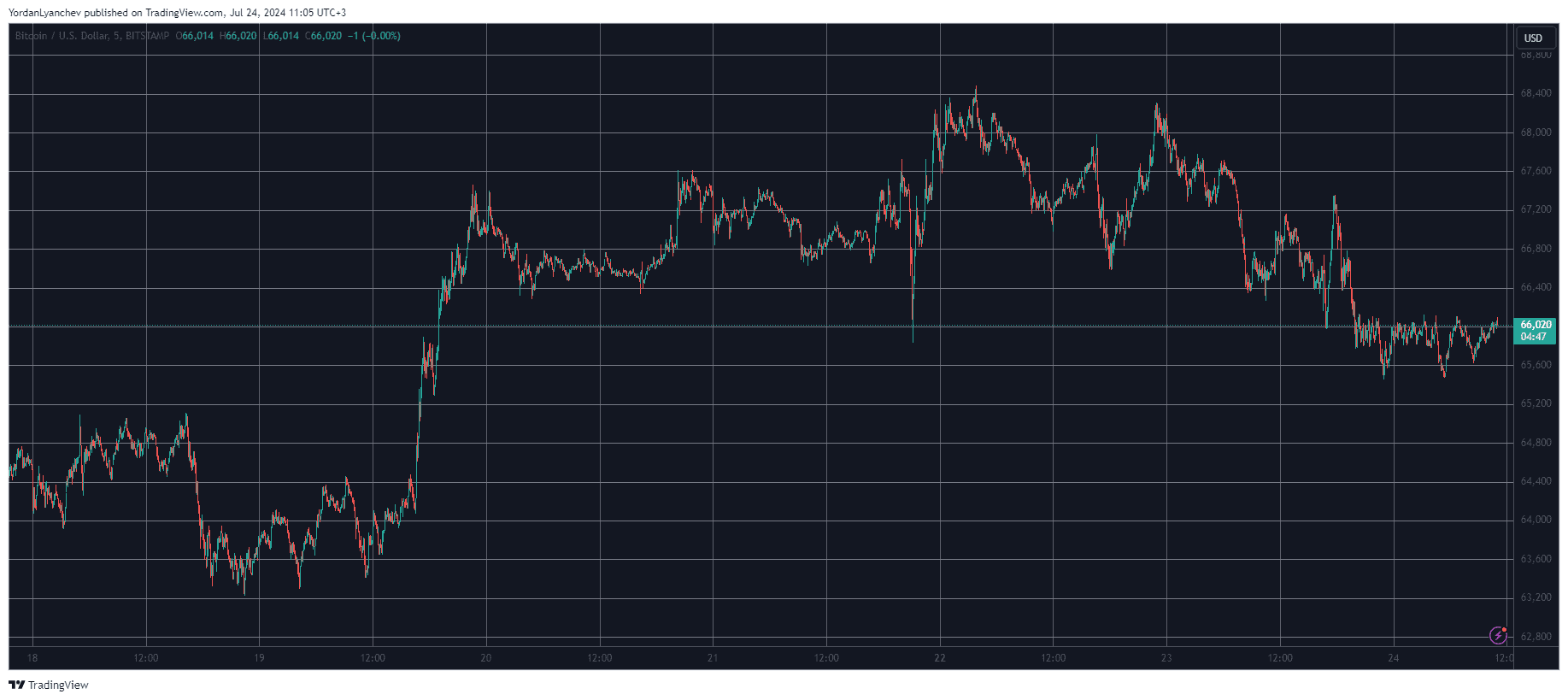

On the day that all eyes were on Ethereum due to the launch of numerous spot ETFs tracking ETH, bitcoin’s price dropped from over $67,000 to under $66,000 before recovering to the latter.

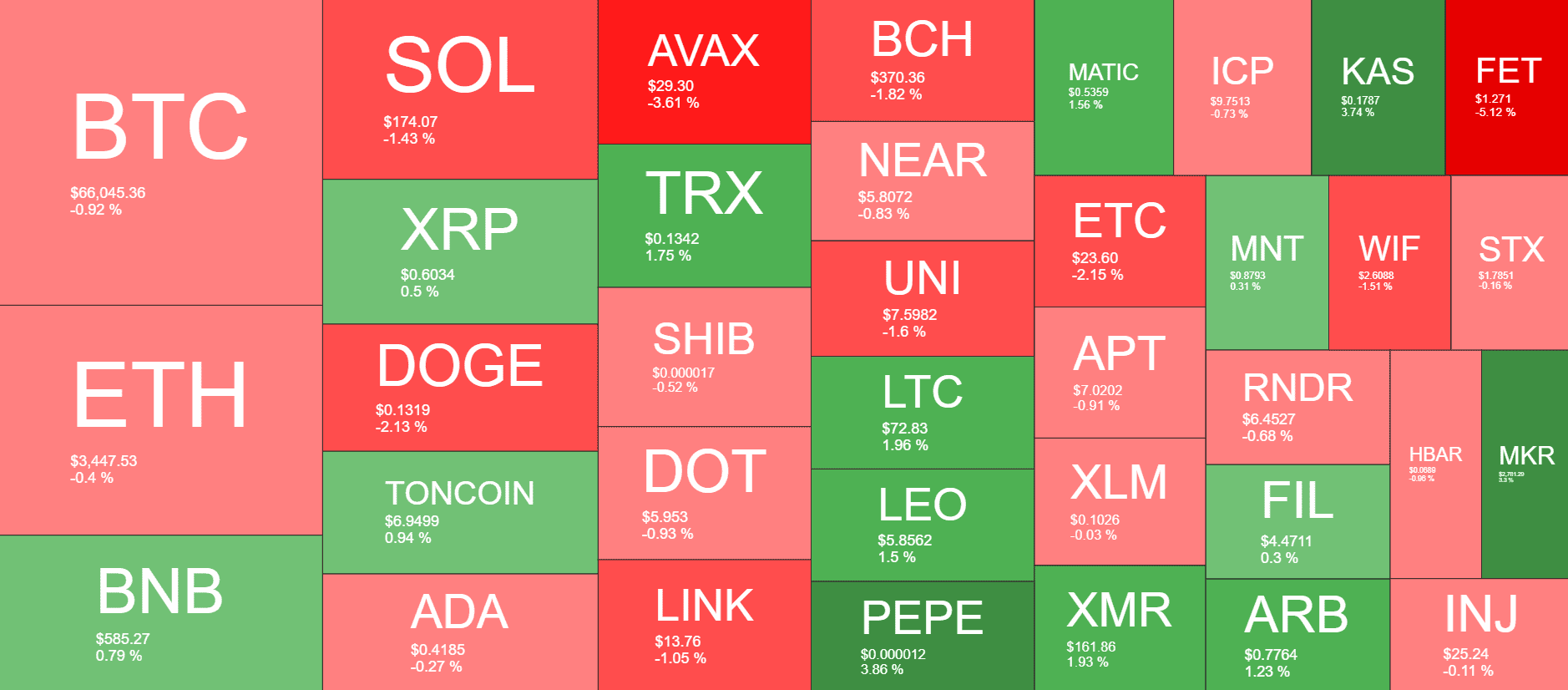

Avalanche and FET have declined the most from the larger- and mid-cap alts, while PEPE and MKR have gained the most.

BTC Drops to $66K

The largest digital asset headed south last Friday morning and when it dipped to a multi-day low of under $63,500. However, it bounced off in the following hours, especially on Saturday, and jumped to just over $67,000.

Although the weekends are generally less volatile, this one wasn’t due to more political developments on the US presidential election front. Joe Biden announced he would withdraw from the 2024 race, which led to an immediate $2,000 price drop for BTC on Sunday.

However, the asset skyrocketed by more than three grand by Monday and tapped a 6-week peak of over $68,400. Nevertheless, it failed to maintain its run and dropped to $66,000 yesterday. More volatility ensued when the spot Ethereum ETFs went live for trading yesterday, but the bears got the upper hand ultimately.

They pushed bitcoin to under $65,600 hours ago, but the asset has managed to reclaim some ground and now sits inches above $66,000. These declines came as the spot Bitcoin ETFs saw nearly $80 million in outflows, thus breaking the positive 12-day streak.

Its market cap has slipped to $1.3 trillion on CG, while its dominance over the alts stands still at 51.7%.

ETH on Spot Ethereum Day

As mentioned above, the community was focused on Ethereum due to the launch of almost ten spot ETH ETFs in the States months after their initial approval. The underlying asset faced some volatility at first, dropping from over $3,500 to $3,400. However, it has calmed since then at $3,450.

Solana, Dogecoin, Avalanche, Chainlink, and FET are among the poorest performers from the larger-cap alts today, while PEPE and MKR have gained the most.

The rest are less volatile today. The total crypto market cap has retraced by around $30 billion and is down to $2.520 trillion on CG.

cryptopotato.com

cryptopotato.com