TAO, the altcoin that powers Bittensor’s decentralized machine learning network, has witnessed a 29% price decline in the last month.

This caused its price to trend within a descending channel. Currently exchanging hands at $276.98, TAO has crossed above the upper line of this channel and is poised for further rally. However, the bearish bias towards the altcoin remains significant.

Bittensor Sees Minor Uptick in Buying Activity

A descending channel is a bearish signal. This pattern is formed when an asset’s price consistently moves lower, creating a series of lower highs and lower lows.

The upper line of the channel forms a resistance set at $434.62 for TAO. Conversely, the lower line serves as support, positioned at $254.82.

TAO’s 7% price hike in the past 24 hours caused it to rally above the upper line of its descending channel.

Read more: 13 Best AI Crypto Trading Bots To Maximize Your Profits

When an asset breaks above this line, it is considered a bullish signal. The breakout suggests a potential reversal of the downtrend and the beginning of an uptrend.

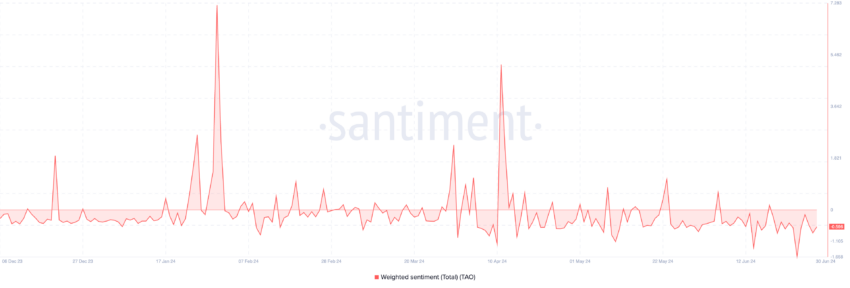

However, despite this, negative sentiment continues to trail TAO. An assessment of the token’s weighted sentiment shows that it has returned predominantly negative values since April.

This metric measures the overall sentiment surrounding an asset by considering both the volume of social media mentions and the polarity (positive or negative) of those mentions.

A negative value of the metric indicates that social media mentions of an asset predominantly express negative sentiments like fear, doubt, and caution. This often hints at a coming decline or confirms an ongoing price dip.

TAO Price Prediction: Is This a False Breakout?

Breakouts can sometimes be false if they occur during periods of low trading volume. If this happens, the price might fall back within the channel. TAO’s trading volume in the last 24 hours has totaled $38 million, rising by 18%.

If its price witnesses a drawback and falls back within the channel, it may exchange hands at $242.55.

However, if it retests the breakout level and continues on its uptrend, it may rally toward $367.59.

beincrypto.com

beincrypto.com