At Bitcoin Market Journal, we invest in crypto tokens as if they were stocks. While there are important differences between the two, we analyze crypto “companies” like traditional companies, and diversify our investments with a mix of both. More on our approach here.

Key Takeaways:

- Ripple, launched in 2012, has demonstrated significant resilience by maintaining a strong market position despite numerous battles with the SEC.

- Ripple’s primary use case in cross-border payments has not yet achieved widespread adoption, with revenue heavily dependent on XRP sales.

- The SEC case against Ripple has been decided, with the judge’s ruling stating that XRP is not a security. This provides crucial regulatory clarity for XRP, though Ripple awaits penalties for past institutional sales deemed unregistered securities.

The Ripple Origin Story

Ripple was conceived in 2011 when three developers, David Schwartz, Jed McCaleb, and Arthur Britto, sought to develop a more efficient and sustainable system than bitcoin for sending value. In 2012, they formed a company, NewCoin, and launched their cross-border blockchain platform XRP Ledger. (The company was later rebranded as Ripple Labs.)

Ripple approached their vision differently than other cryptocurrencies by designing a system to work alongside existing financial infrastructure, not replace it. The team believed this approach would revolutionize the global financial system.

Ripple’s native token, XRP, is central to this system. XRP acts as a bridge currency to facilitate quick, cost-effective cross-border transactions, enhancing liquidity and reducing costs for financial institutions. As a result, Ripple focused on building partnerships with financial institutions to transform cross-border payments. Significant partnerships included Santander, Bank of America, and Standard Chartered.

In 2020, however, the SEC filed a lawsuit against Ripple, alleging that XRP was an unregistered security. This lawsuit has been a major point of contention, affecting XRP’s market price and even led to its delisting from several major exchanges in the U.S.

Despite this setback, Ripple secured a partial victory in July 2023, when the court ruled that XRP sales to retail investors were not securities. However, institutional sales of XRP were deemed unregistered securities, and the company paid a $125 million fine in August 2024 (a fraction of the SEC’s request).

This ruling has provided some regulatory clarity, and has been a significant milestone for Ripple, though the SEC is likely to appeal the ruling: the company is not out of the woods yet.

XRP remains one of the top cryptocurrencies by market capitalization and has maintained a significant presence in the crypto market despite these regulatory challenges.

Key Fundamental Data

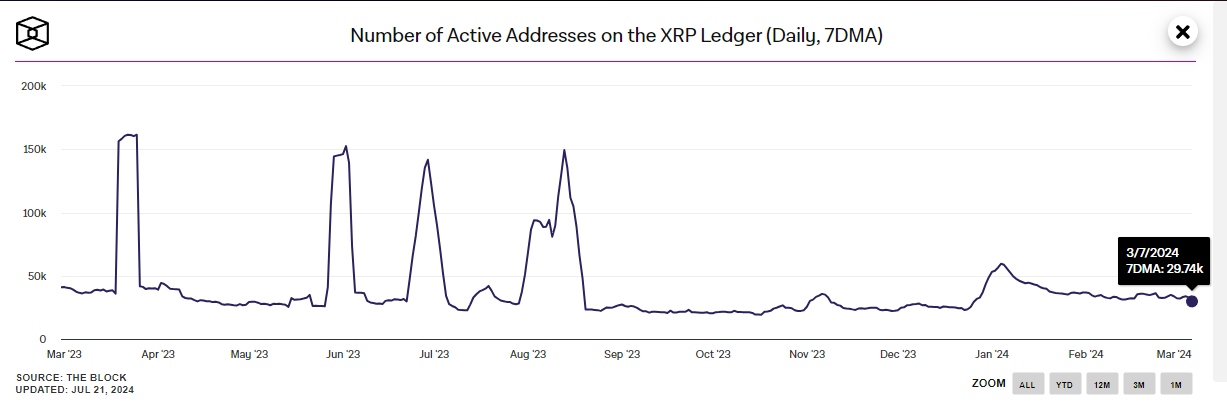

Daily Active Users (DAU): XRP’s DAU has been relatively stagnant over the last year with no significant changes. As of writing, it records an average of 30k DAU according to The Block, lagging behind its competitor Stellar, which has averaged 100k DAU over the past year.

Fees and Revenues:

- Ripple’s On-Demand Liquidity (ODL) service makes up approximately 60% of the company’s revenue. (Instead of converting dollars to Euros, then Euros to dollars, which is costly and slow, partner institutions can use dollars to purchase XRP, then sell their XRP for Euros, which is instant and cheap.) Ripple generates revenue by selling this XRP to institutions to make these cross-border currency conversions.In Q1 2023, Ripple’s ODL-related sales reached approximately $2.93 billion, mostly to smaller financial institutions (the large banks are still nervous about jumping on board, given issues with the SEC). Despite these challenges, ODL usage remains robust, highlighting its importance to Ripple’s revenue stream.

- Licensing Fees for RippleNet: Ripple generates revenue from financial institutions and payment service providers that use RippleNet, its global payment network, for cross-border transactions. While ODL is a significant part of RippleNet, not all RippleNet users rely on XRP or ODL, so the company earns fees from those using the network for fiat-only transactions.

- XRP Sales to Institutional Investors: Ripple periodically sells XRP directly to institutional investors. These sales are distinct from those tied directly to ODL transactions and can contribute to Ripple’s revenue, especially when the market demand for XRP is high.

- Partnerships and Professional Services: Ripple offers consulting and integration services to help financial institutions adopt its blockchain technology. These services generate revenue through consulting fees, integration projects, and technical support.

- Ripple’s Investments and Ventures: Ripple has invested in various startups and blockchain projects, and any returns or dividends from these investments also contribute to the company’s revenue. Ripple’s XRP holdings and strategic sales play a role here as well.

“ODL sales” refers to XRP that Ripple sells to financial institutions for its ODL service, to facilitate cross-border payments. “Total purchases” is the XRP that Ripple bought back from the open market, to manage the XRP supply.

Market Cap: As of writing, the market cap of XRP is approximately $35 billion. The market cap has shown fluctuations over the past year but has not significantly increased during this period. Notably, Ripple’s XRP has a much larger market cap compared to its direct competitor, Stellar's XLM, which has around $3 billion invested in the coin.

XRP’s historical market cap trend.

Market Analysis

Problem that it solves: Ripple launched to address significant problems in the global financial system, particularly focusing on inefficiencies in cross-border payments. The project now offers more products beyond cross-border payments, including infrastructure for governments to issue and manage their Central Bank Digital Currencies (CBDCs).

Customers: Ripple primarily serves a wide range of financial institutions, including banks, payment providers, and other financial services companies. Individual users also constitute a significant portion of Ripple’s customer base, which, according to general crypto market trends, are predominantly male and largely college-educated.

Value creation: Adopting Ripple allows these financial institutions to reap the benefits of a blockchain solution, including fast and cheap transactions. For large institutions and banks, XRP enables fast and low-cost cross-border transactions compared to traditional remittance payments, which are slow and expensive.

Market structure: In terms of blockchain projects, the global remittance space is still emerging, though Ripple, which has been around the longest, is the clear leader.

Market size: The market potential size is massive, as there is potential for Ripple to partner with more banks and institutions with the goal of replacing the SWIFT international payments system. Ripple estimates $150 trillion of cross-border payment flows per year.

Regulatory risks: Ripple has already had encounters with the SEC, plus there’s a high risk of regulation as the project integrates with traditional financial institutions.

Our analysts rated XRP a 3.5 out of 5 for market analysis. Download the complete scorecard here.

Competitive Advantage

Technology/blockchain platform: XRP runs on its own XRP Ledger, launched over a decade ago in 2012.

Lead time advantage: Ripple has a good head start, especially since it's focused on financial institutions. Other solutions like Stellar followed soon after, focusing instead on individuals.

Contacts and networks: Ripple’s well-developed network of contacts has enabled it to secure partnerships with notable financial institutions such as SBI Remit and Travelex. In the past, Ripple has also partnered with major players like Santander and Bank of America.

Our analysts rated XRP a 4 out of 5 for competitive advantage. Download the complete scorecard here.

Management Team

Entrepreneurial team: Ripple’s team has a strong track record, with key members such as current CEO Brad Garlinghouse, who previously held executive positions at AOL as President of Consumer Applications, and had a long tenure at Yahoo!.

Industry/technical experience: The team has been in the industry for more than a decade, working on Ripple and contributing to its growth. As one of the OG cryptocurrency projects, Ripple continues to stand strong, demonstrating the team's extensive technical experience.

Integrity: In its lawsuit against Ripple, the SEC accused the company's top executives of misleading investors and profiting from unregistered sales of XRP. However, Ripple has since been cleared of all charges after paying a $125 million fine. (However, the SEC can still appeal.)

Our analysts rated XRP a 4 out of 5 for the management team. Download the complete scorecard here.

Token Mechanics

Token required: XRP is essential in the Ripple ecosystem, as it is the technology by which Ripple delivers faster and cheaper international payments and currency exchange.

Value added: XRP is used as a bridge currency instead of fiat, allowing financial firms to make cross-border transactions faster and cheaper.

Decentralized: XRP is not fully decentralized: only select network participants are allowed to validate transactions. In addition, XRP and the XRP Ledger are developed and promoted by the centralized entity Ripple, which is a major player in the XRP ecosystem.

Token supply: In terms of tokenomics, this is one of the most complex blockchain projects to explain to investors.

XRP was pre-mined, with all 100 billion XRP released at the genesis of the blockchain. Ripple still holds about 40 billion of these tokens in escrow, which it sells to partners to support its ODL product. This increases the circulating supply of XRP, which could dilute the value of your holdings as an investor.

However, Ripple manages this by buying back XRP to help stabilize the market, but note that it generally sells more than it buys back. This may not be a problem if the price of XRP continues to increase, offsetting the new tokens entering the market, but it is a tricky balance for the company to maintain. Think of XRP like a stock that is also being used to power the actual product.

Public exchange: XRP is listed on popular exchanges like Binance, Coinbase, and KuCoin.

MVP: XRP has been up and running since its launch in 2012.

Our analysts rated XRP a 3.5 out of 5 for token mechanics. Download the complete scorecard here.

User Adoption

Technical Difficulty: One of Ripple's selling points is its fast transaction speeds. Also, Ripple's partnerships with large banks and institutions are likely to attract even more partnerships, and potentially pose a real competitor to SWIFT.

Halo Effect: Ripple has partnered with large, reputable financial institutions such as Santander and Bank of America.

Buzz: XRP generates a significant amount of buzz and boasts an impressive social media presence with over 2.7 million followers on Twitter.

Our analysts rated XRP a 4 out of 5 for buzz. Download the complete scorecard here.

Potential Risks

Team: Ripple’s team risk is quite low, as the project has been around for more than a decade, providing ample industry experience. However, as a privately-held company, questions about information asymmetry may arise, potentially leading to concerns about the team having information the general public is unaware of, which could result in unfair trades.

Financial: Ripple's holdings are about 40 billion XRP. Since the company's holdings are heavily concentrated in XRP, this means their financial health is closely tied to the value and liquidity of XRP. Any significant fluctuations in XRP's market price could substantially impact Ripple's overall financial stability.

Regulatory: XRP has undergone regulatory scrutiny with the SEC and emerged with a partial victory (though the SEC could still appeal). This experience arguably lowers XRP's regulatory risk, as Ripple has faced and addressed significant regulatory challenges, providing a more predictable regulatory path forward.

Smart Contract: The XRP Ledger codebase undergoes regular audits approximately every two years, including those conducted by well-known security analyst Guido Vranken. Ripple also maintains a bug bounty program that rewards users for reporting bugs and vulnerabilities.

Traction: XRP has a large off-chain following, but on-chain, the XRP Ledger records roughly 30k daily active users. While this is not necessarily low, it is for a project of XRP’s size. Its competitor Stellar, for example, records over 100k daily active users.

Behavioral: XRP frequently generates significant buzz in the cryptocurrency market, which can lead to FOMO, driving investors to buy XRP in hopes of quick profits. However, a substantial portion of XRP investors are likely committed to Ripple's long-term vision and have been willing to hold XRP through periods of volatility and regulatory hurdles.

Our analysts rated XRP a 3 out of 5 for risk (Note that for this section lower = better). Download the risk scorecard here.

Investor Takeaway

Ripple's resilience stands out as one of its strongest attributes. As one of the oldest projects in the cryptocurrency space, it has weathered numerous regulatory and market challenges while maintaining a strong position. Despite facing a high-profile SEC lawsuit, Ripple has managed to secure partial legal victories, continue its operations, and maintain significant market capitalization.

On the flip side, despite its technological advancements and strategic partnerships, Ripple has faced adoption challenges. Its primary use case as a cross-border settlement solution has not gained the widespread traction initially anticipated. It is being used primarily by smaller financial institutions, though it does provide a legitimate alternative to SWIFT which could gain adoption over time.

Overall, our analysts rated XRP a 3 out of 5, based on its demonstrated resilience balanced against its slower-than-expected adoption of its cross-border settlement solution. Download the complete scorecard here.

This analysis is to help make you a better-informed investor; it is not financial advice. The future may look different than the past. All investing involves risk; see our investing approach for how we manage risk through diversification. Never invest more than you’re willing to lose, and see losses as learning.

bitcoinmarketjournal.com

bitcoinmarketjournal.com