The privacy coin monero (XMR) has experienced a 7.7% increase in the last 24 hours and a 16.5% rise over the past week.

Monero Trading Volume Doubles in 24 Hours

After a prolonged decline and hitting a significant low in mid-April, monero (XMR) has recovered in value. For instance, on April 13, XMR was trading at $115 per unit, and today, it stands at $181.

Monero and other privacy-focused coins have faced challenges this year, primarily due to multiple delistings from centralized exchanges. Despite notable fluctuations in the crypto asset’s hashrate, XMR’s price has been climbing.

Following a hashrate peak in May, the hashrate dropped significantly at the end of the month due to Europol’s “Operation Endgame,” which targeted botnets and shut down over 100 servers.

This crackdown negatively impacted cryptojacking operations, where mining software illicitly uses people’s CPU power to mine XMR. Over the past 30 days, XMR has increased 37.8% against the U.S. dollar, with a 24-hour trade volume of around $128.82 million.

According to coingecko.com, the most active exchange for monero on June 10, 2024, is HTX. XMR trading volume has doubled since June 9, with tether (USDT) being the most popular trading pair, accounting for 82% of XMR trades. Other popular pairs include USD, BTC, EUR, and ETH.

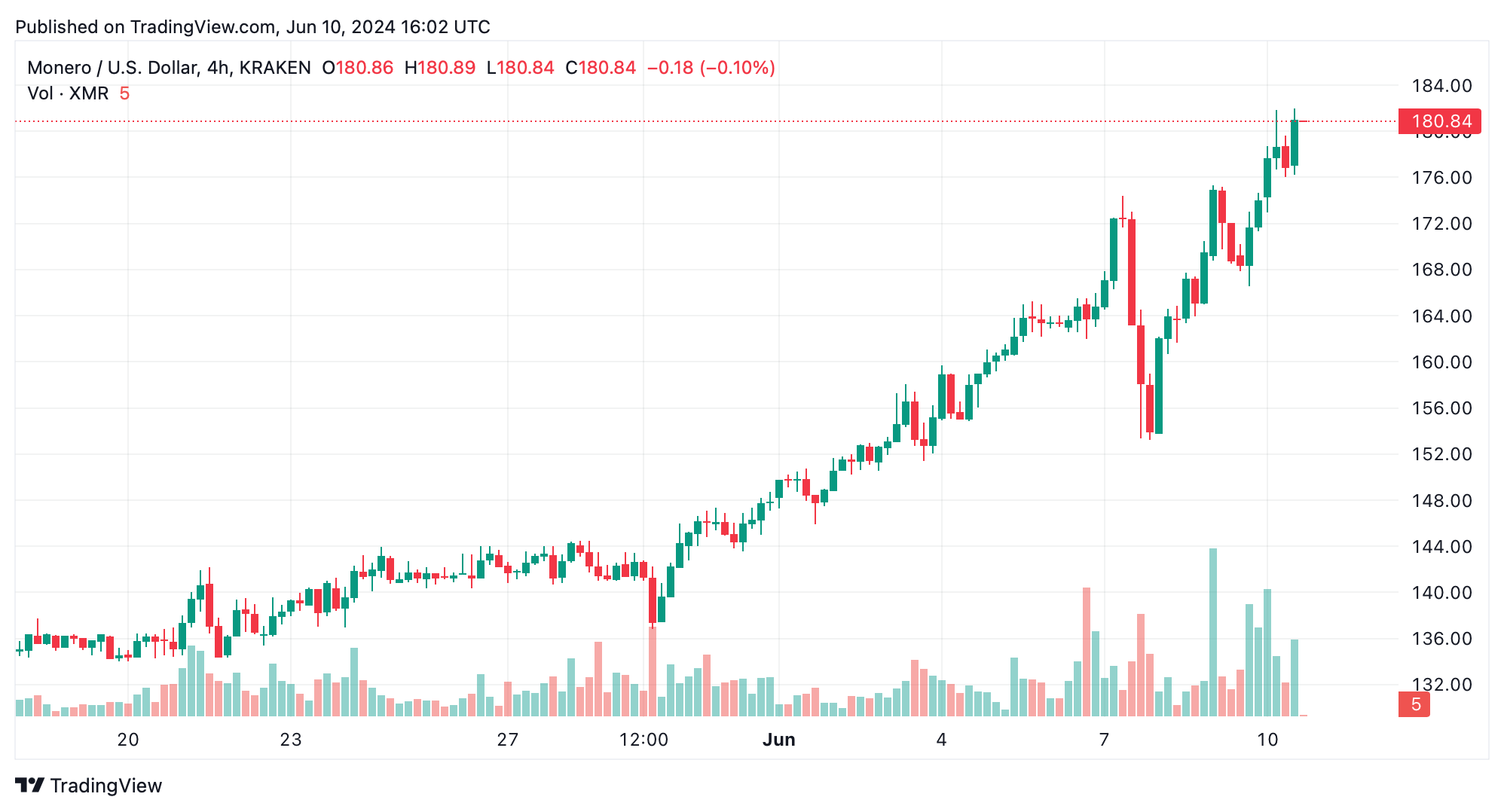

XMR charts show a strong bullish trend across various timeframes. The daily chart indicates a significant upward movement from mid-May, with prices rising from approximately $130 to the current $181.

This uptrend is supported by increasing volume, suggesting strong buying interest. Key support levels are at $170, $160, and $150, with the next resistance level around the psychological $190 mark.

The relative strength index (RSI) on the XMR/USD daily chart suggests the asset might be nearing overbought territory, indicating a potential pullback. On the 4-hour chart, the bullish momentum continues with higher highs and higher lows, aligning with the daily analysis.

Immediate support levels are around $176 and $172, with resistance near $185 and the next potential resistance at $190. Moving averages across different timeframes signal a bullish trend, reinforcing the uptrend’s strength.

Oscillators provide mixed signals, with the RSI nearing overbought levels, suggesting caution for new entries. Overall, XMR’s technical indicators suggest a continuation of the bullish trend, with attention to resistance levels for potential profit-taking.

What do you think about monero’s market performance? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com