In June, Binance Coin (BNB) shocked the crypto market by becoming the first of the top ten altcoins to reach a new all-time high (ATH). Interestingly, this happened nearly three months after Changpeng Zhao was sentenced to four months in prison.

Popularly called CZ, the former Binance CEO is set to be released from jail next month. Here is why his comeback could send BNB’s price to another ATH.

CZ’s Homecoming Signals Strength for Binance and BNB

According to the United States Federal Bureau of Prisons (BOP), CZ has been moved from the prison at the Federal Correctional Institution Lompoc in central California. A look at recent data shows that Zhao is now at the Residential Reentry Management (RRM) Long Beach.

The RRM is a halfway house in San Pedro in the same city. From BeInCrypto’s findings, the transfer appears to be related to his release scheduled for September 29.

However, on X, there have been rumors that the exchange’s co-founder might be let out early. But it was a case of mistaken interpretation. Regardless of the release data, it seems that his return could spark a wave of buying pressure for BNB.

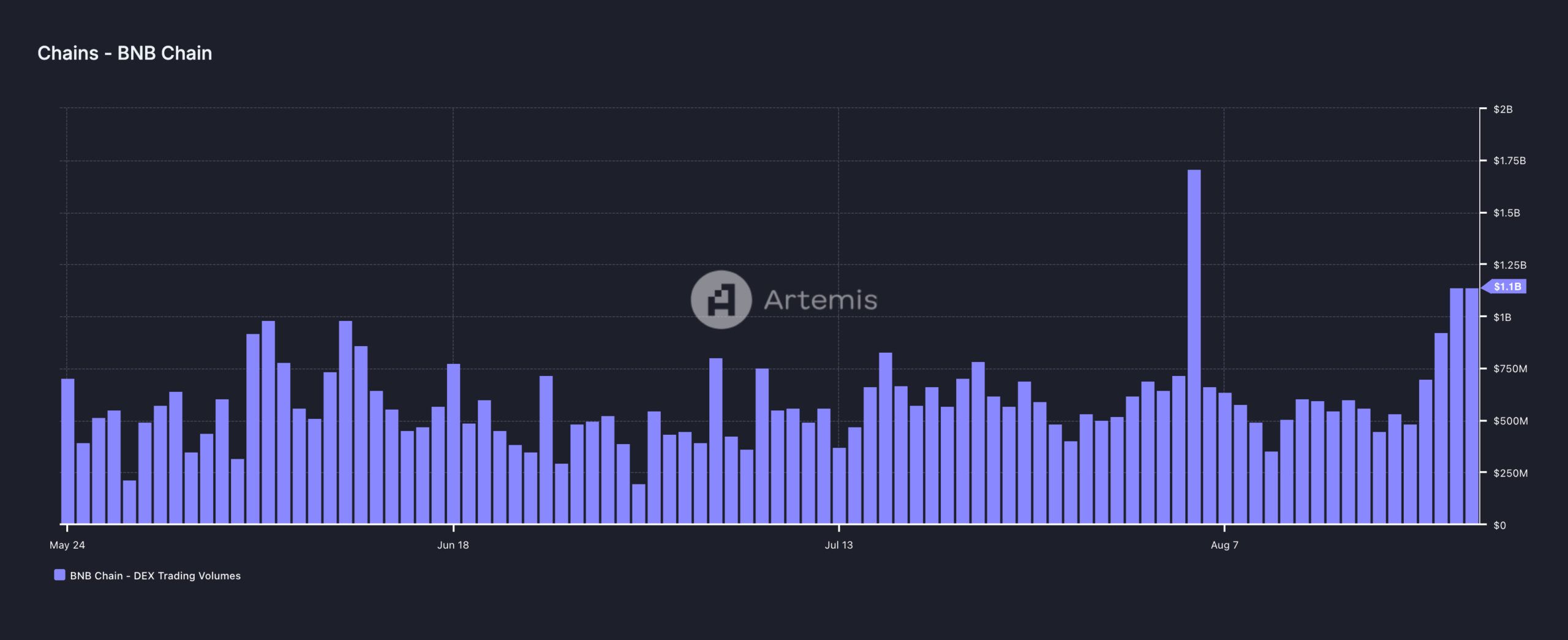

For instance, according to Artemis data, BNB’s DEX trading volume has surpassed $1 billion for the first time since the August 5 market crash. This volume is the amount of cryptocurrency traded outside of centralized platforms like Binance.

An increase in this value suggests rising demand and foreshadows a price increase for the coin involved. BNB currently trades at $578.72, a 19.22% drawdown from its ATH of $720.67.

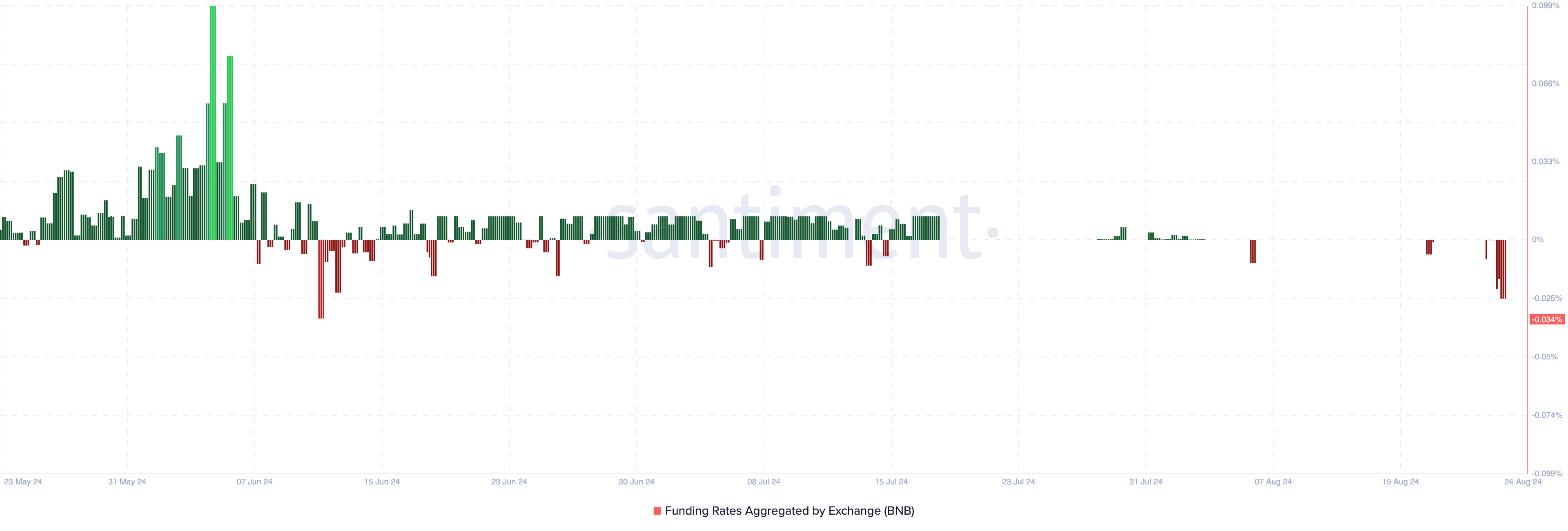

If the DEX volume continues to increase toward CZ’s anticipated release, BNB’s price might follow. Should this happen, the coin value might surpass its current ATH. In addition, Binance Coin’s Funding Rate is negative, indicating that traders expect the price to fall in the short term.

Read more: Who Is Changpeng Zhao? A Deep Dive Into the Ex-CEO of Binance

However, negative funding and an increase in price are rarely a good combination for those expecting a price decrease. Hence, if shorts (sellers) remain aggressive and the price increases, BNB’s price might experience another upswing.

BNB Price Prediction: It’s About Time to Return Higher than $700

Despite BNB’s price fluctuations, the 4-hour chart indicates it is moving within an ascending channel.

This pattern suggests that the bullish sentiment remains intact. If the pattern holds, BNB could potentially retest the $700 level before the end of September.

On the daily chart, the Awesome Oscillator (AO) is positive, confirming that the momentum around the coin is bullish. This indicator compares recent price movements to historical performance.

When the AO is negative, it means that the momentum around the cryptocurrency is bearish. Thus, in Binance Coin’s case, the rising momentum could help drive the price higher.

As seen below, BNB’s price could rally to $648.80 within the next few weeks. If buying pressure increases, it could also jump to $724.67.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

However, if Binance’s former CEO CZ is released from prison and the US SEC pursues another lawsuit against him and Binance, BNB’s price might decline. In such a scenario, the coin’s value could drop to $526 or even $472.

beincrypto.com

beincrypto.com