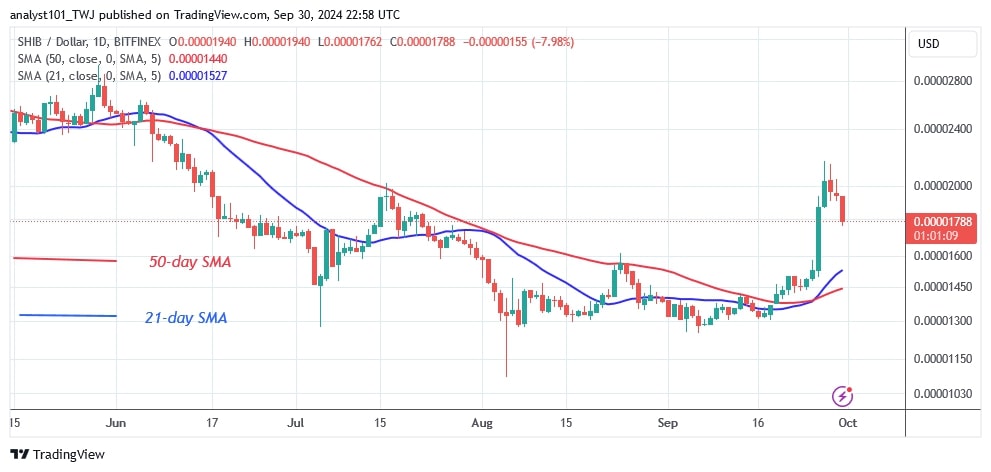

The price of Shiba Inu (SHIB) is in an uptrend after breaking above the moving average lines and the $0.00001600 resistance level.

Long-term forecast for the SHIB price: bullish

The cryptocurrency rose to a high of $0.00001861 but was then pushed back. Buyers were unable to sustain their bullish momentum above the $0.00002200 resistance, leading to a decline. SHIB fell but found support above the breakout level of $0.00001600.

The altcoin's uptrend will continue if it finds support above the moving average lines. The market will rise or break through the $0.00002200 resistance level. SHIB will reach a high of $0.00002600 if the current barrier is broken. However, the altcoin will be forced to trade above $0.00001600 and below $0.00002200 if buyers fail to sustain the price above its recent high.

SHIB indicator analysis

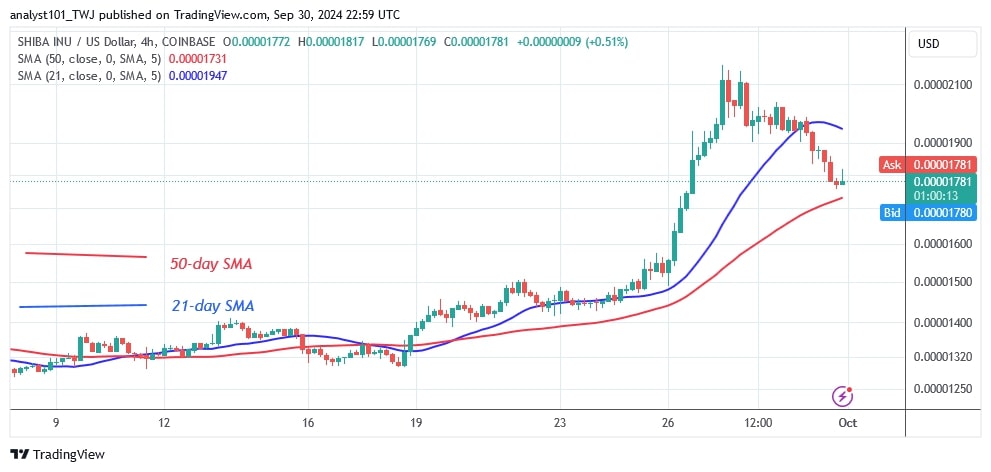

On the daily chart, the price bars are displayed above the moving average lines. This indicates that the uptrend will continue. However, the price bars on the 4-hour chart are below the moving average lines. This indicates that the selling pressure could continue. The moving average lines show a bullish crossover as the 21-day SMA crosses above the 50-day SMA.

Technical indicators

Key Resistance levels: $0.00001200, $0.00001300, $0.00001400

Key Support levels: $0.00000600, $0.00000550, $0.00000450

What is the next move for SHIB?

SHIB price is finding support above the $0.00001600 breakout level on the 4-hour chart. The altcoin is correcting higher as it approaches the 50-day SMA barrier.

On the upside, the positive momentum will continue if the price breaks above the moving averages. In contrast, selling pressure will return if SHIB is rejected at the moving average lines. The altcoin is expected to drop to a low at the $0.00001300 support.

Coinidol.com reported on weekend that SHIB was the cryptocurrency with the second-highest performance of the previous week.

Disclaimer. This analysis and forecast are the personal opinions of the author. They are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.

coinidol.com

coinidol.com