Livepeer (LPT) has emerged as the top gainer among the top 100 cryptocurrencies with the recent price rally. However, profit-taking could mean a sharp U-turn.

LPT is up by 17.7% in the past 24 hours and is trading at $24.5 at the time of writing. The asset briefly touched an intraday high of $26.16 earlier today. Livepeer’s price rally helped its market cap surpass the $800 million mark, making its way to the leading 100 cryptocurrencies list — currently sitting on the 95th spot.

Moreover, the daily trading volume of Livepeer increased by 108%, reaching $140 million.

Livepeer was launched in 2017 as the first decentralized and open-source live video streaming platform. Its native token plunged to an all-time low of $0.42 in March 2020. However, the 2021 bull run brought LPT to an all-time high of $100.24 on Nov. 9, 2021.

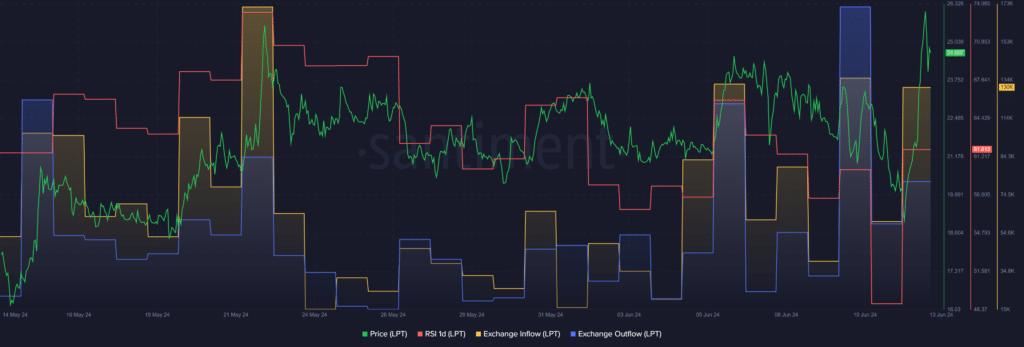

According to data provided by Santiment, the LPT exchange inflow increased by 115% over the past 24 hours — rising from 60,638 tokens to 130,250 LPT coins. The heightened inflows show that some investors, including whales, are aiming for short-term profits.

Data from the market intelligence platform shows that the Livepeer exchange outflow surged by 42% in the past 24 hours — rising from 74,984 coins to 106,630 tokens. This movement shows that some holders are aiming for long-term investments.

Per Santiment, the LPT relative strength index (RSI) rose from 48 to 61 over the past day. The indicator shows that Livepeer is slightly overbought at this point.

Consequently, LPT could potentially witness high price volatility due to the increased trading volume, exchange inflows and RSI.