Uniswap’s (UNI) price had a rather interesting 24 hours as the Ethereum-based altcoin escaped the bears.

The question now is whether, with the help of investors, it can continue its journey of recovering its March losses.

Uniswap – Good to Buy?

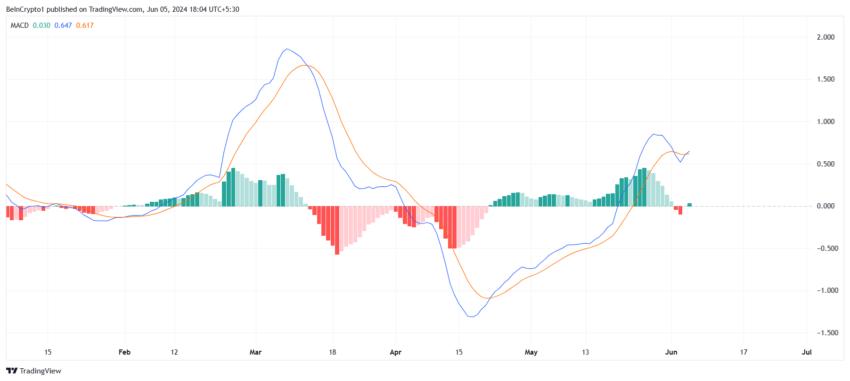

Uniswap’s price rise was bullish, as it put the altcoin back in the growth race and saved it from a downtrend. This is reflected in the Moving Average Convergence Divergence (MACD) indicator.

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It helps identify potential buy or sell signals based on crossovers, divergences, and the strength of the trend.

UNI observed a bearish crossover a day before the rise, its first in over a month and a half. However, as the rally restored the bullish crossover, the indicator quickly put this to rest.

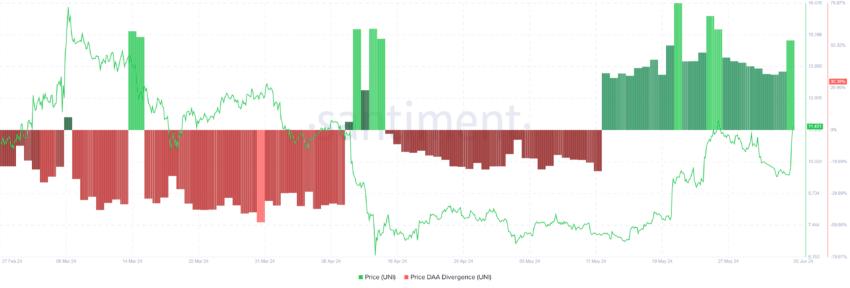

This rise also inflicted optimism among investors, with participation going up. As a result, the price daily active addresses (DAA) divergence began flashing a buy signal. Price DAA divergence refers to the discrepancy between a cryptocurrency’s price movement and the number of unique addresses actively transacting daily.

Read More: How To Buy Uniswap (UNI) and Everything You Need To Know

It is flashing a bullish sign for the altcoin, which could favor its rise.

UNI Price Prediction: Multi-Week Barrier Stands Strong

Uniswap’s price has been trading below the $11.6 resistance level for nearly two months. The altcoin was vulnerable to further decline, hovering below $10 yesterday before rallying by 20% in 24 hours. This rise brought it closer to the key resistance.

Breaching this barrier is important as it would enable UNI to reclaim $12 as support and head towards breaking past $13.1.

Read More: Uniswap (UNI) Price Prediction 2023/2025/2030

However, failure to do so may cost the altcoin this 20% rise, as Uniswap’s price could fall back to $10 or lower. Testing the critical support at $9.0 will invalidate the bullish thesis.

beincrypto.com

beincrypto.com