Shiba Inu could target highs last seen in late 2021 following a symmetrical triangle breakout, as market analyst Charting Guy confirms the token is “ready.”

The analyst made this assertion while discussing Shiba Inu’s price movements over a 1-week timeframe. The symmetrical triangle in question has been forming over recent months.

Its lower trendline began shaping up in May. Meanwhile, the upper trendline emerged after SHIB’s price dropped from its yearly peak of $0.000045 in March. These converging lines suggest a consolidation phase is nearing its end. As a result, a breakout could be imminent.

Crucial Shiba Inu Levels

The accompanying chart shows several key Fibonacci retracement levels acting as resistance and support zones. Currently, Shiba Inu is trading for $0.00001457, with the bulls ready to leverage the 0.236 Fibonacci support at $0.00001104 as defense.

Should the price break upwards, the first major resistance lies at $0.00001643, representing the highs of mid-August. This region is the last roadblock between Shiba Inu and the $0.00002 psychological threshold. Beyond this, the next resistance level rests on the 0.5 Fibonacci mark, aligning with a price of $0.00002266.

Further resistance points are marked at $0.000031247 and $0.00003967. Notably, once Shiba Inu breaches these areas, it will face the previous March resistance at $0.000045810, which prevented it from reaching further yearly highs. Breaking this could help push SHIB toward the ultimate $0.00008841 target.

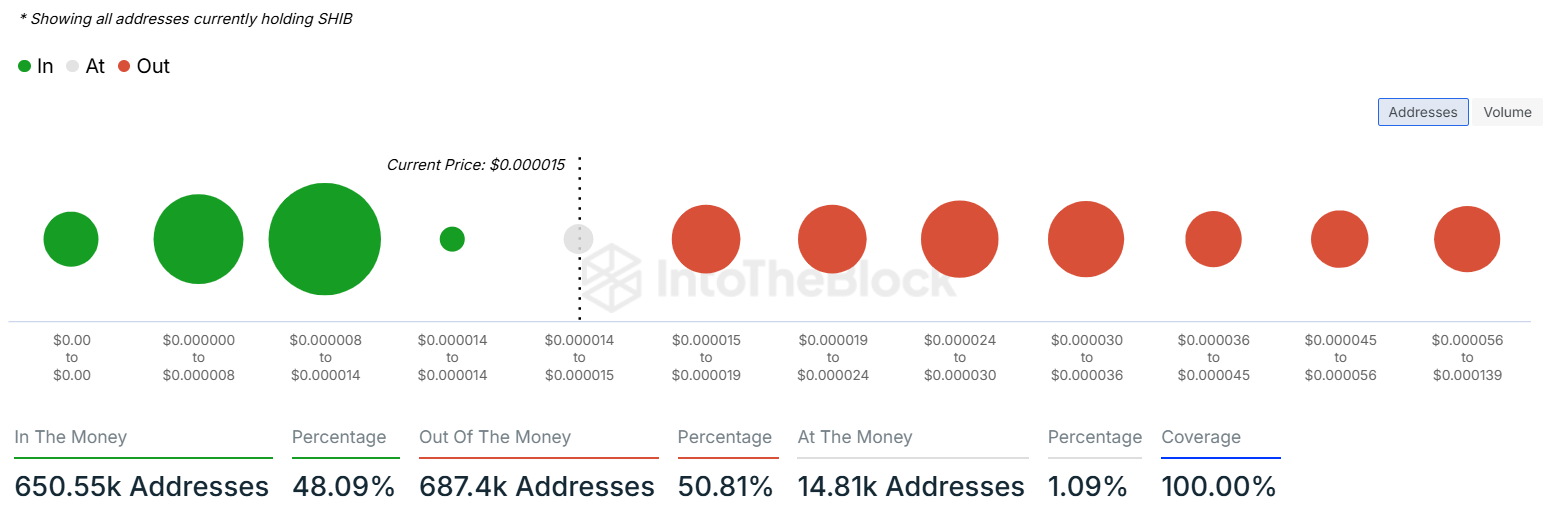

Shiba Inu is likely to face its biggest resistance at the Fibonacci levels between $0.000024 and $0.000030. Particularly, IntoTheBlock data suggests that the market features a large sell wall within this price range, where 143,380 addresses purchased 49.33 trillion SHIB at an average price of $0.000027.

Meanwhile, a downward move could see SHIB testing lower supports at $0.000008411 and $0.000005808. However, this remains highly unlikely. Shiba Inu has not revisited these levels in months. The weekly RSI, now at 45, suggests market uncertainty but confirms the possibility of an upward push.

SHIB Bulls Maintain Control

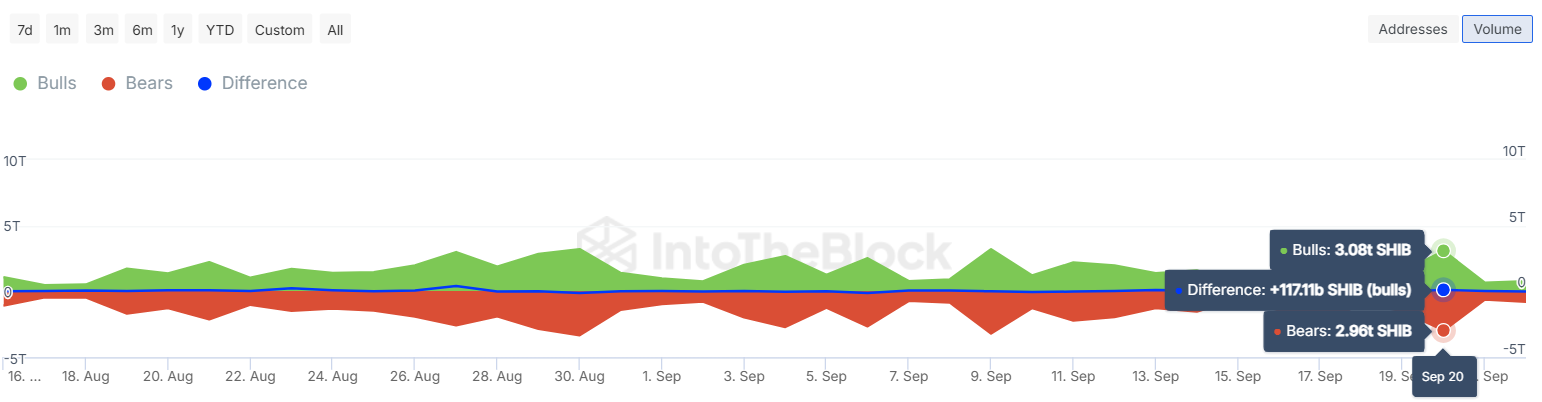

Market data on bull-bear volume corroborates the bullish outlook surrounding SHIB. Notably, since mid-September, Shiba Inu intraday purchase volumes by bulls have persistently overshadowed sale volumes from bears.

Specifically, on Sept. 20, bulls bought over 3 trillion SHIB, overshadowing bearish volume by 117.1 billion tokens. This represented the largest excess demand since Sept. 6.

In addition, large Shiba Inu transactions have remained above the 1 trillion mark daily since Sept. 16, per IntoTheBlock data. The only outlier occurred on Sept. 18, when volume dropped to 604 billion tokens.

thecryptobasic.com

thecryptobasic.com