Bitcoin’s price soared to a multi-day peak of almost $62,000 yesterday but failed there, and the subsequent rejection drove it south by around four grand.

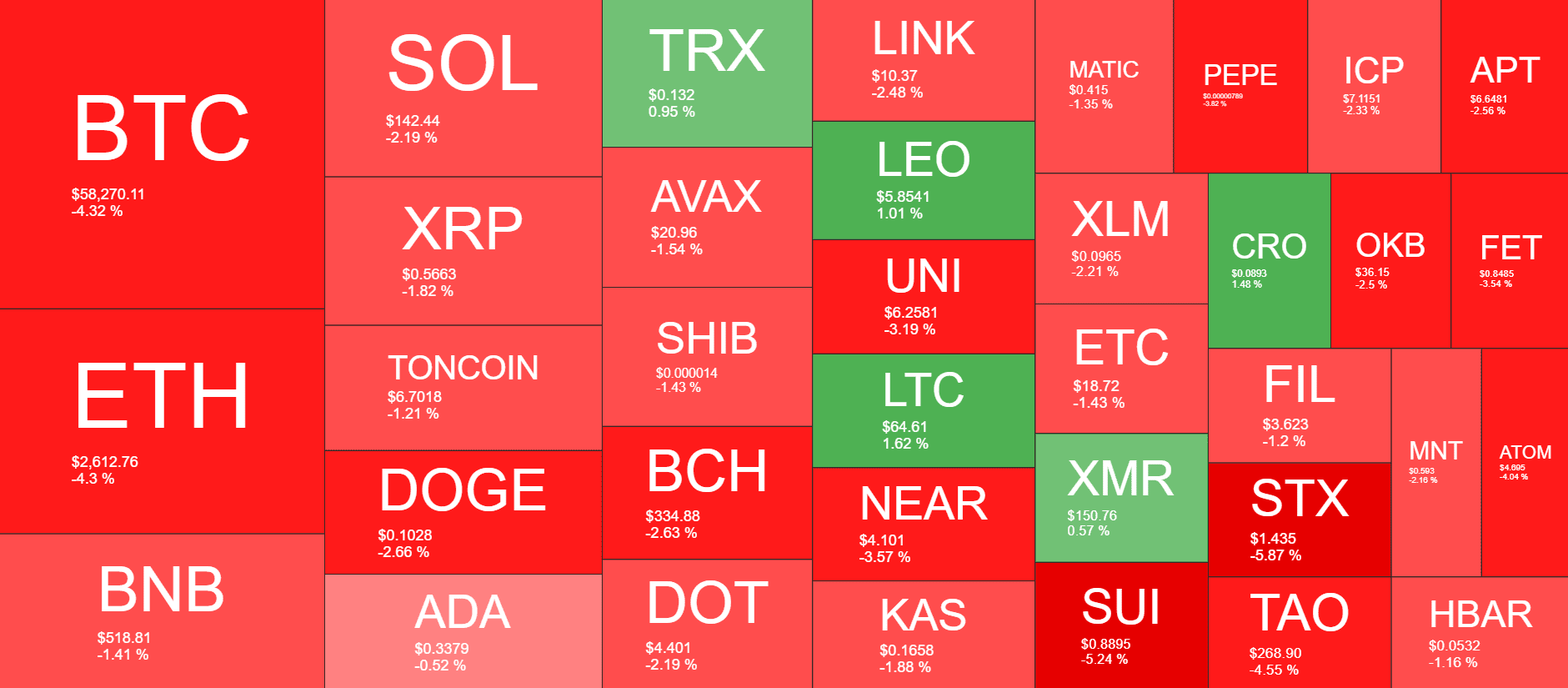

The altcoins have turned red on a daily scale as well, with ETH retracing by 4.5% to just over $2,600.

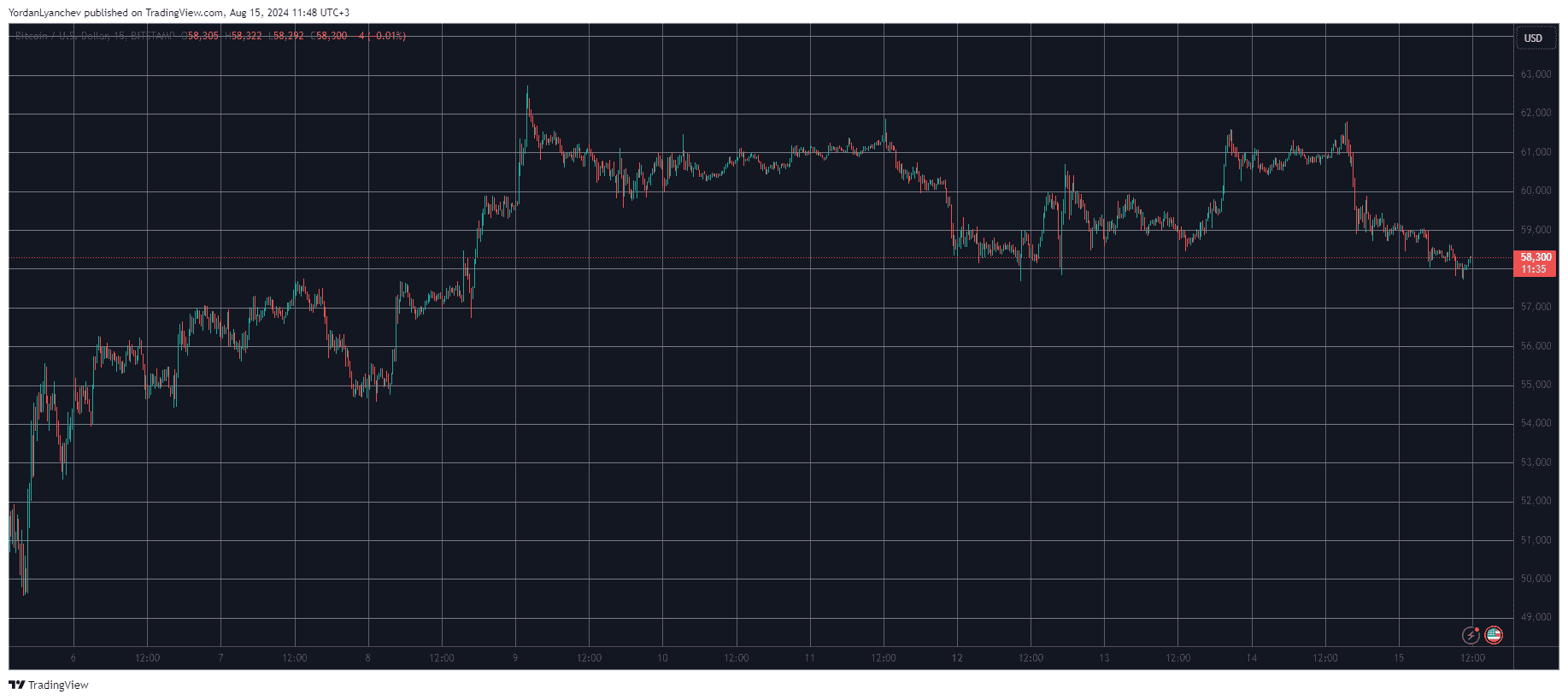

BTC Down to $58K

The primary cryptocurrency had a volatile last week but managed to recover most of the losses by its end. On Friday, the asset had neared $63,000 after gaining more than $13,000 since the Monday low.

The weekend was relatively sluggish as BTC lost some ground and stood mostly in a range between $60,000 and $61,000. Monday started with a retracement again, but a lot less painful this time as bitcoin fell to just under $58,000.

It bounced off on Tuesday and Wednesday and jumped to nearly $62,000 yesterday after the US announced the CPI data for July. Nevertheless, BTC dropped once again later on after reports that the US government had sent roughly $600 million to Coinbase Prime.

The cryptocurrency’s local low came hours ago at just under $58,000. Despite being able to bounce above that level now, the asset is still more than 4% down on the day. Its market cap has slid to $1.150 trillion, while its dominance over the alts has taken a hit and is down to 53.3%.

Alts Heading Downhill

Ethereum is among the poorest performers in the past 24 hours from the larger-cap altcoins. It has dropped by a similar percentage as BTC and sits at just over $2,400 following Jump Crypto’s latest ETH sale that sparked speculations about a further decline.

Binance Coin, Solana, Ripple, Toncoin, Dogecoin, Cardano, Shiba Inu, Bitcoin Cash, and Polkadot are also in the red, while Tron has charted a minor increase.

The biggest losers from the mid-cap alt cohort are TIA, WIF, and BRETT, all of which have declined by around 7-9%.

The total crypto market cap is down to $2.160 trillion, which means that it has lost roughly $80 billion since yesterday.

cryptopotato.com

cryptopotato.com