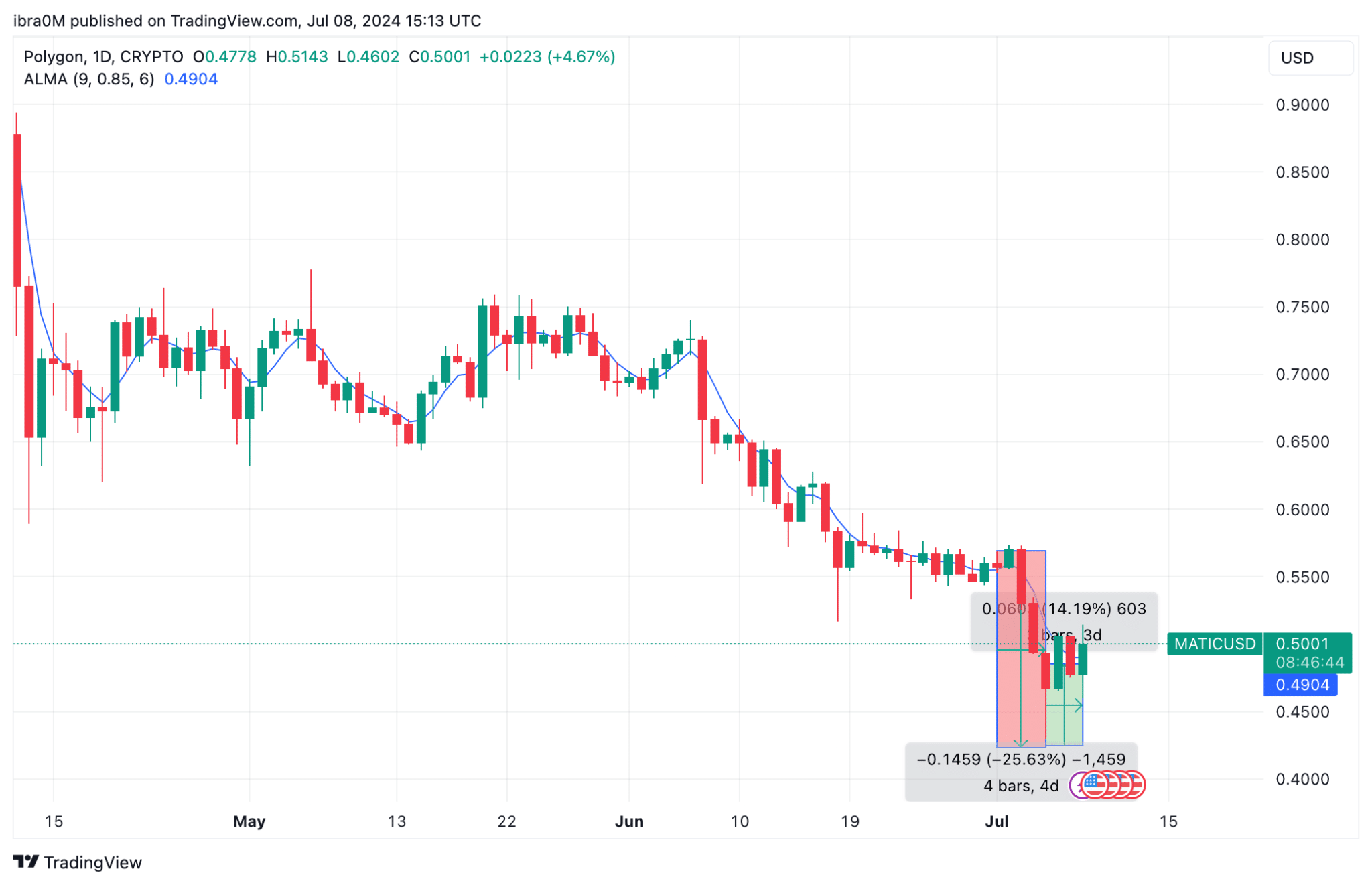

MATIC price recovery stalled at $0.49 on July 8, after a 14% rebound over the weekend, derivatives markets data trends shows that majority of MATIC traders are opting to close out their positions amid rising volatility.

MATIC Price Nears $0.50 Retest as Bulls Show Resilience

MATIC price action mirrored that crypto market trend as it descended into a downward spiral in the first week of July 2024. But following the positive Non-Farm Payrolls reports released on Friday, Polygon (MATIC) has flashed strong recovery signals.

Built as a scaling solution to Ethereum, Polygon (MATIC) has struggled for traction since Ethereum migrated to the Proof-of-Stake (PoS) consensus. This has led to an accelerated downswings as the crypto market sell-off intensifies.

During an intense crypto market sell-off, MATIC price tumbled below $0.43 mark. Notably, this is its lowest in over 2 years dating back to July 2022. But in comparison, most of the other altcoins in the top 20 crypto market rankings are still holding on to sizable yearly time frame gains.

This highlights how much MATIC has underperformed amid fears of obsolescence since Ethereum completed the PoS migration in September 2023, and the expected migration to a new ‘POL’ token.

In recent months, the Polygon team has taken major steps to spur investor confidence. Landmark partnerships with trending projects like Chainlink could open new markets and expand the MATIC token utility in the coming months.

But, recent trends observed in the MATIC derivatives markets suggest that investors are not buying into these new initiatives.

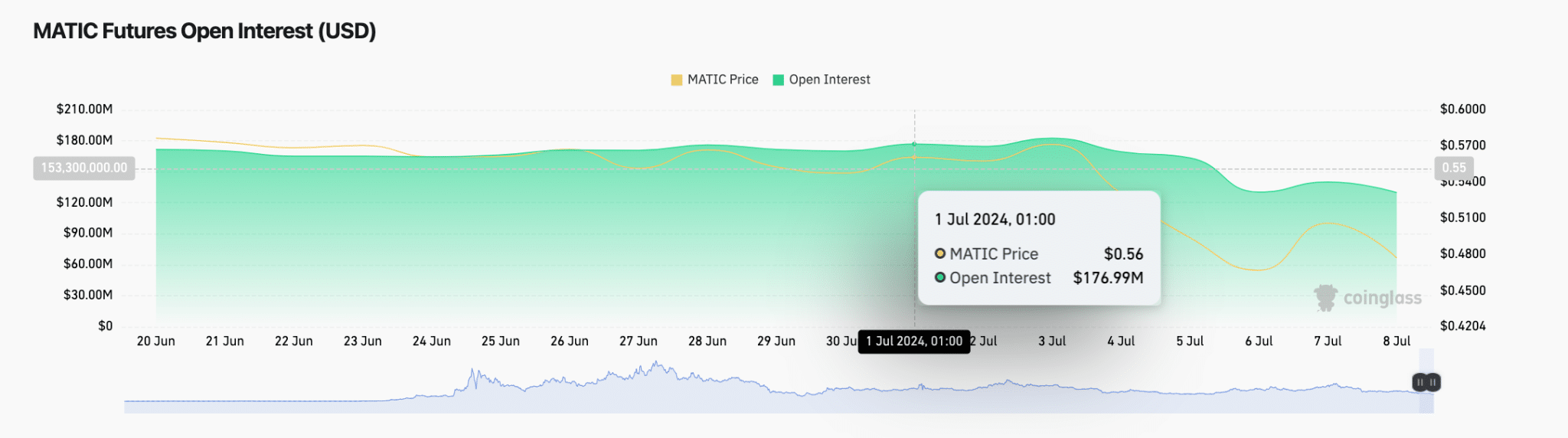

The Coinglass chart below tracks changes in total capital invested in futures contracts for a specific crypto asset. When analyzed in comparison to the current price trends, it reveals insights to the direction of investors’ sentiment.

As depicted in the chart above, MATIC open interest stood at $176.9 million as of July 1. But since frenetic spot market sell-offs which has led to 24% price dip, MATIC derivatives traders have shown weak resilience.

At the time of writing on July 8, MATIC’s open interest had dipped to $129 million. This decline of $47.9 million accounts for a 27% decline in capital invested in MATIC derivatives markets.

When an asset’s open interest declines faster than its price during a market dip, it signals increasing bearish momentum for a number of reasons.

Firstly, it indicates that traders are closing their positions, either voluntarily due to loss-cutting strategies or through forced liquidations, which exacerbates the downward price pressure.

This behaviour suggests a lack of confidence among traders in the asset’s near-term recovery potential, leading to a reduction in both speculative buying and hedging activities in the derivatives market.

Secondly, the significant drop in open interest, as observed in MATIC, implies that new capital is not entering the market to support the asset.

This lack of new investment indicates that traders are either reallocating their capital to other assets with more promising short-term prospects or remaining on the sidelines due to uncertainty.

Consequently, this decrease in open interest, coupled with the recent price dip, reinforces a bearish outlook for MATIC unless there is a notable shift in market sentiment or a resurgence of buying interest in both the spot and derivatives markets.

MATIC Price Forecast: $0.40 Retest Imminent?

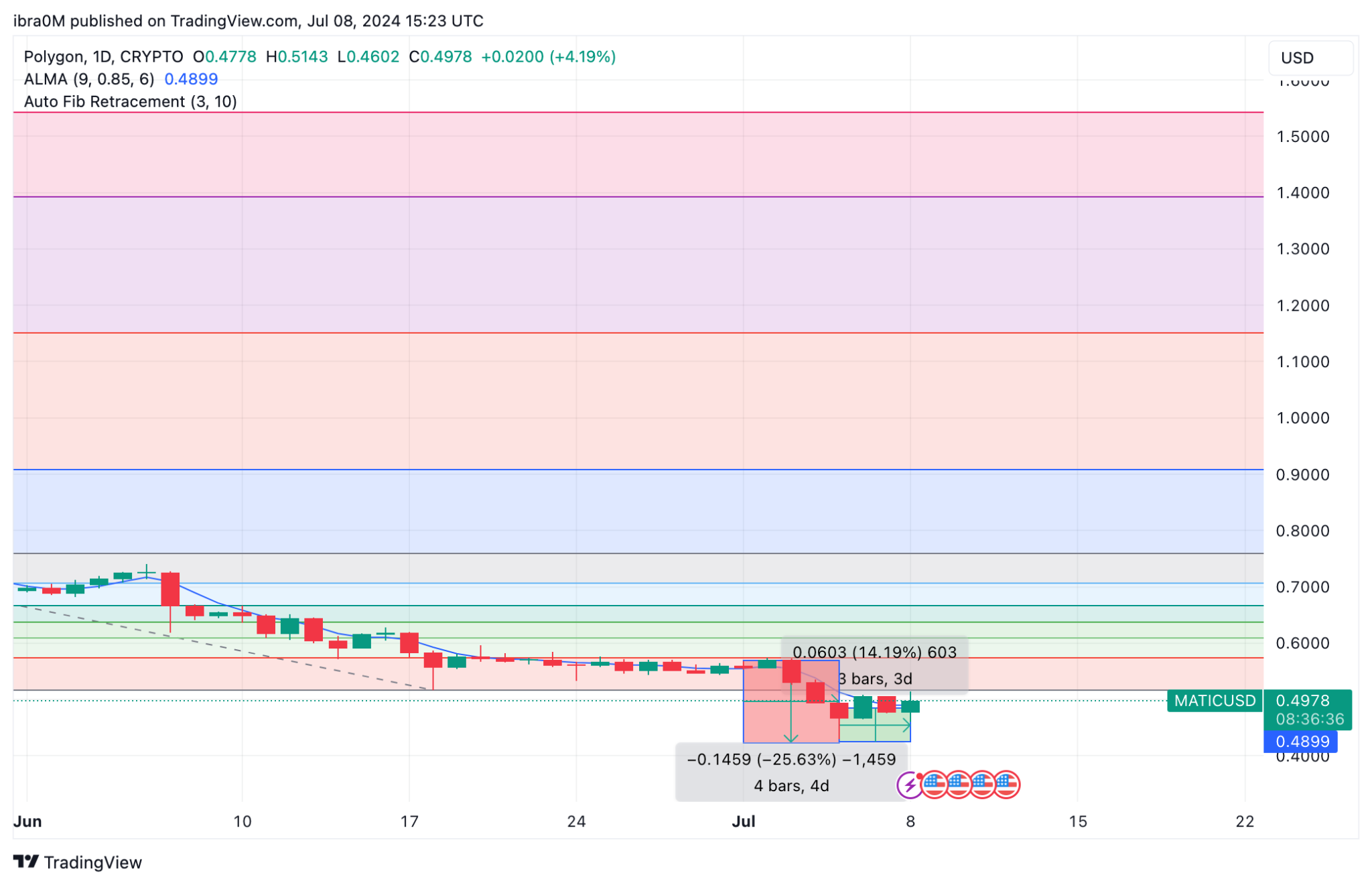

MATIC has been experiencing a significant downtrend, as evidenced by the series of lower highs and lower lows on the daily chart. The price is currently trading at $0.4978, just above the ALMA (Arnaud Legoux Moving Average) at $0.4899, which is acting as a short-term support level. However, the broader bearish sentiment remains dominant, and the potential for further downside is considerable.

The recent price action has seen MATIC recovering slightly from a low of $0.4602, gaining approximately 4.19% in the process. Despite this short-term bounce, the overall trend remains bearish.

The Auto Fibonacci Retracement levels indicate that the price is struggling to break above the 23.6% retracement level, which aligns with the $0.5143 resistance. If MATIC fails to sustain above this level, it could lead to another wave of selling pressure.

Key support levels to watch are at $0.45 and the psychological level of $0.40. The $0.45 level has previously acted as support, and a break below this could signal a retest of the $0.40 level, which would mark a significant decline.

On the upside, the $0.5143 level acts as immediate resistance, followed by $0.55, which aligns with the 38.2% Fibonacci retracement level. A break above these levels would be required to invalidate the bearish outlook and signal a potential reversal.

thecryptobasic.com

thecryptobasic.com