Hedera’s HBAR is at a pivotal juncture as it teeters near the critical support level of $0.05031. While the network has shown impressive growth, marked by a rise in transaction fee revenue and a boost in new addresses, HBAR has struggled to convert this progress into price momentum.

Throughout 2024, the altcoin has consistently underperformed, leaving investors questioning whether the current support will hold or if a more profound decline is on the horizon.

Network Growth vs. Price Performance

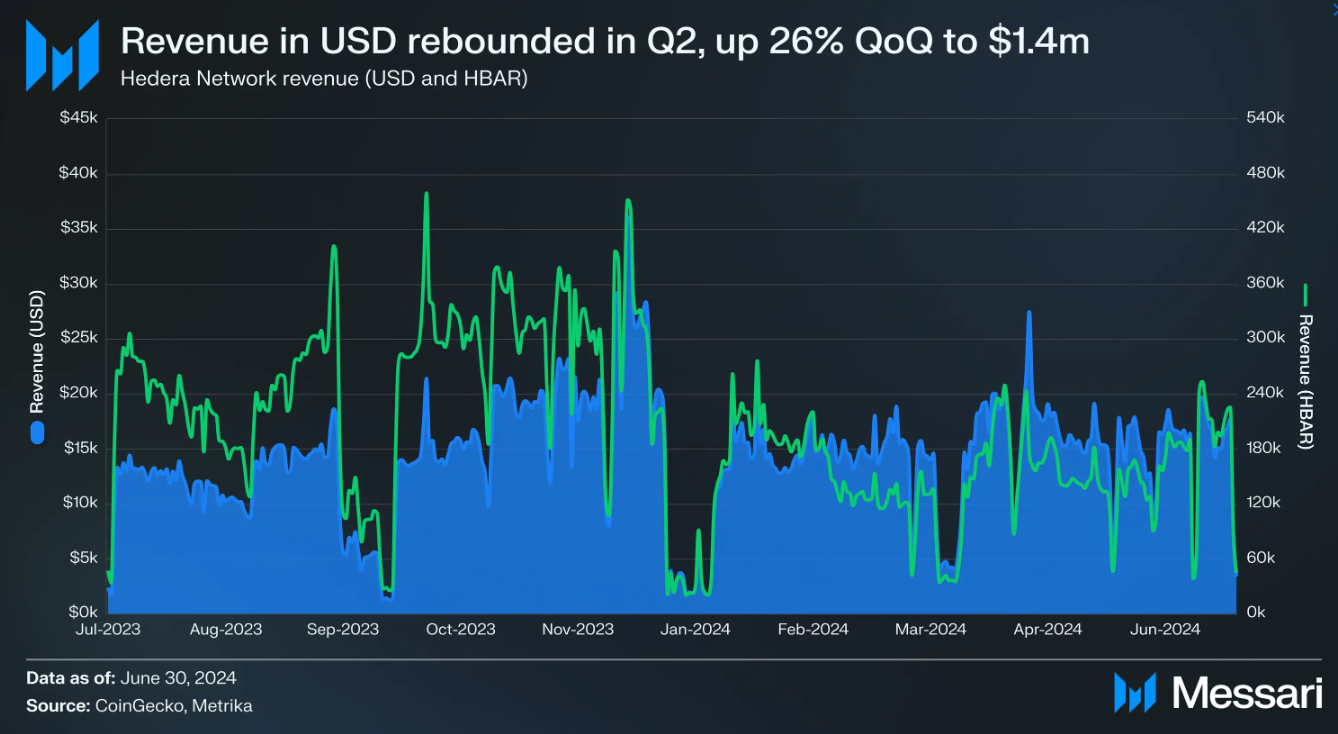

The Hedera network has experienced notable growth, particularly in the second quarter of 2024. According to a recent report by Messari, the network’s revenue from transaction fees reached $1.4 million during this period, marking a 26% increase compared to the previous quarter.

Source: Messari

This figure reflects the second-highest quarterly revenue ever in the history of Hedera implying an increase in the activity of the network. Also, the figures relating to the creation of new addresses on the Hedera network have gone up by 31%, averaging 11,000 new addresses every day in Q2 2024.

Such measures were supported by average daily transactions, which jumped by 46% to 132.9 million. In spite of these positive developments, the price of HBAR has not been improving.

The year-to-date performance of the altcoin is more modest as it has lost 39% in value, unlike many of its peers in the market.

On-Chain Metrics Offer Mixed Signals

While the network growth paints a bullish picture, other on-chain metrics suggest a more cautious outlook. One key indicator, Total Value Locked (TVL) in Hedera’s decentralized finance (DeFi) ecosystem, has dropped significantly.

Hedera’s TVL (Source: DefiLlama)

According to DeFiLlama, Hedera’s TVL has decreased from a yearly peak of $156.73 million to the current $46.15 million. This decline indicates a reduced activity by decentralized finance applications on the Hedera network, further complicating the outlook for HBAR.

Despite the drop in TVL, Hedera’s market cap ranking has improved, primarily due to increased circulating supply. However, this has not been enough to offset the overall bearish sentiment surrounding HBAR.

With these mixed signals, the pressing question lingers: Is HBAR on the verge of a breakout, or will the bearish trend persist?

A Key Support Level in Focus

As of press time, HBAR was trading at $0.051, slightly below its key support level of $0.05031. Since early August, the token has been consolidating within the $0.05031-$0.06384 range, with $0.0531 acting as a critical support level.

HBAR/USD 1-Day Chart (Source: TradingView)

As proven historically, each time HBAR has tested this support, it has bounced back, indicating a high concentration of buy orders around this price. However, the Relative Strength Index (RSI), currently at 38.37, suggests that bearish momentum remains strong.

While the RSI has shown signs of a bounce after testing the support level, it is unclear whether this will be enough to hold the price above $0.0531. Further corroborating this scenario, market sentiment around HBAR has been predominantly negative over the past two months.

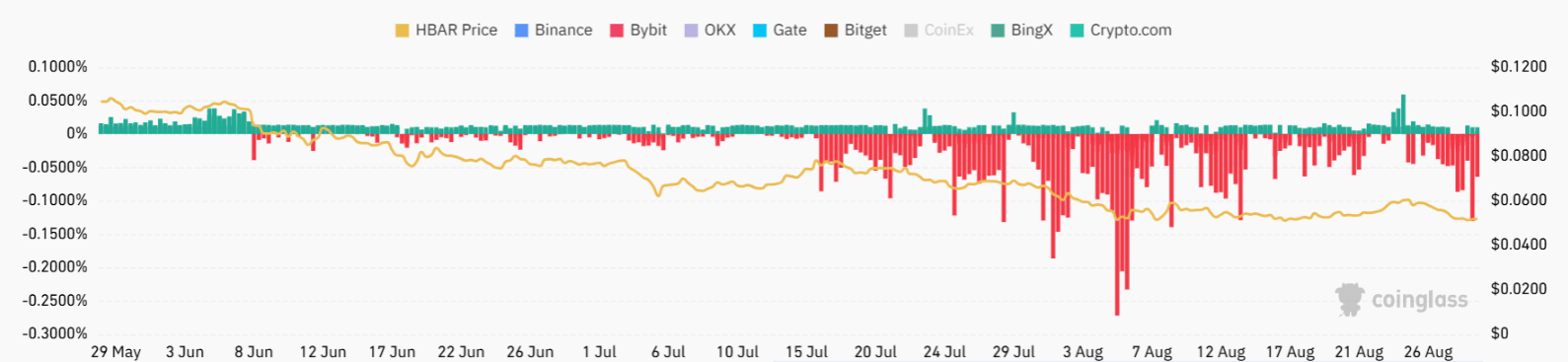

Source: CoinGlass

Data from Coinglass shows that HBAR’s funding rates have been primarily negative, reflecting a bearish outlook among traders taking short positions. For HBAR to reverse this trend, a significant increase in buyer interest and broader market support will be necessary.

thecoinrepublic.com

thecoinrepublic.com