As ex-Binance CEO Changpeng “CZ” Zhao nears his release date, Binance Coin (BNB) buyers are becoming increasingly cautious. The coin’s price decline over the past few days due to low buying volume suggests that traders hesitate to commit to large positions.

This raises the question of whether CZ’s release will trigger a wave of profit-taking that bumps BNB prices or if it will propel BNB’s price to new highs.

Binance Coin Traders Reduce Activity

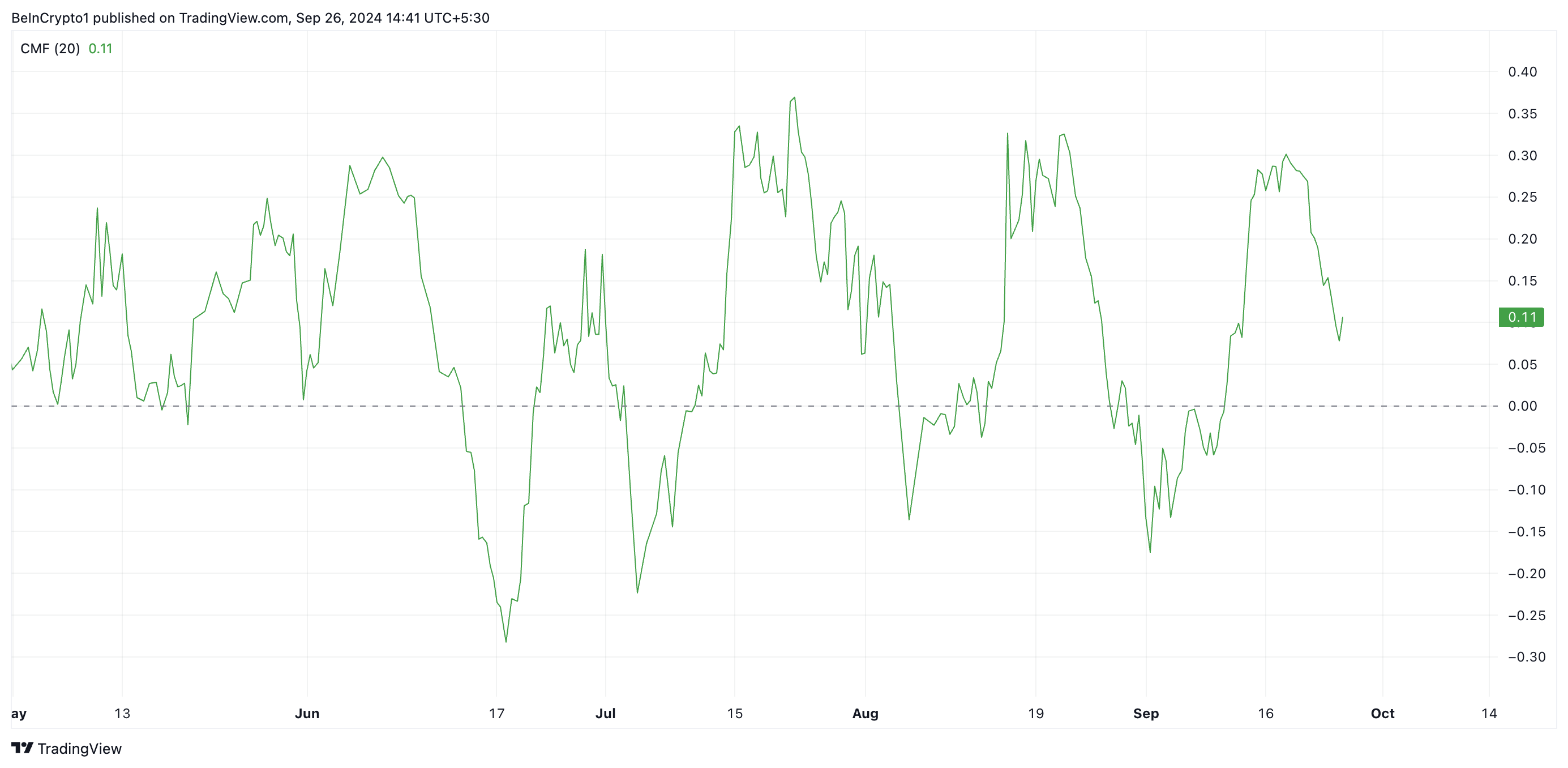

BNB’s Chaikin Money Flow (CMF), which tracks how money flows into and out of the asset, has steadily declined since September 21. At press time, BNB’s CMF is in a downtrend at 0.12.

Although the coin’s CMF is still positive, the decline suggests that buying pressure is weakening. While there may still be more buyers than sellers in the market, the intensity of buying is decreasing, indicating a lack of confidence in a positive price action in the near term.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

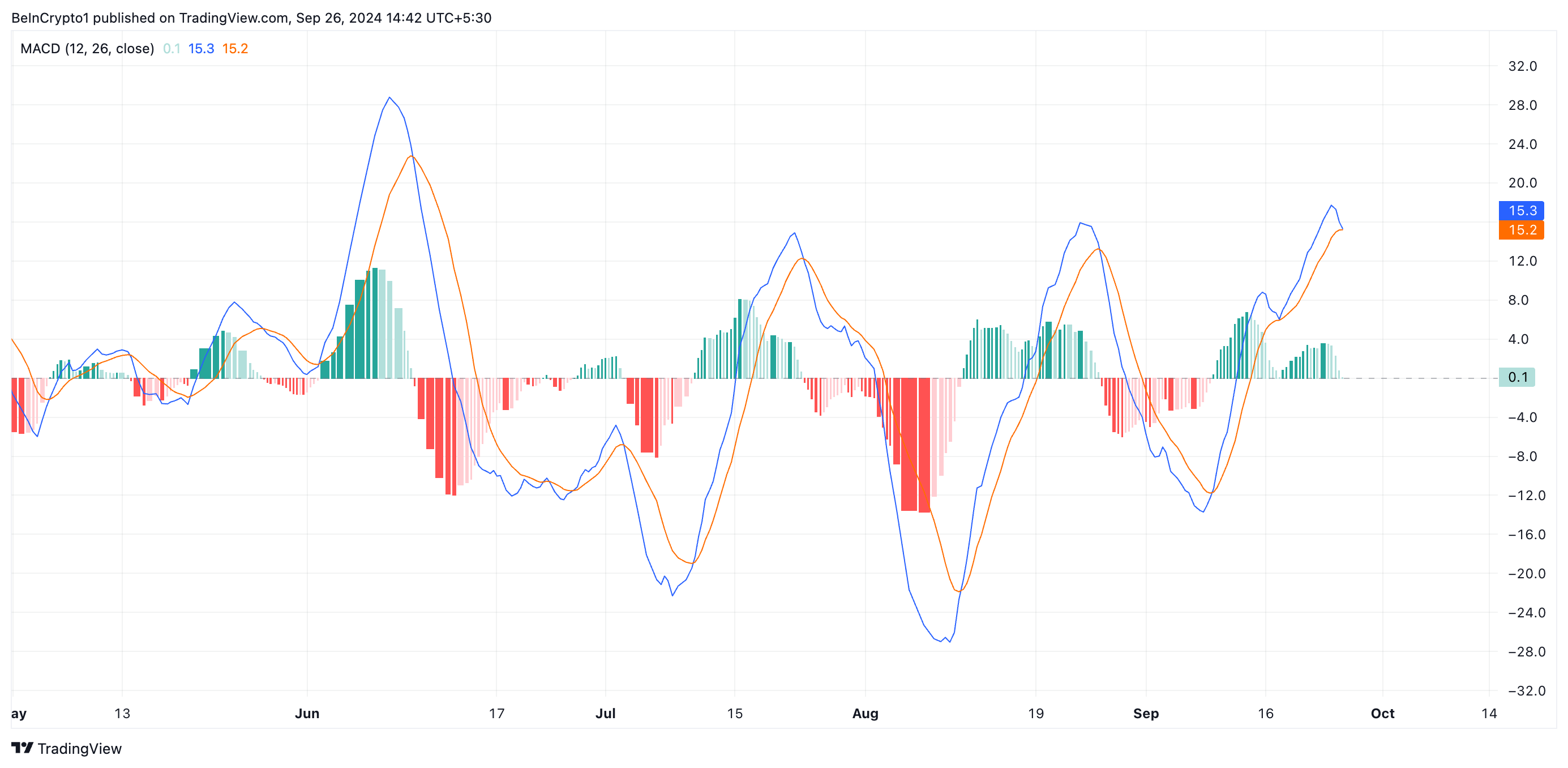

Further, readings from the coin’s moving average convergence/divergence (MACD) support this outlook. As of this writing, BNB’s MACD line (blue) is poised to cross below its signal line (orange). This indicates a potential shift in market trends.

A cross below the signal line is a bearish signal. It suggests that the uptrend is weakening and a decline is imminent. Traders often interpret it as a sign that it might be time to exit long positions or consider shorting the asset.

BNB Price Prediction: CZ Determines Where Price Goes Next

The decrease in BNB buying pressure leading up to the September 29 CZ release suggests it could turn into a classic “sell-the-news” event. In such scenarios, traders buy in anticipation of an event and sell once it happens, often leading to a price decline.

If the current drop in buying momentum persists, BNB’s price may fall toward the established support level of $522.90.

Read more: How To Trade Crypto on Binance Futures: Everything You Need To Know

However, if market sentiment turns positive and buying activity picks up again, BNB’s price could rebound, potentially reaching $652.90, which would invalidate the earlier bearish projections. A surge in buying momentum would likely propel the coin above key resistance levels, signaling renewed confidence.

beincrypto.com

beincrypto.com