Litecoin (LTC) and Ordinals (ORDI) are experiencing mixed signals in the market, with recent price increases met with technical indicators suggesting potential for further volatility.

Currently, Litecoin (LTC) is priced at $70.66, reflecting a 0.89% increase over the past 24 hours. The market capitalization stands at approximately $5.26 billion, also increasing by 0.89%. However, the 24-hour trading volume has risen by a notable 54.21%, reaching around $524.61 million.

Source: Coinmarketcap

The chart indicates that LTC’s recent support level is around $68.00, a point where the price has rebounded multiple times. Conversely, the resistance level is approximately $71.63, marking the peak before the recent decline.

LTC/USD 1-day price chart, Source: Trading view

The price trend shows a downward trajectory followed by a slight recovery, peaking at $71.63, dropping to $68.00, and currently recovering to $70.41. The 1-day RSI for LTC reads 41.20, suggesting the coin is in oversold territory. Moreover, the 1-day MACD trading below the signal line suggests potential further downward pressure in the short term.

On the other hand, ORDI is currently priced at $35.74, showing a 0.77% increase over the past 24 hours. The market capitalization is around $750.53million, increasing by 0.74%. The 24-hour trading volume for ORDI is approximately $299.59 million, which has surged by 52.89%.

Source: Coinmarketcap

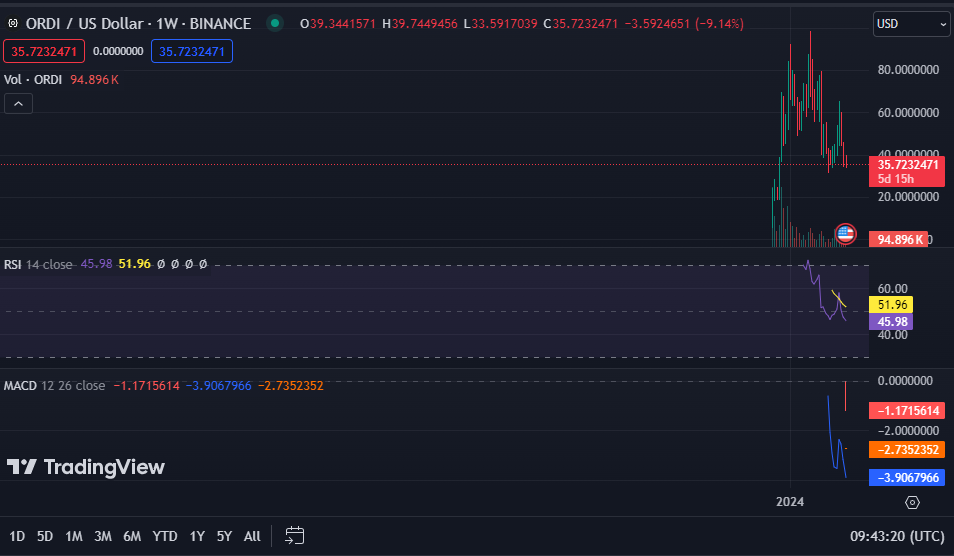

The chart analysis for ORDI shows a recent support level at $34.00, a point where the price has consistently rebounded. The resistance level is around $36. 97, which was the record high point before deterioration in the recent period.The price trend depicts a downward trend followed by a slight recovery, with a peak at $36.97, a drop to $34.00, and a current recovery to $35.50.

ORDI/USD 1-day price chart, Source: Trading view

The 1-day RSI for ORDI reads 45.94, indicating the coin is neither overbought nor oversold but is nearing oversold territory. Additionally, the 1-day MACD trading below the signal line suggests a short-term downtrend.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com