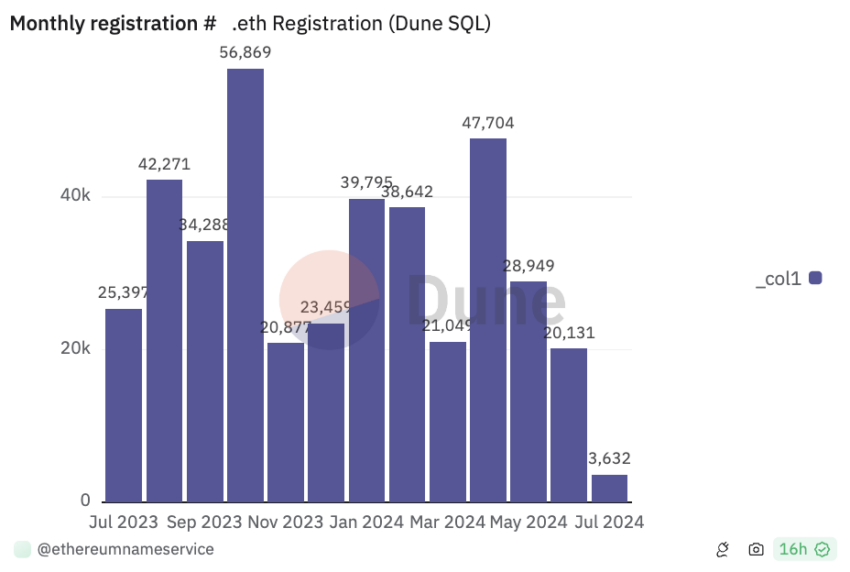

Leading domain name service provider Ethereum Name Service (ENS) witnessed a quarterly decline in domain registrations in the second quarter.

After peaking at a year-to-date high at the end of April, monthly registrations on the protocol dwindled.

Ethereum Name Service Saw a Dip in .eth Name Registrations

ENS domain name purchases are made with Ether (ETH). As the price of ETH stagnated during the quarter in review, the cost of gas fees for transactions on the Ethereum Network also fell.

One might have expected a surge in .eth domain name registrations due to the lower fees. However, interest in this asset class remained low amid general market consolidation, leading to a reduction in spending on domain name registrations by market participants.

On-chain data showed that the count of .eth names registered totaled 20,131 in June. This marked a 30% month-over-month (MoM) decline from the 28,949 .ETH name registrations recorded in May. It also represented a 58% decrease from the peak of 47,704 registrations in April.

Read More: Ethereum Name Service (ENS): Everything You Need to Know

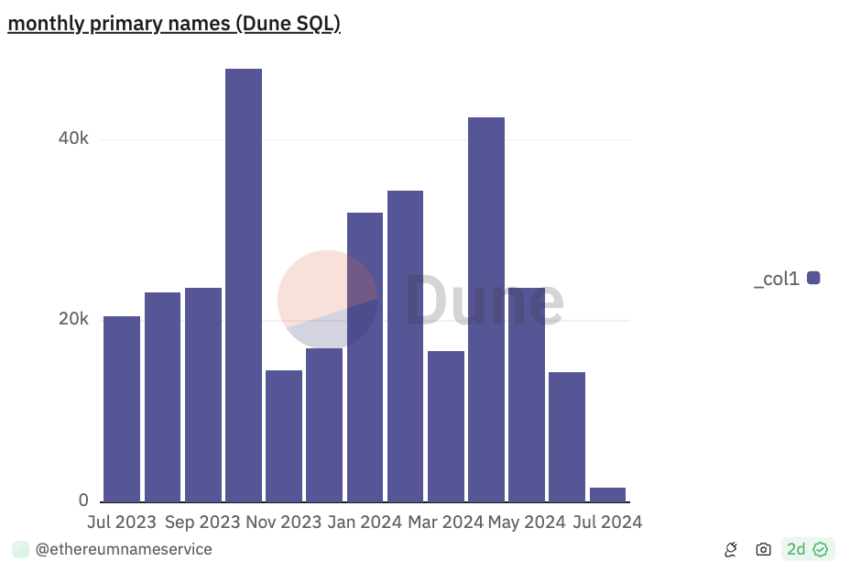

Further, primary ENS name registrations fell to its year-to-date low at the end of June. A primary ENS name is a unique, human-readable name used to identify and locate a specific Ethereum address. With a primary ENS name, decentralized applications (dAPPs) can find and display such a user’s ENS name when connected to the user’s Ethereum account.

During those 30 days, the number of primary ENS names registered was 14,401, a 39% MoM fall and a 55% decline from the 31,982 primary names registered at the beginning of the year.

ENS Price Prediction: Open Interest Drops After Recent Milestone

BeinCrypto reported earlier that ENS’ derivatives open interest climbed to an all-time high of $153 million on July 1. However, it has since declined. At $80.12 million at press time, ENS’s open interest plummeted by 48% within seven days.

Open interest refers to the total number of outstanding derivative contracts, such as options or futures, that have not been settled. When it declines, it signals traders are closing their positions without opening new ones. This suggests a decline in an asset’s derivatives market activity.

This may be a bearish signal as it is often accompanied by a decline in the token’s value. This is true in ENS’ case, as the altcoin’s price has decreased by 25% in the last week.

Confirming that the altcoin is trailed by bearish sentiment at press time, ENS’ Relative Strength Index (RSI) is below its 50-neutral spot at 47.93. At this value, the token’s RSI suggests that selling pressure outweighs buying activity. If this trend continues, ENS’ price may fall to $23.26.

Read More: Ethereum Name Service (ENS) Price Prediction 2024/2025/2030

However, if it witnesses a resurgence in buying activity, the bearish projection above will be invalidated as ENS’ price will charge upward toward $25.68.

beincrypto.com

beincrypto.com