- 1 Analyst Cryptolee shared a bullish outlook on BEAM, noting a stop in lower lows formation, and supertrend turning bullish.

- 2 Derivatives show a 39.75% surge in open interest and the liquidation chart reflects more short liquidation.

- 3 It ranked 76th in terms of market cap and holds a market cap dominance of 0.04%.

Beam is a privacy blockchain that utilizes a protocol known as Mimblewimble. Its price has illustrated the bull’s presence in the last three days with a surge of more than 20% this week from the support of $0.01537. Additionally, on the intraday basis, BEAM has advanced 9.44% to $0.01860 (at press time).

As per coinmarketcap, its volume-to-market cap ratio stands at 4.29%. That exhibits comparatively low to moderate liquidity, followed by the last 24 hours of trading activity in BEAM. At press time, Beam (BEAM) had a market cap dominance of 0.04%, and there was a 223% spike in BEAM’s trading volume over the last 24 hours.

Its Market value stands at $918.66 Billion, where it has surged 9.49%, and in terms of market cap, the BEAM has positioned itself as ranked 76th out of the top 100 cryptos on the coinmarketcap list.

According to the trading view, the price had fallen to its ATL at $0.0153 by June 29th, 2024, at the PYTH exchange and has been traded 20% above. Meanwhile, its ATH was $0.0444, which it attained on March 10th, 2024; from that high, it was almost 60% down.

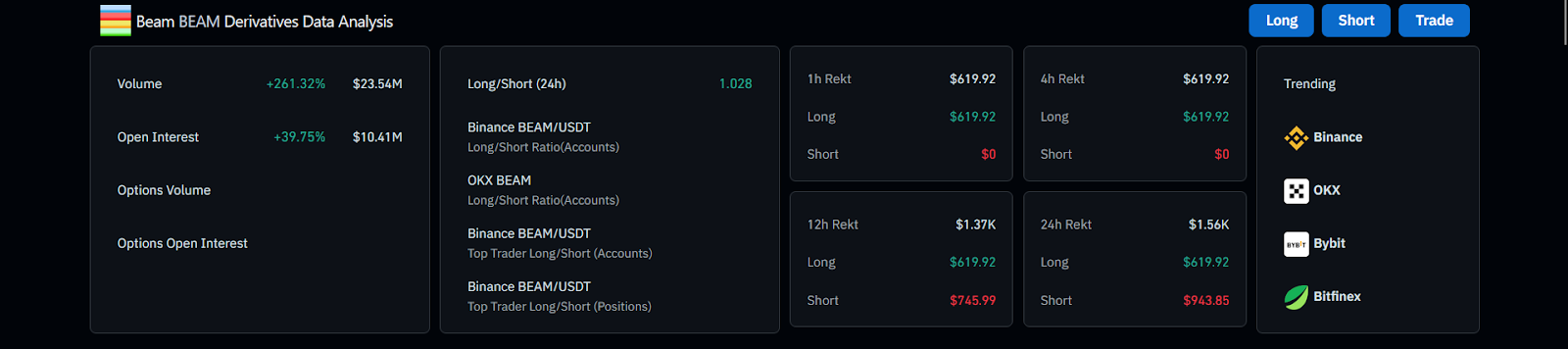

BEAM Crypto Derivatives Data Analysis

BEAM’s liquidation chart shows higher short liquidation; it has now indicated, at the time of writing, that the price bulls have more control. In the last 24 hours, more amount of shorts worth $943.85 were liquidated, whereas longs worth $619.92 were liquidated.

BEAM Derivatives Data | Source: Coinglass

Furthermore, in the derivatives, the open interest showed a surge of 39.75% in the open contracts of the BEAM crypto. Similarly, in the past 24 hours, BEAM has recorded a strong surge of more than 261% in the trading volume of the derivatives.

Overall, the derivatives data points towards further bullishness in the price to come in future.

Analysts Take on the BEAM Price!

Despite the market dip, analyst Cryptolee showed a chart in a tweet post, where he optimistically shared that the market has stopped forming a lower low.

$BEAM taking a breather. Nice. pic.twitter.com/b4RFQCWg1V

— cryptolee (@CryptoLeee) July 2, 2024

After a brief consolidation, the price showed bullish action, while the super trend also flipped from the bearish side to a bull one. In his words, he optimistically stated that the BEAM had been taking a nice breather.

BEAM Crypto Price Action Analysis!

BEAM crypto has been trading in a downward parallel channel; despite significant attempts to breach the wedge, both parties of bulls and bears failed to achieve that, which led to big wicks on the daily chart. The first failed attempt was of a bear breakdown on April 13th, and the second was a bull break on May 31st, 2024.

The price action so far highlights the movement in the wedge only; the recent price has taken support and surged from $0.01537; it could hit the target of $0.0244, and if it manages to break this time out of the wedge, then the next target would be $0.0312.

bullishness up to the trendline looks confirmed by Sam_TCR on TradingView.com

The bullishness up to the trendline looks confirmed by the MACD bullish cross with a rising histogram at 0.00034, and the RSI jumped from 14-SMA and glared at 46.41.

However, the loss of support of $0.01537 could do a favor to bears, and a breakdown could start, as well. So, in both cases, the investors should be prepared and cautious (DYOR).

Summary

Beam saw a 20% price surge from $0.01537, now at $0.01860. It has low to moderate liquidity and a market cap dominance of 0.04%. Ranked 76th, it has a market value of $918.66 Billion. The trading view shows a 60% drop from ATH of $0.0444.

The liquidation chart reflects more short liquidation. Derivatives show a 39.75% surge in open interest and a 261% rise in trading volume.

Despite a downward parallel trading channel, recent price action suggests the potential for a rise to $0.0244. MACD and RSI indicators support bullishness, but caution is advised for investors.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

thecoinrepublic.com

thecoinrepublic.com