Chainlink (LINK) is gaining the attention of market participants, as evidenced by its rising social dominance. However, its weakening buying pressure suggests this may not be a bullish sign.

A negative divergence has emerged on LINK’s price chart, which could cause it to lose its most recent gains.

Chainlink Is the Talk of the Town

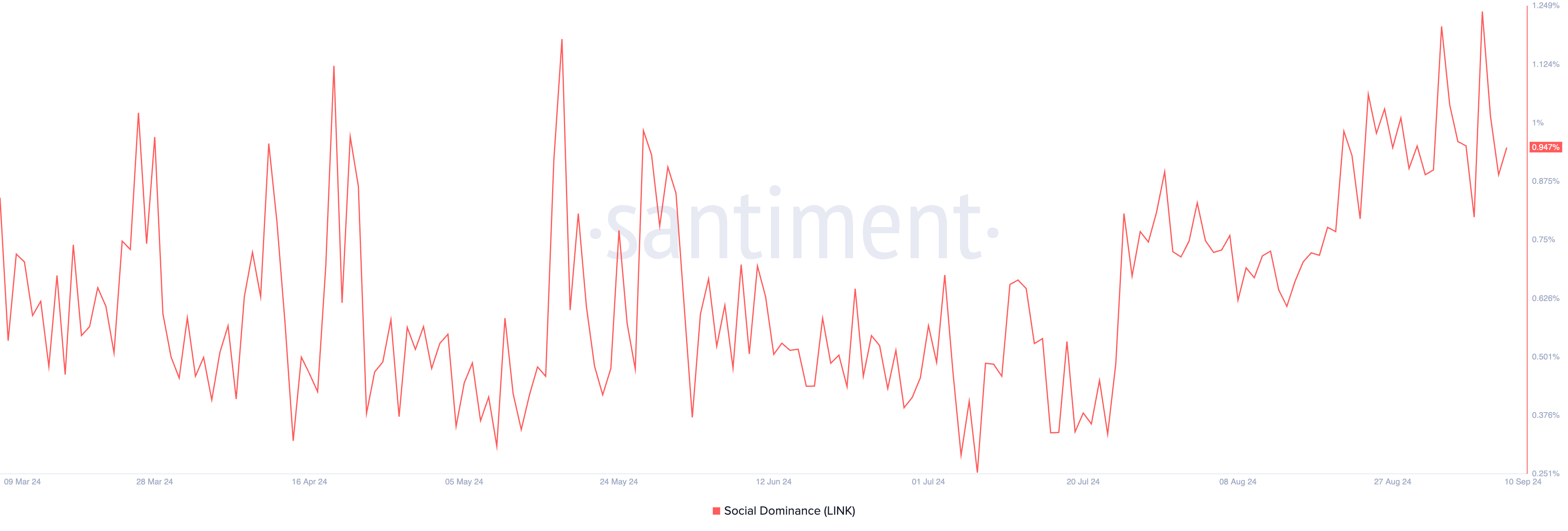

On-chain data from Santiment shows a spike in LINK’s social dominance. On September 7, this closed at a high of 1.24, representing its highest since December 2023.

This metric tracks an asset’s share of online discussions compared to the total conversations around the top 100 cryptocurrencies by market capitalization. When it surges, it means that discussions about the asset in question are suddenly a much more significant part of the overall conversations happening in the crypto market compared to before.

Interestingly, the uptick in LINK’s social dominance has occurred amid the reduction in the number of addresses holding the altcoin due to its price troubles.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

Exchanging hands at $10.47, the altcoin’s value has declined by 16% since August 26, forcing some of its holders to dump their tokens. The number of addresses holding LINK currently totals 722,000, declining steadily since August 11.

LINK Price Prediction: Bearish Divergence Puts Token at Risk

In a post on X, an on-chain data provider noted that Chainlink’s high social dominance, combined with a declining number of total holders, is generally a bullish signal if markets stabilize this upcoming week. However, a bearish divergence forming on the price chart counters this outlook.

Recently, LINK’s price has seen a slight increase, but at the same time, its Chaikin Money Flow (CMF) indicator has been trending downward, signaling a bearish divergence. This suggests that while the price is rising, the underlying volume and money flow supporting the increase are weakening, indicating a potential decline as buying pressure fades.

If LINK reverses its current uptrend, it could fall back to the $10.25 support level, which it recently broke above. If bulls fail to defend this level, LINK’s price could drop further, potentially reaching $8.08.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

However, It will rally to $11.24 if the uptrend is maintained, invalidating the bearish projection above.

beincrypto.com

beincrypto.com