money. At current prices, this volume is worth $1.87 billion and is larger than those holding ADA in profits, which purchased around $0.35.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

Based on the conditions above, it is highly unlikely that ADA will reach $0.39 in the short term due to this supply zone. As such, some of these Cardano investors might fail to achieve the profitable status desired.

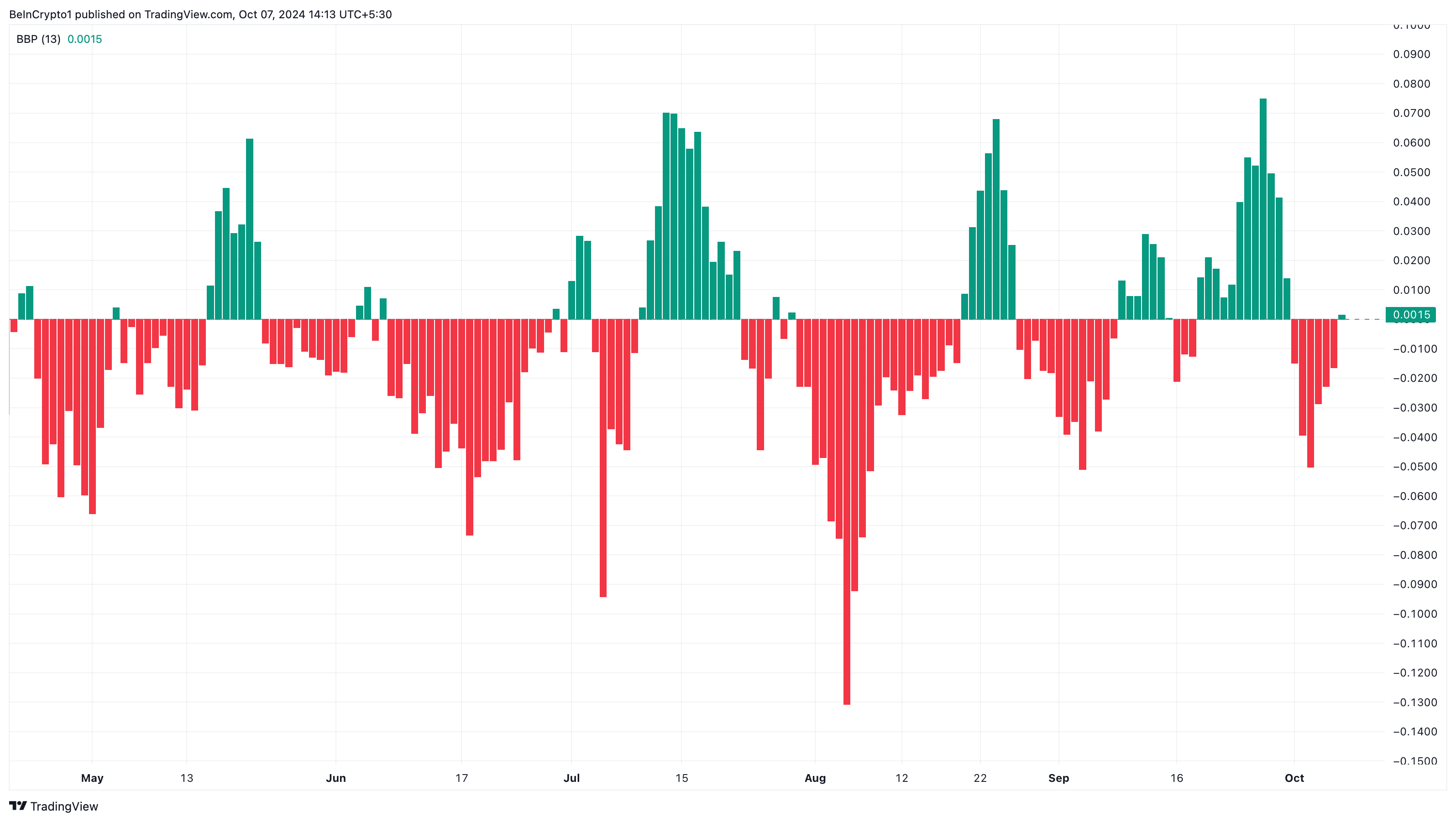

Another indicator suggesting a Cardano price decrease is the Bull Bear Power (BBP). The BBP compares the strength of buyers (bulls) with that of sellers (bears). When the indicator’s reading is green, buyers are in control, but if it is in the red, sellers are dominant.

On the daily chart, there is a slight green histogram bar. However, it is nothing compared to the red ones, suggesting that bulls are yet to match bearish control.

ADA Price Prediction: No More Appreciation

Following its recent jump, ADA is approaching two major supply zones: one at $0.42 and the other around $0.50. An analysis of the daily chart shows that Cardano might face resistance around $0.37.

If validated, this could send the token’s value down to $0.34 support. If bulls fail to defend this support, ADA’s price might see another decline, and the cryptocurrency’s value could tank to $0.31.

Read more: 6 Best Cardano (ADA) Wallets You Should Consider in October 2024

On the flip side, Cardano could resist going down to that point if the strength of buyers improves. Should that be the case, the Cardano’s price might breach $0.42 and head toward $0.50.

beincrypto.com

beincrypto.com