Amid the gradual recovery of the global cryptocurrency market, which now stands at a market capitalization of $2.48 trillion with a 1.6% increase in the last 24 hours, many cryptocurrencies are showing oversold conditions, potentially signaling a “buy the dip” opportunity.

The recent downturn has led to significant sell-offs, pushing several assets into oversold territory. Oversold conditions typically indicate that the selling pressure is overextended, suggesting a potential rebound.

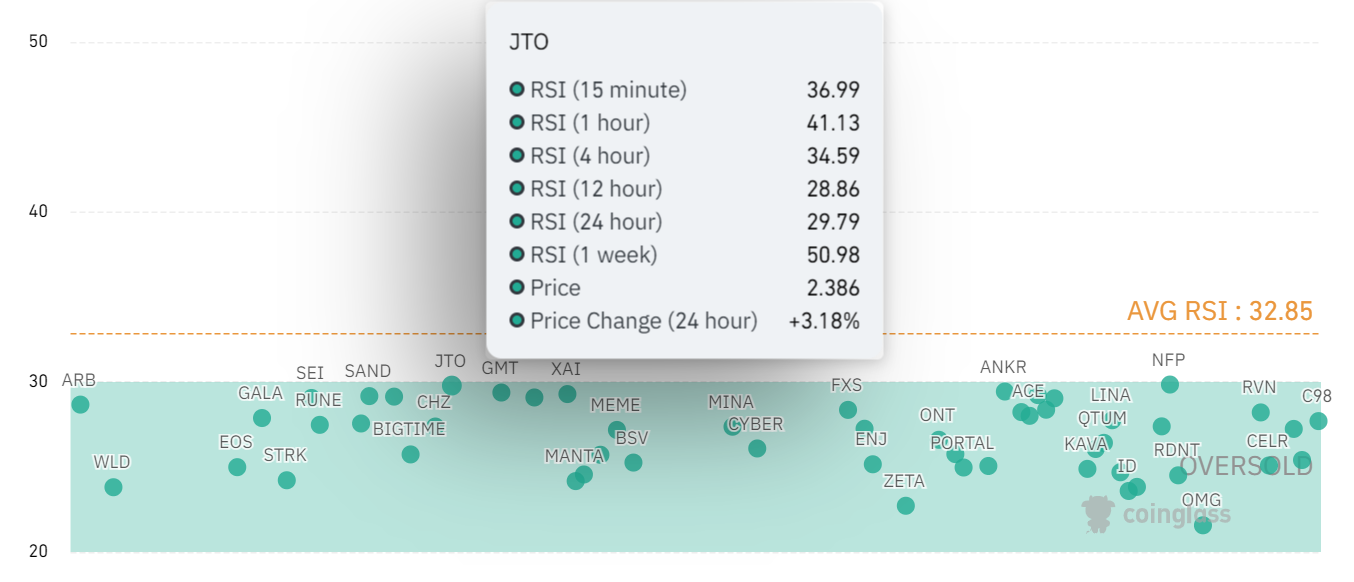

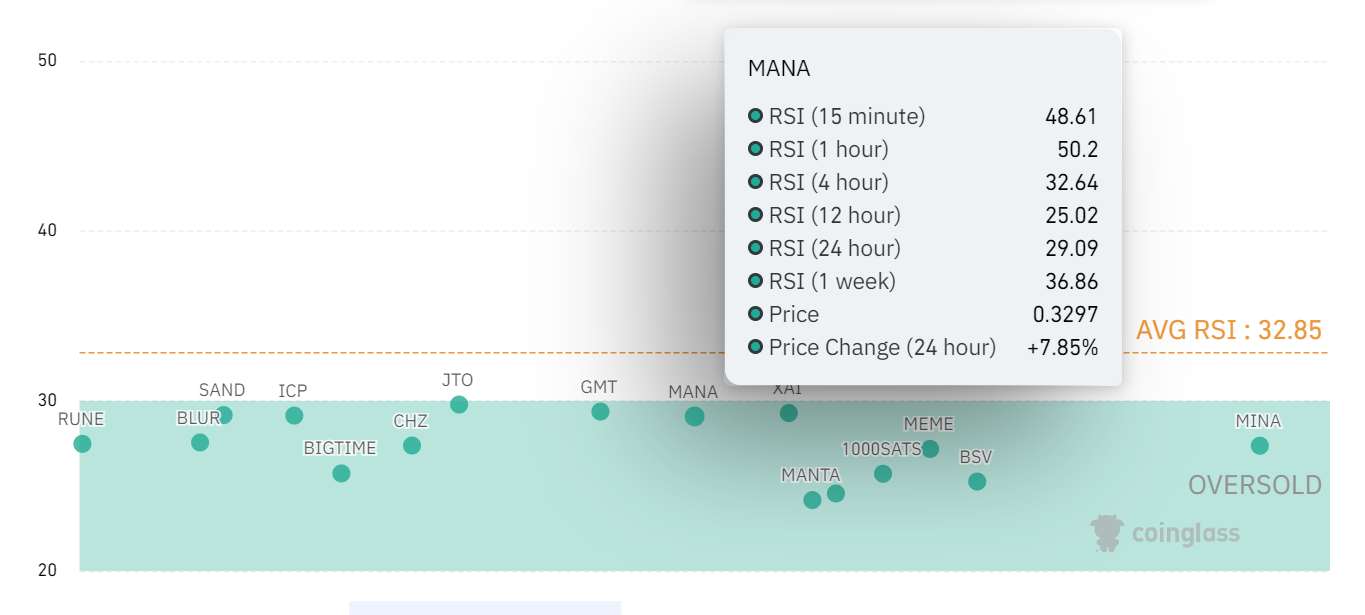

The overall Relative Strength Index (RSI) supports this transition, with an average 24-hour RSI of 32.85, according toCoinGlass. An RSI below 30 generally indicates oversold conditions, suggesting that the asset has been subjected to heavy selling pressure and may be due for a rebound.

While the current average RSI of 32.85 is slightly above the oversold threshold, it indicates that many cryptocurrencies are still near oversold territory and could present buying opportunities.

This near-oversold condition suggests the market may be stabilizing and preparing for a potential recovery.

In this context, Finbold has identified two cryptocurrencies as strong buy candidates for the week based on their RSI levels and other supportive factors.

Jito (JTO)

The RSI for Jito (JTO) across multiple time frames supports a buy decision. The 24-hour RSI is 29.79, close to the critical oversold threshold of 30. An RSI below 30 generally indicates that an asset is oversold and may be poised for a price rebound.

This level suggests that JTO has experienced heavy selling pressure, which could be nearing exhaustion. Additionally, the 12-hour RSI is 28.86, further confirming the oversold condition.

Although the shorter time frames, such as the 1-hour and 4-hour RSIs, are above 30, these values indicate that some short-term buying interest has occurred. This suggests that the asset is beginning to recover from its oversold state, though it has not fully stabilized.

JTO’s price has also increased by 3.18% in the last 24 hours, indicating that a recovery might already be underway. The combination of oversold RSI levels on longer time frames and a recent price uptick suggests that JTO is a compelling buy.

Investors can expect the price to correct upward as market sentiment improves, providing a potential entry point for profitable trades.

Decentraland (MANA)

RSI levels of Decentraland (MANA) across various time frames also indicate strong buy signals. The 24-hour RSI is 29, within oversold territory. This RSI level signals that MANA has been significantly sold off and is likely to experience a price reversal. The 12-hour RSI is even lower at 25.02, further supporting the oversold condition.

Although shorter time frames, such as the 1-hour and 4-hour RSIs, are above 30, these indicate that some short-term buying has occurred, suggesting the potential for a continued recovery. The 7% increase in MANA’s price over the past 24 hours reinforces this outlook.

When an asset’s RSI is below 30 on longer time frames but shows signs of buying interest on shorter time frames, it could indicate that the downward trend is losing momentum and may signal a potential rebound.

The oversold condition on longer time frames, coupled with positive short-term price movement, suggests that MANA is well-positioned to benefit from the broader market recovery.

Both cryptocurrencies are exhibiting oversold RSI levels on longer time frames and signs of recovery in shorter time frames, indicating strong potential for upward corrections.

However, it is essential to consider that RSI should not be used as a single indicator for making investment decisions. Investors and traders should also take into account other technical indicators, market conditions, and fundamental analysis when evaluating potential trades.

Amid these positive outlooks, a cautious and well-rounded approach to investing is always recommended.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com