The global cryptocurrency market cap stands at $2.22 trillion today, reflecting a 3% increase in the last 24 hours. Despite Bitcoin’s (BTC) current selling pressure, positive divergence on the RSI suggests potential recovery, signaling a buying opportunity.

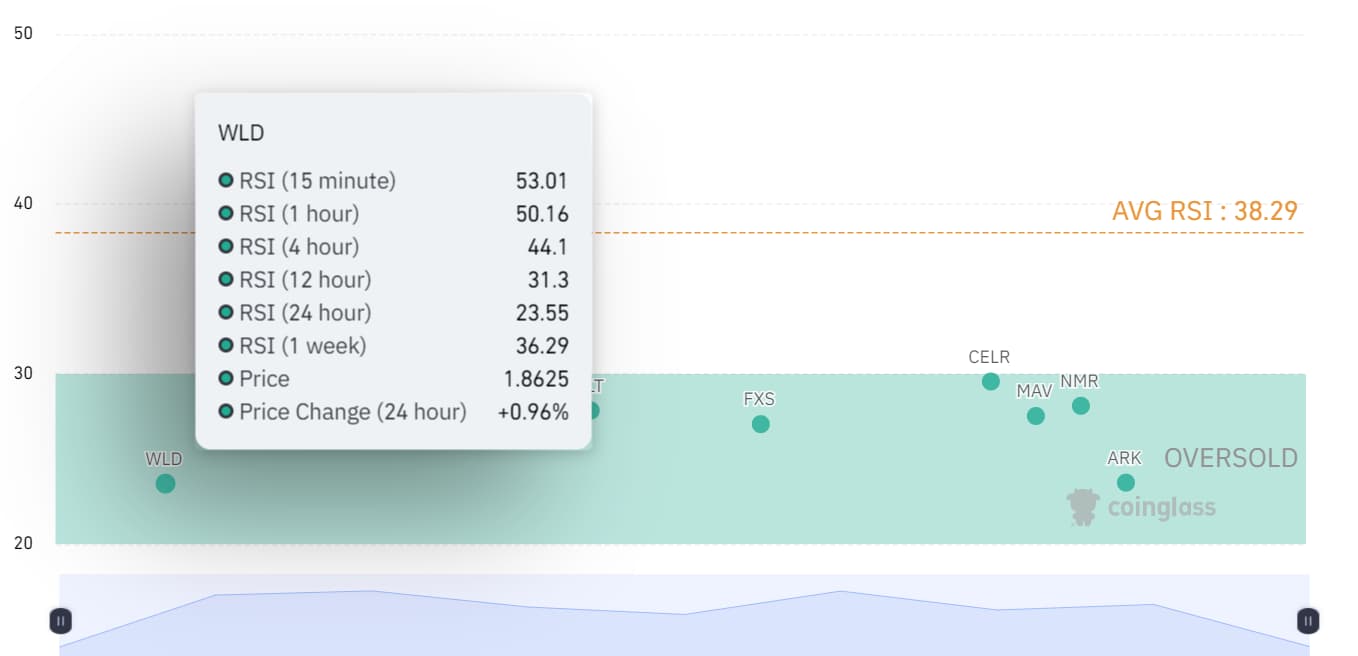

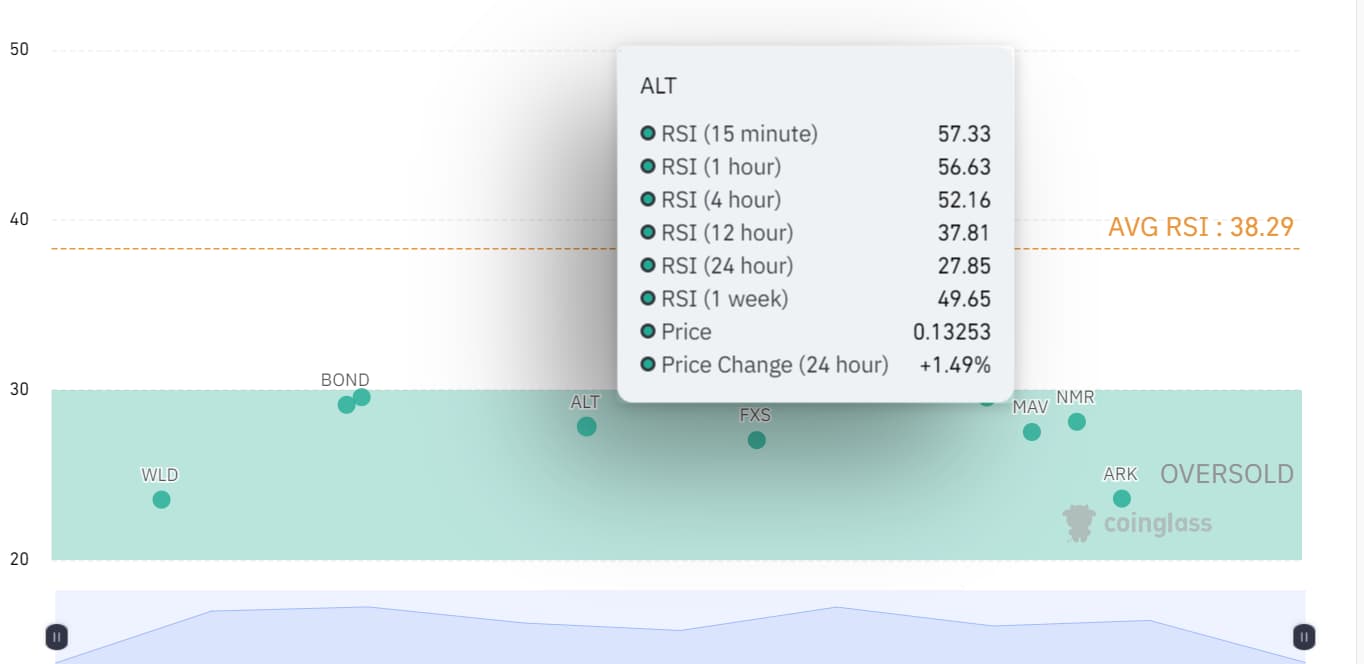

The overall 24 hour market RSI average is 38.29, indicating a transitional phase, according to CoinGlass. This transition implies that several cryptocurrencies, particularly those with oversold RSI values, may be undervalued and poised for a price increase, presenting an attractive entry point for investors looking to capitalize on market volatility.

In this context, Finbold has identified two cryptocurrencies as buy candidates for the week based on their RSI levels and other indicators.

Worldcoin ($WLD)

Worldcoin’s ($WLD) RSI values across different timeframes, such as the 24-hour RSI at 23.55 and the 1-week RSI at 36.29, clearly indicate that the asset is oversold.

This significant deviation from the average RSI of 38.29 suggests that $WLD may be undervalued and poised for a price increase.

Currently, $WLD is priced at $1.8625, with a 24-hour price change of 0.96%. Despite being in the oversold territory, this slight price increase indicates a potential recovery phase, making it an opportune moment to buy.

Several other technical indicators further support the buy signal for $WLD. The Relative Strength Index (14) stands at 23.736, indicating a buy, while the Commodity Channel Index (20) is at -109.991, also signaling a buy.

Additionally, the Momentum(10) indicator is at -0.694, further supporting a buy signal, and the Williams Percent Range (14) is at -90.211, which is another strong buy signal. These indicators highlight that the current momentum and market sentiment are conducive to a potential price rebound.

Altlayer ($ALT)

Altlayer ($ALT) presents a compelling buy opportunity this week due to its oversold status and supportive technical indicators. With an average RSI indicating significant oversold conditions, $ALT appears undervalued and poised for a potential price rebound.

Currently priced at $0.13253, $ALT has seen a slight price increase of 1.49% over the past 24 hours, suggesting the beginning of a recovery phase.

The RSI across various timeframes underscores $ALT’s oversold status, with a 24-hour RSI of 27.85 and an average RSI of 38.29. Key technical indicators support the buy signal: the RSI (14) is at 28.5389, the Commodity Channel Index (20) is at -89.7605, and the Momentum (10) indicator is at -0.0340.

These indicators suggest favorable buying conditions and highlight a conducive environment for a price rebound.

Despite the moving averages indicating a predominantly bearish outlook, the strong buy signals from key oscillators suggest that $ALT’s current market conditions offer a promising investment opportunity.

Traders should consider the mixed signals and monitor market trends closely, but the oversold status and supportive technical indicators position $ALT as an attractive buy for those looking to capitalize on its potential recovery.

Both Worldcoin and Altlayer are currently in oversold territory and present strong buy signals according to various technical indicators. Investors and traders should consider these opportunities while remaining vigilant of market trends and mixed signals.

Amid these positive outlooks, a cautious and well-rounded approach to investing is always recommended.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com