Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Bitcoinbase

Coinbase stock is considered a proxy bet on crypto’s success.

But what does success mean for crypto?

Basing it on rising prices and record-high valuations feels right but markets don’t really tell the whole story.

Maybe success is more about how much data is kept in decentralized file storage protocols, or stablecoin adoption in places with rampant high inflation.

Perhaps it’s the total value locked in real-world asset projects, like BlackRock’s tokenized money market fund on Ethereum. All those have little to do with whether bitcoin’s price goes up or down.

Yep, crypto consuming traditional finance and bringing blockchain rails to the masses sounds like success to me.

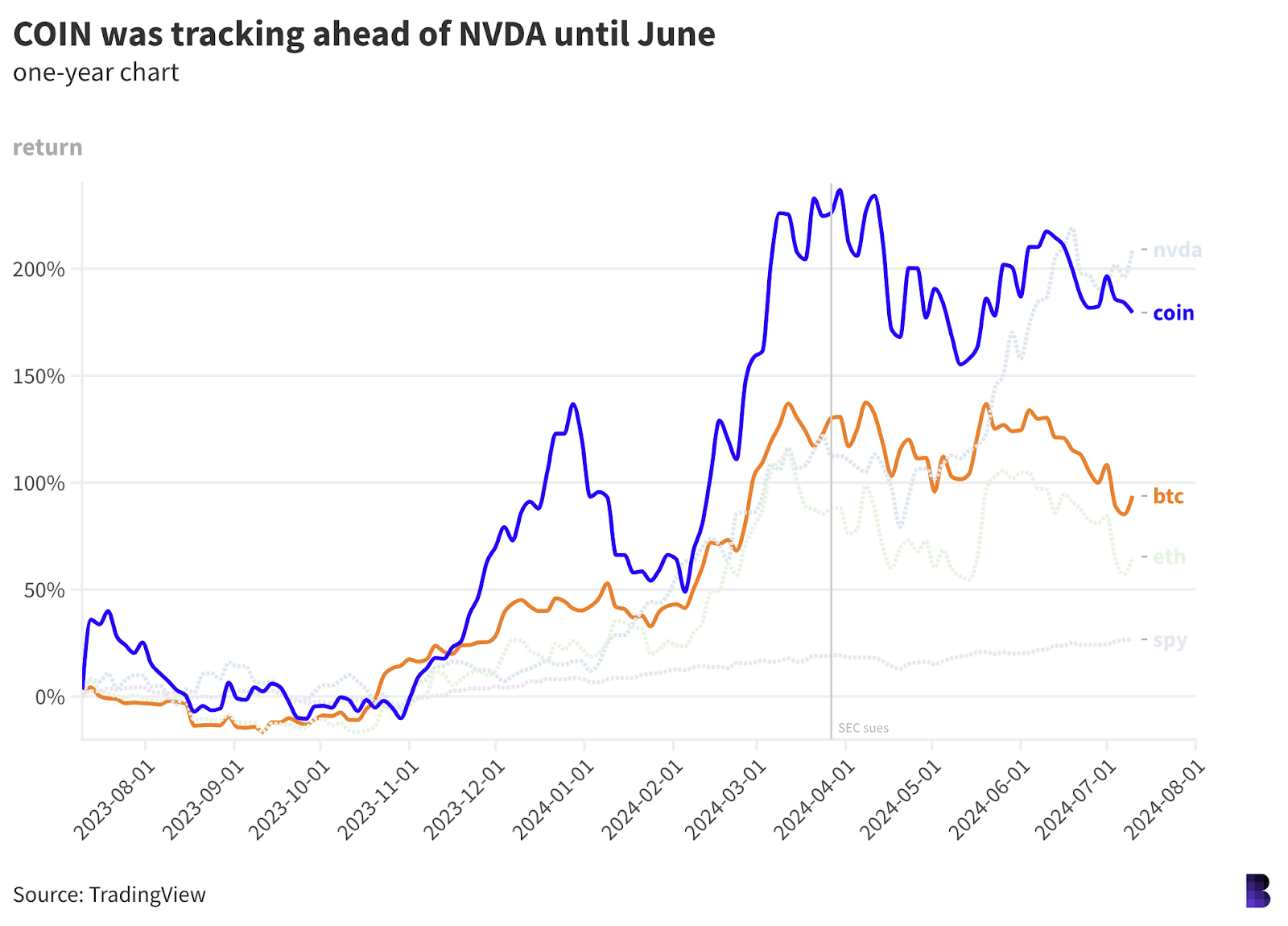

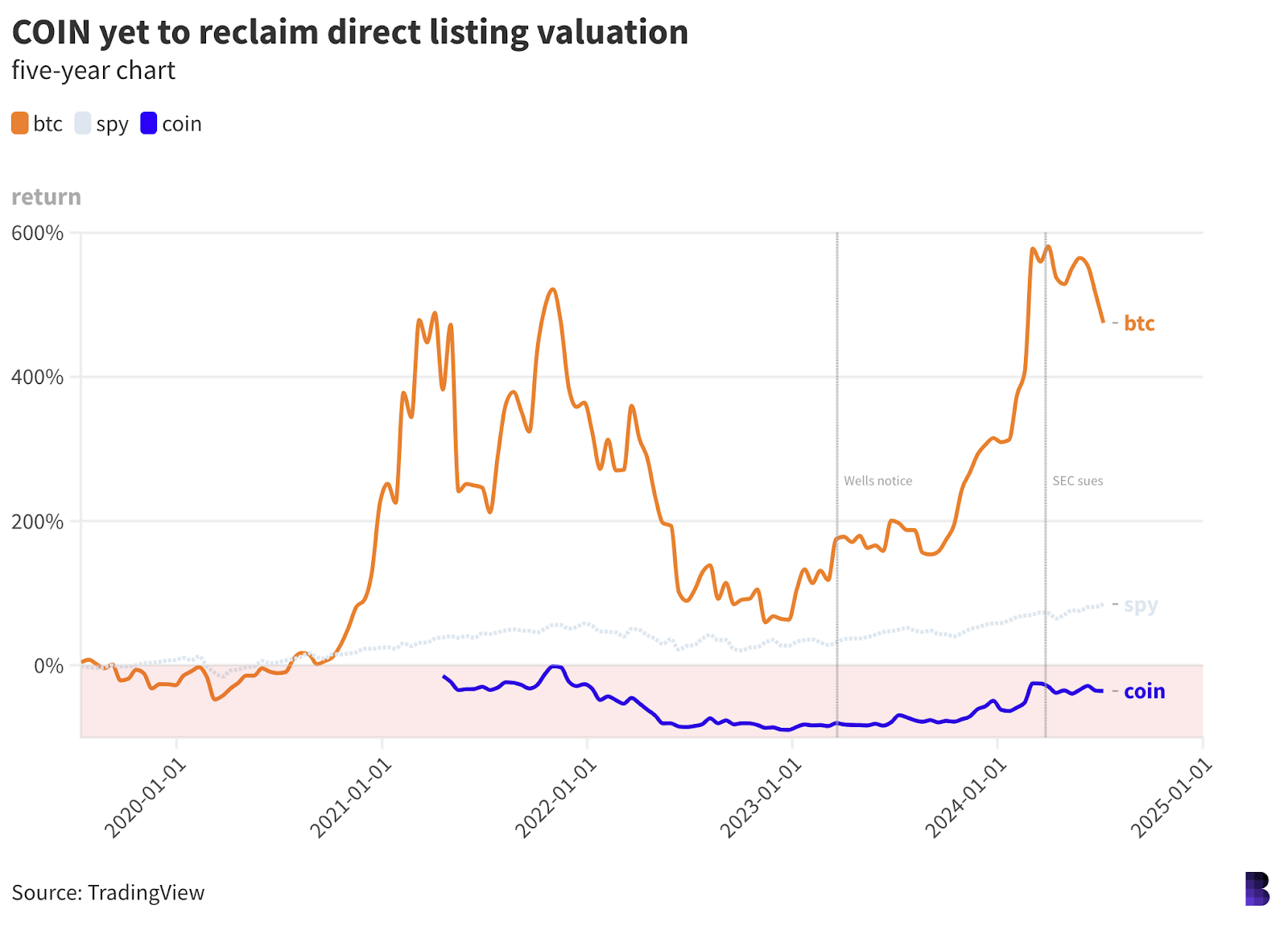

For Coinbase, figuring out ways to offer shareholders exposure to that goal seems like the move. But since its direct listing in April 2021 — practically peak bull market — the stock has been closely tied to bitcoin’s price, as is the case with the rest of the crypto market.

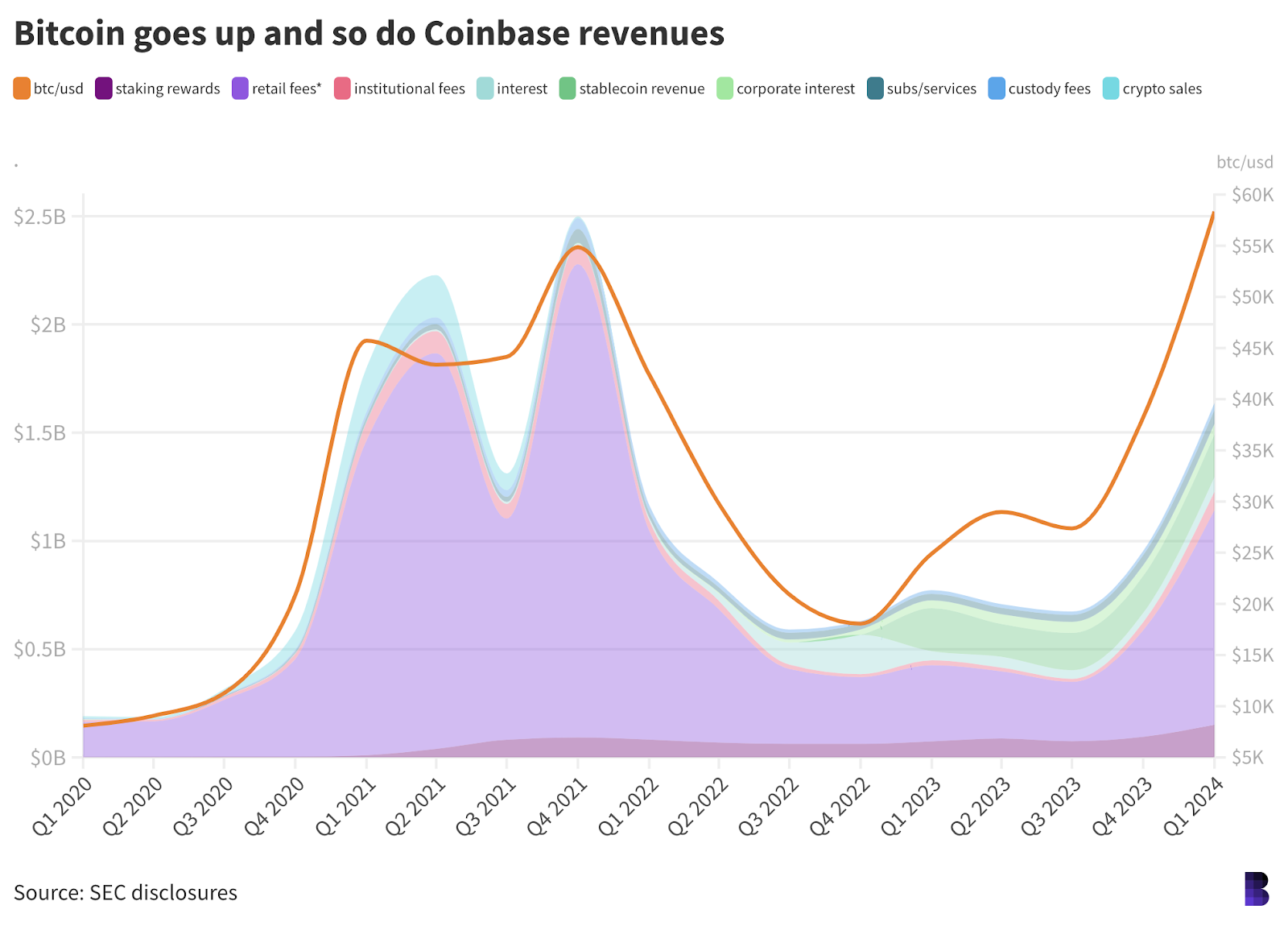

At one point, over 80% of Coinbase revenues came from retail trading fees. Coinbase would rake in tons of fee revenue when volumes were high — usually during major bull runs.

Bitcoin rallied nearly 600% between July 2020 and March 2021, from $9,000 to $61,000.

At the same time, Coinbase’s retail fee revenue grew by 1,000%, exploding from $164 million to over $1.8 billion from a total of $2.23 billion.

That same trend has persisted even after Coinbase has successfully diversified its revenue streams, thanks largely to its staking-as-a-service offerings, interest and stablecoin revenues via USDC, which it launched with Circle in 2018.

Coinbase brought in almost $151 million in staking rewards for itself in this year’s first quarter, the most ever, equal to about 9% of total quarterly revenues.

The company no doubt hopes to eventually decouple its share price — and revenues — from the price of bitcoin.

But the SEC may have done that already, at least over the short term.

The stock has more or less traded sideways since the SEC formally sued over its staking-as-a-service products in March.

Bitcoin has meanwhile retraced over 20%.

The SEC considers staking services as unregistered securities offerings, something Coinbase has pledged to fight.

Kraken settled similar charges last February and agreed to pay $30 million in penalties.

In the event that Coinbase loses the fight over staking services, stablecoin revenue and interest on user funds could help bridge the gap.

But in the meantime, staking revenues are, seemingly, increasingly important for Coinbase, especially if detaching from bitcoin’s price is indeed one of its goals.

If that’s the case, then its battle with the SEC could turn out to be far more pivotal than it seems at first glance, especially if we’re in for lower trading volumes over the next few quarters.

— David Canellis

Data Center

- At a $54 billion market cap, COIN is in the top 400 largest companies as tracked by CompaniesMarketCap — on par with Heineken, Universal Music Group and Hilton Worldwide.

- COIN short interest was 4.9% of the float as of the latest readings halfway through June, down from 11.4% at the end of last year.

- Coinbase reported safeguarding $329.5 billion in customer crypto assets in Q1, up from $197.15 billion in the previous quarter. That would’ve been 12% of crypto’s total market cap at the time.

- BTC and ETH are up slightly over the past day, sitting at $58,500 and $3,310 each.

- SEI, FLOKI and STX are leading the top-100, per CoinGecko, up between 8% and 10%.

Lower your expectations

The stock market’s earnings season officially kicks off on Friday with bank earnings.

Following in David’s footsteps, I want to take a bit of a different approach with COIN and instead look forward to get a sense of where it’s going after its last quarterly earnings report.

In case you need a refresher, bitcoin’s wild ride up helped boost Coinbase’s earnings, and it reported a revenue beat in the first quarter.

However, bitcoin’s tumble down might also weigh on its second-quarter earnings.

“We believe consensus is overly optimistic in extrapolating strong March trends,” Mizuho analysts wrote Tuesday. They’re expecting to see average daily trading volumes take a hit, declining “sequentially each month of the quarter.”

Overall, they forecast volume to be down roughly 30% quarter over quarter.

Adding to that, they also think that Coinbase is losing traction as top dog when it comes to market share, estimating that COIN lost 50 basis points in comparison to other exchanges. So far in July, that metric has worsened and Coinbase’s market share hit a low not seen since May of last year.

Bit of a stark contrast to Coinbase’s Q1 report, which was a lot of rainbows and butterflies. In all fairness, we’re in a totally different environment now.

Responding to what they think could be a bit of a rougher quarter, Mizuho analysts lowered their revenue estimate to $1.29 billion from $1.4 billion — a 6% drop.

While Coinbase trades around $220 a share currently, Mizuho gave the stock a $145 price target.

“This is a premium to the 11-16x median for payments, exchange, and asset manager peers, as we give COIN credit for recent strength and prudent cost management, but represents a modest discount to where the stock currently trades given reliance on lower-quality revenue streams like alt-coins and staking and the potential for pricing pressure over time,” the analysts wrote.

With COIN’s nearly 14% decline in the last month, let’s zoom out and look at the larger crypto stock landscape.

While some investors — those not eager to cut their teeth on altcoins or, dare I say, memecoins — look to crypto-related equities given the drawdowns seen in both ether and bitcoin, the stocks aren’t faring much better.

MicroStrategy is, unsurprisingly, down 18% in the last month. Though bitcoin miners face their own set of issues post-halving outside of bitcoin’s price action, big outfits like Marathon and Riot are down roughly 6% and 14%, respectively, in the past month.

Core Scientific and Hut 8, however, are bucking the trend, with CORZ essentially flat on the month and Hut 8 soaring a whopping 46%.

This year has truly been a rollercoaster for crypto. There’s still a lot of bullishness to be seen, but there’s also a fair amount of bearishness peeking through.

Just don’t expect the crypto stocks to escape the downward trend, though they’ll also benefit if we see a recovery in the fall.

— Katherine Ross

The Works

- Bernstein initiated coverage of Core Scientific and Iris Energy, reiterating its $200,000 price target for BTC.

- Time investigated reports of health issues across a bitcoin mining town in Texas.

- Polychain accused a former employee of accepting “adviser” tokens from Eclipse, CoinDesk reported.

- Standard Chartered’s Zodia Markets is interested in Alan Howard-backed Elwood Capital Management, Bloomberg reported.

- All of the selling from the German government is stemming from the state of Saxony, CoinDesk reported.

The Riff

Q: Could there ever be an “Amazon of crypto”?

No? If we’re comparing apples to apples, then the answer is obviously no. I’ll admit I’m not a huge fan of these types of comparisons though.

I guess if we’re talking about the overall share that Amazon takes up in its corner of the world, then I could see a company trying to replicate its trajectory in crypto, and I can already see comparisons to companies like Coinbase.

I’m of the mind that they’re totally different and they have very different goals. If I were to put on my cynical hat, I’d acknowledge how Big Tech like Amazon is looking to capitalize on tech trends while crushing smaller businesses.

I want to believe that crypto’s different and that we won’t see that type of merciless behavior from the top dogs in the industry. Which would, of course, mean hell no to an “Amazon of crypto.” But perhaps I’ve gone soft in my old age.

— Katherine Ross

There’s just something about crypto that breeds competition.

Maybe it’s the monstrous amount of venture capital poured into all corners of the space. All sorts of startups building different products and platforms with overlapping goals.

“We’re all building the same thing” largely rings true, and they’re all competing for mind and market share.

All this is even reflected in the industrialization of Bitcoin mining. It’s not in Marathon or Core Scientific’s interest to have all the hash rate — it would undermine bitcoin’s value proposition if one operation were to control too much of the network.

Bitcoin is better off with an even playing field, and, idealistically, so is crypto. The permissionlessness of the market should, in a perfect world, reinforce that.

— David Canellis

blockworks.co

blockworks.co