Based on the Layer-1 blockchain network, APT has bounced back from its downward trajectory and is on the brink of a breakout. It climbed above the 20-day and 50-day EMAs mark and is eyeing extending the gains.

Notably, buyers were eyeing the make-or-break zone of the $8 mark, which was the primary juncture. APT was trading inside a falling channel and was willing to cross the 200-day EMA mark for a short-term reversal.

With the market recovery, Aptos participated in the altcoin rebound celebration and recuperated its gains by over 40% in the last two weeks. Still, the token was traded below the 38.2% Fib zone.

Meanwhile, the trend remained neutral, and the token reached its crucial resistance clusters near $8. It was quite difficult for the bulls to surpass these hurdles with a single hand, and they needed strong momentum to defeat the bear army.

Until the $8 mark is crossed, sellers will dominate. The token may consolidate around its 50-day EMA mark ahead. Despite the pullback from the oversold region, the buyers lacked momentum though they attempted to attain follow-on gains.

How is Aptos Performing Right Now?

At press time, APT was trading at $7.39 with an intraday surge of 5.56%, reflecting a rise. Its volume soared by 14% to $90.28 Million in the last 24 hours.

The pair of APT/BTC is at 0.000111 BTC, while the market cap is $3.45 Billion. Analysts are neutral and suggest that APT may break out and retest the $10 mark soon.

It has a total supply of 1.11 billion, while the circulating supply stood at 467.40 Million.

Will Aptos (APT) Take the Bold Move Ahead?

APT reached its most vital cluster near the $8 mark, and the buyers are preparing to embark on a short-term reversal. Also, an indecision candlestick was noted during the intraday session.

Once it breaks and closes above $7.50, a short-term rise would be validated, and the token might stretch rise to the $8 mark. Meanwhile, the trading volume remained low, which is a concern.

A tweet by @Iwantcoinnnews revealed that APT has shown a pump and is set to approach the $10 mark ahead.

$APT | Even aptos is pumping

— iWantCoinNews📈 (@iWantCoinNews) July 19, 2024

Lets bid resistance together. pic.twitter.com/CnqUA0hP21

A Tweet by @Iwantcoinnnews | Source: X

Per the Fibo levels, the token has stayed above the 23.6% zone and is eyeing to approach the 38.2% zone near the $7.70 mark.

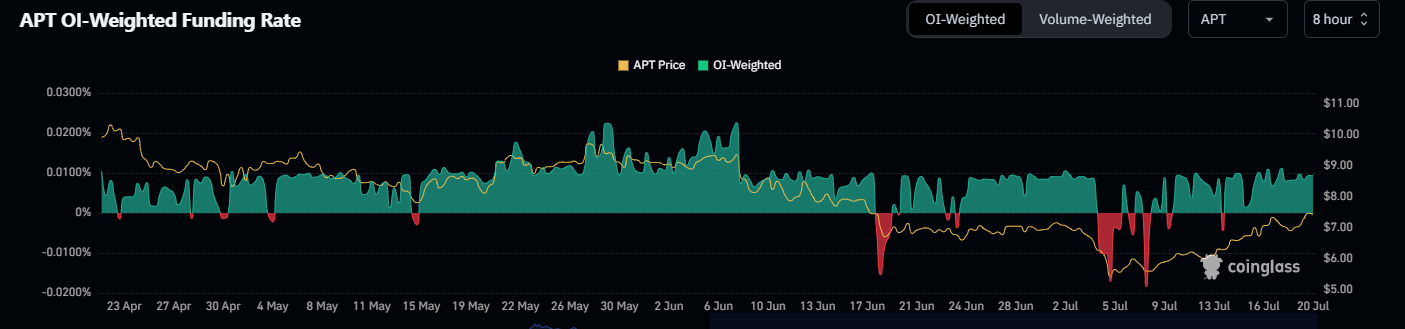

APT Funding Rates Still on the Positive Way

The OI-Weighted funding rate chart displayed positive money flow and continued to plot the green bars, highlighting the bullish sentiment among investors.

Total Open Interest and Development Data Overview

The development activity data witnessed a slight decline and dropped over 12% this week, noted at 34.12, conveying a decremental shift in the ecosystem.

Meanwhile, the open interest data rose over 4.30% to $65.94 Million, reflecting fresh long additions in the past 24 hours.

The immediate support levels for the Aptos token are $7.20 and $6.70, whereas the key upside hurdle is around $8, followed by $8.60

The token price climbed above the 20-day EMA mark and reached the 50-day EMA mark. However, a breakout was yet to be triggered. Buyers are yet to bounce back.

thecoinrepublic.com

thecoinrepublic.com