Curious about where Ronin's (RON) price might head this July? Check out our latest price prediction to find out just how high RON could soar this month! Discover the factors driving Ronin value and what experts are saying about its potential rise.

How has the Ronin (RON) Price Moved Recently?

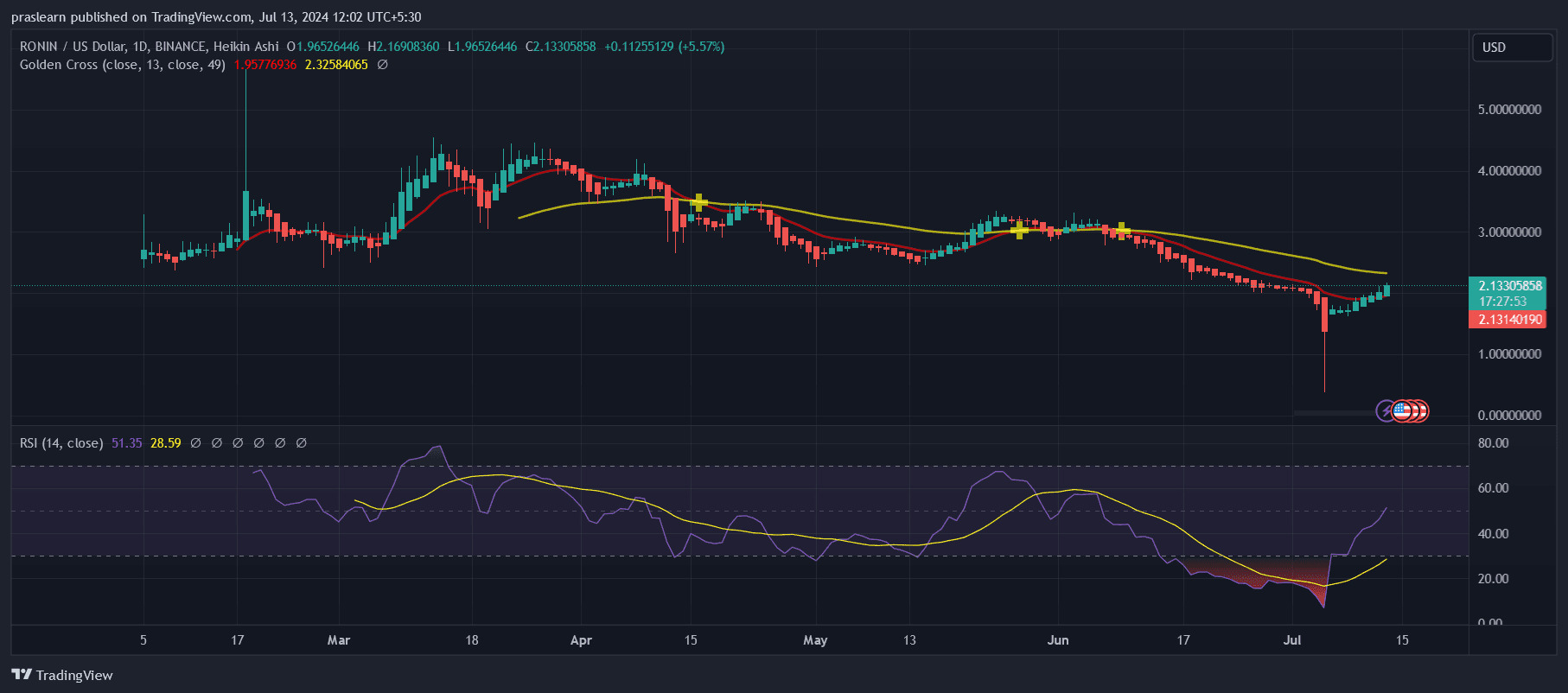

As of today, Ronin (RON) is priced at $2.13, with a 24-hour trading volume of $42.60 million. Its market cap stands at $692.03 million, holding a market dominance of 0.03%. Over the past 24 hours, RON's price has risen by 10.60%.

Ronin's peak price was $4.46, reached on March 26, 2024, while its lowest price was $0.00004011 on March 13, 2020. Since its all-time high, the lowest price recorded was $1.54779, and the highest since then was $2.16. Currently, the Ronin price prediction sentiment is neutral, and the Fear & Greed Index shows a score of 25, indicating extreme fear.

Ronin has a circulating supply of 324.90 million RON out of a maximum supply of 1.00 billion RON. The yearly supply inflation rate is 41.41%, with 95.14 million RON created in the past year.

Why is Ronin (RON) Price UP?

Ronin's (RON) price increase can be attributed to its recent integration with Coins.PH, a regulated Filipino crypto exchange, which has added PHPC liquidity to the Ronin blockchain. This move is particularly impactful as the Philippines is a major hub for both Axie and Ronin users. By facilitating rapid and low-cost transactions in Philippine Peso, this integration enhances the practicality of Ronin for everyday financial activities. Users can now perform peer-to-peer transfers, merchant payments, remittances, and business transactions more efficiently, significantly boosting Ronin's utility and appeal.

The introduction of PHPC on the Ronin platform supports financial inclusion and economic freedom in the Philippines. By making it easier for users to manage their Ronin wallets for routine transactions, this integration enhances user engagement and trust in the ecosystem. This positive development has led to increased demand for RON, reflected in its recent price rise. As the integration continues to gain traction, it is expected to attract more users and drive further adoption, fueling optimism and supporting the upward trend in RON's market value.

How high can the Ronin (RON) Price Trade in July?

Given Ronin's recent developments and performance metrics, the outlook for its price in July appears cautiously optimistic yet tempered by several factors. Over the past year, RON has demonstrated exceptional growth, with a remarkable 190% increase in price. It has outperformed 79% of the top 100 crypto assets and has notably surpassed both Bitcoin and Ethereum in terms of performance. Currently trading above its 200-day simple moving average and near its cycle high, RON benefits from high liquidity due to its substantial market cap.

However, despite these strengths, there are signs of caution. The recent price action shows RON as overbought, potentially indicating a correction in the near future. With only 11 green days in the last month and a significant decrease of 52% from its all-time high, the market sentiment may be shifting. Additionally, less than 32% of RON's total supply is currently in circulation, which could impact price stability and volatility.

Moreover, the yearly inflation rate of 41.41% raises concerns about dilution of value over time, which could influence investor sentiment and price trajectory. Considering these factors, while RON has shown resilience and growth potential, it also faces challenges that could limit its immediate upward movement.

While RON may continue to benefit from positive market sentiment and ongoing developments like the integration with Coins.PH, investors should remain cautious of potential corrections given its current overbought status and the broader market dynamics. Therefore, while RON's price may see some upward movement, a measured approach to its potential performance in July suggests a range-bound or consolidating pattern is plausible until clearer market signals emerge.

cryptoticker.io

cryptoticker.io