Chainlink’s (LINK) price is likely to recover after experiencing one of the largest single-day declines in over two years.

The reason behind this is the opportunity presented by the market to accumulate LINK at low prices.

Chainlink Investors Have a Shot at Profits

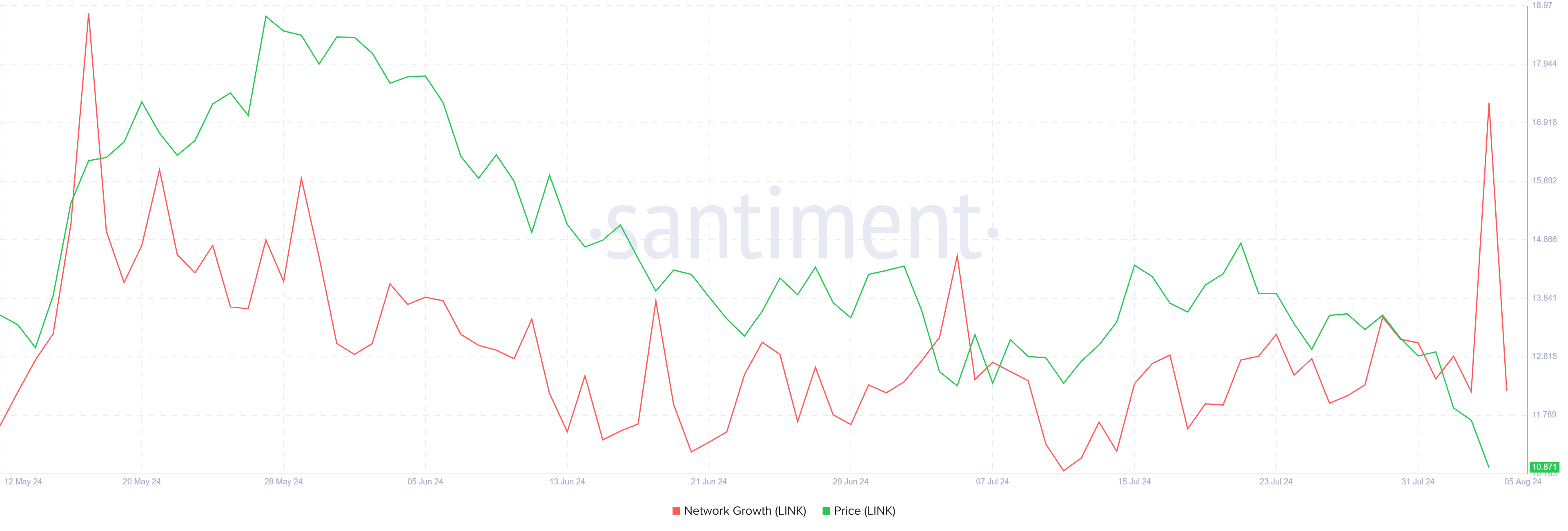

Chainlink’s price is currently at a multi-month low and is poised for potential recovery if investors act contrary to broader market cues. According to the network growth indicator, there has been a sharp uptick in the last 24 hours.

This uptick represents an increase in new addresses, i.e., new investors joining the network. The rise in new investors signals that the crypto asset is gaining traction in the market, which could translate to growth.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

Secondly, the new investors joining at current prices will likely attempt to accumulate now and sell later. Whether they sell or not is secondary since the Market Value to Realized Value (MVRV) ratio supports accumulation.

The MVRV ratio evaluates investor profit and loss. Currently, Chainlink’s 30-day MVRV is at -30%, indicating extreme losses but very low selling pressure. Historically, LINK MVRV between -4% and -14% typically signals the beginning of recoveries and rallies, marking an accumulation opportunity zone.

LINK Price Prediction: Recovery Ahead

If Chainlink’s price reacts to the aforementioned conditions, it could prevent any further decline. After noting a 27% decline over the past 24 hours, the altcoin is above the support of $8.29, trading at $8.52, and could bounce back.

However, the altcoin would need to see considerable bullishness to reclaim $12 as a support level. If LINK does not experience such recovery, it could remain above the psychological support of $10.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

On the other hand, a drop below the support of $8.29 could lead to Chainlink’s price reentering consolidation between $9.35 and $5.86. This range confined LINK for nearly 17 months before it could escape. Indeed, re-entering the range would invalidate the bullish thesis.

beincrypto.com

beincrypto.com