Thinking of going long on crypto? Check out our list of the best crypto to hold right now, including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

The rise of meme coins has popularized short-term crypto investments, especially among people looking for quick profits. A recent CoinGecko report indicated that meme coins were the most profitable cryptocurrencies in Q1 2024, with popular ones posting average yields of more than 1312%.

However, these coins have a high risk of volatility, which may lead to significant losses. As such, some hopeful crypto investors would rather resort to less hyped but relatively more stable crypto coins for long-term investment.

But not every cryptocurrency is built for the long haul. Finding the best cryptos to buy and hold requires some research on your part. It would help if you examined their underlying fundamentals, the size of their ecosystems, and their use cases within and outside those ecosystems.

Additionally, you will need to consider their value proposition and potential for long-term growth and adoption. In this article, we have considered all that and created a list of the top 5 cryptos to hold. Read on to find out more.

Table of Contents

Bitcoin (BTC)

Having Bitcoin on the list of best cryptocurrencies to hold long term is a no-brainer. Not only is it the oldest cryptocurrency in existence, but it boasts the highest market capitalization, at more than $1.3 trillion, which is currently about 53% of the entire crypto market’s value.

Data from the investment platform Curvo shows that Bitcoin has delivered triple-digit annualized returns for over ten years. It was also among the best-performing assets globally between 2011 and 2023, per data collected by market analyst Charlie Bilello.

Asset Class Returns since 2011… pic.twitter.com/k11MGG6zmR

— Charlie Bilello (@charliebilello) January 1, 2024

Furthermore, the greenlighting of spot Bitcoin exchange-traded funds (ETFs) in January 2024 gave institutional investors access to the cryptocurrency, giving it a measure of mainstream legitimacy.

A look at Bitcoin’s all-time price chart above shows that, in between a few dips, the coin’s value has increased over time and is currently trading at some of the highest levels it has been at since its launch in 2009.

Additionally, Bitcoin’s scarcity makes it a good candidate for those looking to buy and hold. Scarcity often breeds value, and only 21 million Bitcoins will ever exist, meaning there’s a high chance its price will go up even further in the future. Some experts like ARK Invest CEO Cathie Wood have suggested the price of Bitcoin could rise to as much as $1.5 million by 2030.

Bitcoin’s biggest downside is that the blockchain wasn’t built to support decentralized applications (dapps) or non-fungible tokens (NFTs). As such, it may limit its functionality and use cases and disadvantage it against other blockchains and cryptocurrencies.

Ethereum (ETH)

Ethereum is the second-largest crypto asset by market cap after Bitcoin, and as such it qualifies to be one of the top 5 crypto to hold. It has great potential as a long term investment. The project offers a wide range of utilities, a solid use case, and ongoing improvements.

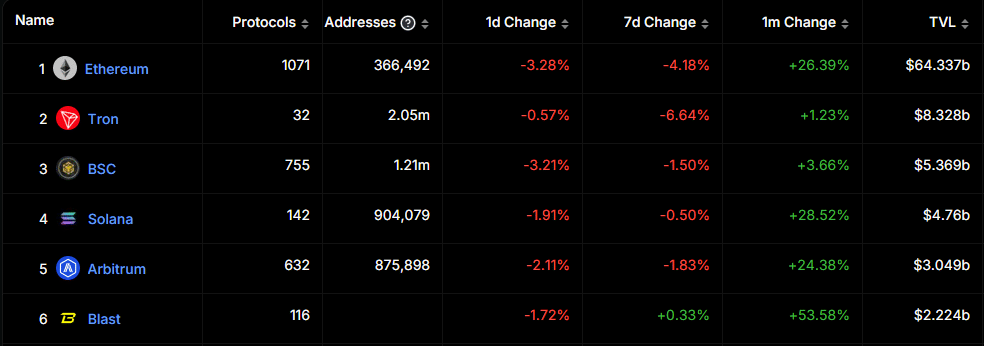

The blockchain’s total value locked (TVL) currently exceeds $64 billion, nearly three times more than its next five competitors combined.

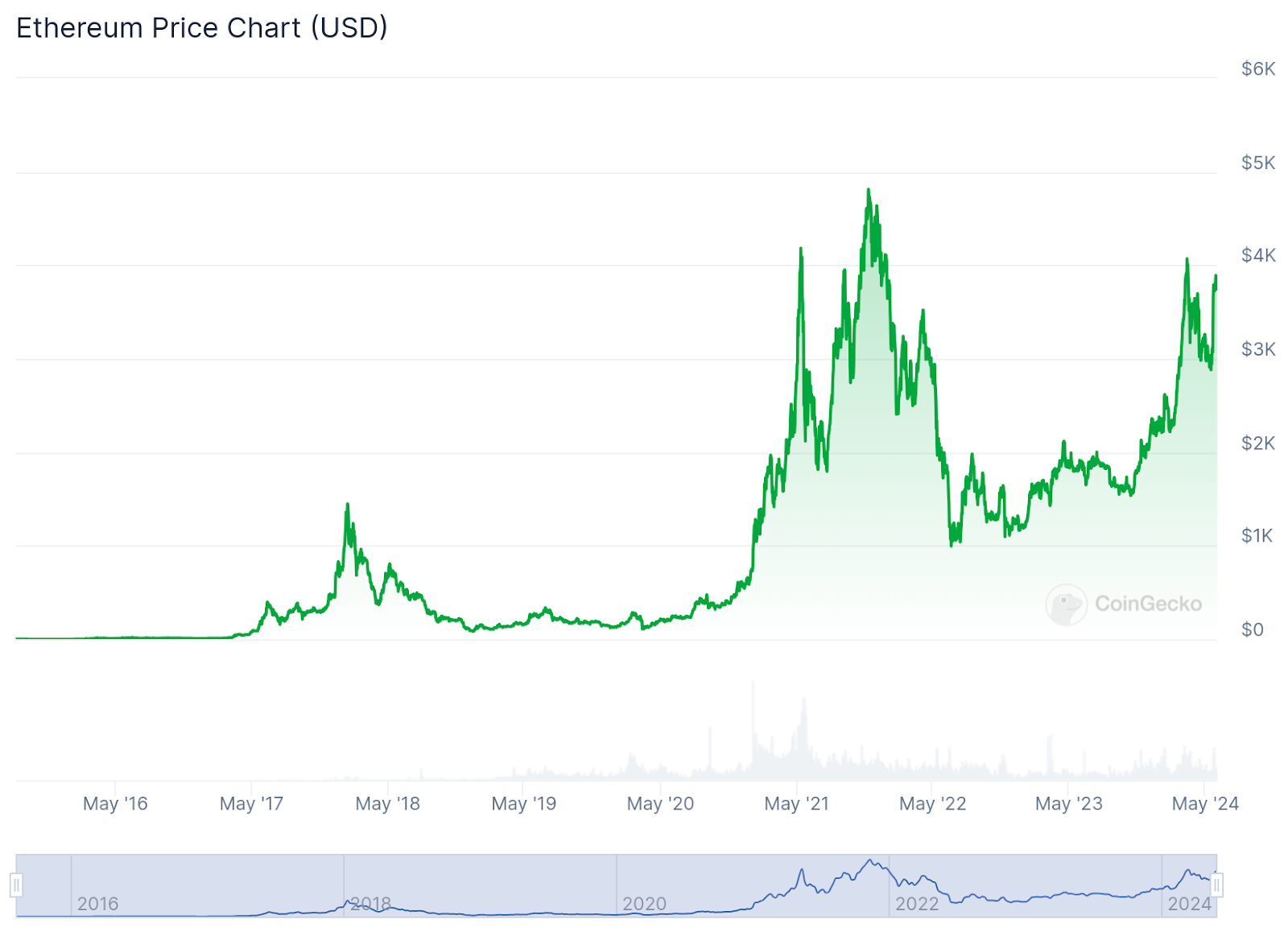

Furthermore, since its launch in 2014, when ETH changed hands at just $0.31, the token has shown impressive growth. It reached a new all-time high (ATH) in 2021 but then experienced a decline during the 2022 crypto winter. However, 2023 saw a rebound, with ETH hitting a yearly high of $2,120 in April.

2024 has been a strong year so far, with ETH nearing its all-time high again in March when it reached $4,067.

According to data from CoinGecko, if you bought ETH a year ago and held on to it, your investment would have been up nearly 100% at the time of this writing.

When deciding whether to buy and hold ETH, it’s crucial to consider its long-term utility, which is among the best in the crypto space. Not only does it house a large chunk of the dapp and decentralized finance (defi) sectors, but its ERC20 standard is used by some of the most engaging projects in crypto, including meme coins such as Pepe (PEPE), Shiba Inu (SHIB), and Floki (FLOKI).

Additionally, the recent approval of Ethereum ETFs by the U.S. Securities and Exchange Commission (SEC) also bodes well for ETH’s future. Considering all of the above, Ethereum makes sense as a crypto that you can buy and hold.

Best altcoins to hold

Solana (SOL)

Aside from the crypto heavyweights Bitcoin and Ethereum, one of the best altcoins to hold could be Solana. The coin saw significant growth in the first quarter of 2024, moving from the $83 range in January to more than $202 in April.

With a market cap north of $76 billion and daily trading volumes consistently above $2 billion, per data from CoinGecko, Solana’s market activities indicate strong investor confidence.

The blockchain was designed for high-speed, high-volume transactions at lower costs, and it supports tens of thousands of transactions per second. This makes it a serious contender to Ethereum for dapps, decentralized finance protocols, and non-fungible tokens.

Furthermore, the growing demand for faster and cheaper transactions could drive Solana’s adoption, which many expect to continue expanding as more use cases emerge.

Despite aiming for high security and transparency, Solana has faced several network outages and performance issues, raising concerns about its reliability. Additionally, its association with Sam Bankman-Fried, the disgraced founder of FTX, negatively impacted its reputation and led to a drop in its price.

However, the coin still registered impressive growth over the last year. CoinGecko’s data shows that anyone who bought SOL a year ago and held it would have been nearly 690% richer at the time of this writing.

Solana currently has the fourth-largest TVL amongst blockchains and boasts a $230 billion ecosystem, per figures from CoinMarketCap. Additionally, it has introduced valuable use cases such as Solana Pay, which allows consumers and merchants to connect directly via the blockchain, handling transactions in SOL or a stablecoin with instant settlement and virtually no fees.

The blockchain is also exploring the mobile space. In 2022, it launched the Saga, a web3-enabled smartphone aimed at onboarding more users to crypto by making it easier to interact with decentralized applications.

Given Solana’s current fundamentals and ongoing developments, many experts see it as one of the best coins for holding. A VanEck report from October 2023 even predicted a staggering 10,600% price rally for Solana by 2030, potentially putting its price around the $3,200 range.

Chainlink (LINK)

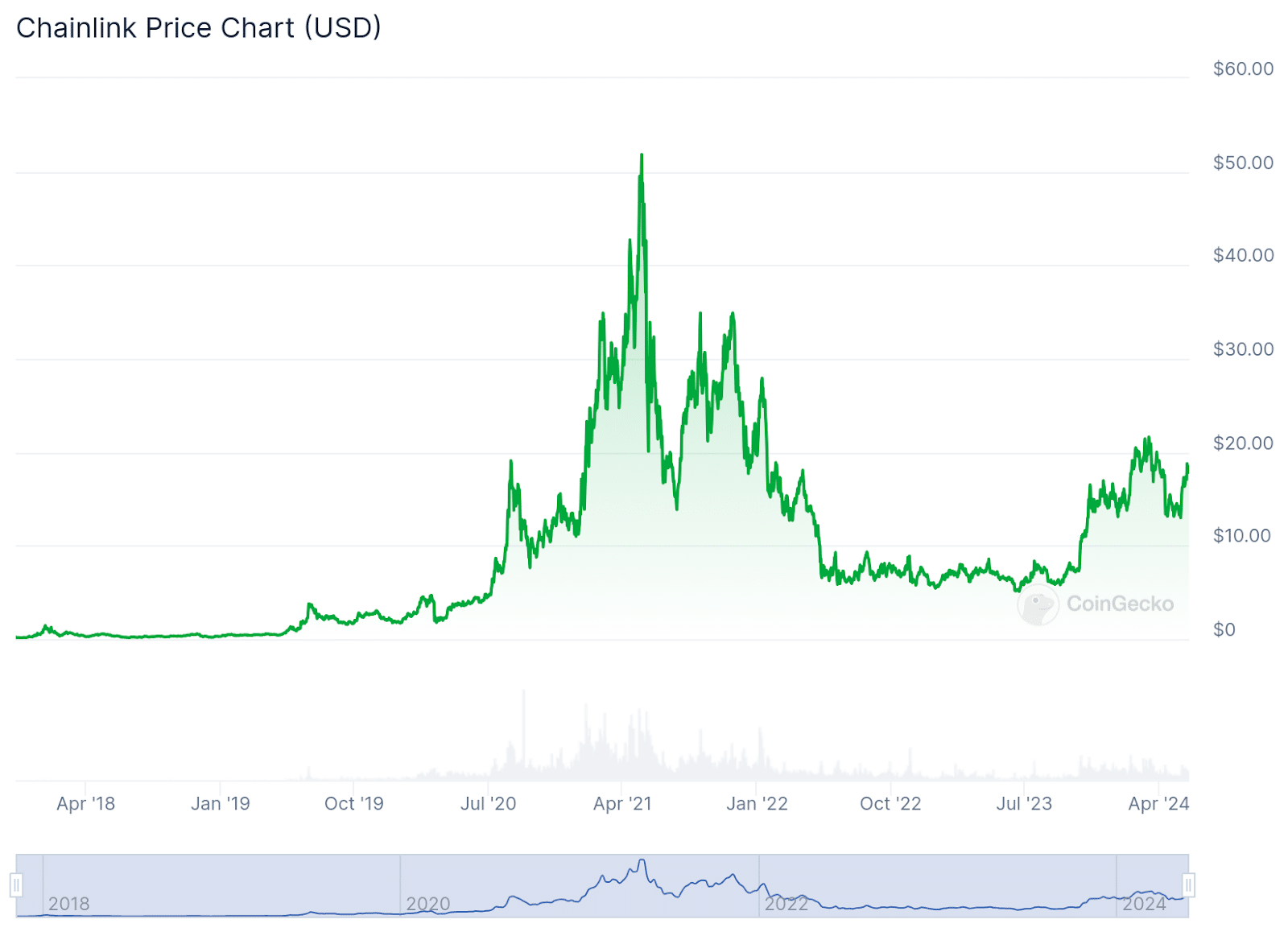

Another altcoin that could be worth a long-term punt is Chainlink (LINK). It has seen a meteoric rise from its modest beginnings at $0.29, achieving a staggering 4,790% increase between 2018 and 2023. When considering Chainlink’s all-time high of $52.88, the increase becomes an incredible 18,134%.

At the time of writing, LINK was priced at $17.99, with a daily trading volume of $558.4 million. Though currently 65% lower than its ATH price, its year-to-date performance is still a solid 178%, with a 30-day gain of 38.7% as of May 31, 2024.

Chainlink boasts a market capitalization of $10.7 billion, indicating its robust potential for future growth. Although this market cap pales in comparison to Bitcoin’s current $1.3 trillion valuation, some feel that LINK’s potential and utility could surpass Bitcoin, which primarily functions as a decentralized store of value.

While predicting the market may be challenging due to its volatility, Chainlink boasts numerous core strengths and innovations that could cement its long term position in the blockchain and defi space.

It offers a decentralized oracle network that connects smart contracts on blockchain platforms to real-world data sources. This decentralized structure eliminates single points of failure, enhancing security by using a distributed network of node operators.

The platform is extensively used in defi to integrate real-world data into decentralized applications and smart contracts. It is crucial for price feeds, lending protocols, insurance products, and more within the defi ecosystem.

Additionally, Chainlink has partnered with Google Cloud to bring decentralized oracle capabilities to the cloud platform, enabling smart contract developers to integrate real-world data seamlessly.

It has also integrated with the Tezos blockchain and has a significant presence on the Binance Smart Chain (BSC). On Tezos, Chainlink is used to enhance Tezos-based smart contracts with secure and reliable off-chain data while providing decentralized oracle services for BSC ecosystem projects.

Another collaboration that could solidify Chainlink’s position in mainstream financial services and its long term future is the one it has with SWIFT, which aims to connect traditional banking systems with smart contracts through secure and reliable data feeds.

Considering all of the above, it is not unreasonable to think Chainlink may have a secure long term future and could possibly be one of the best altcoins to hold.

Avalanche (AVAX)

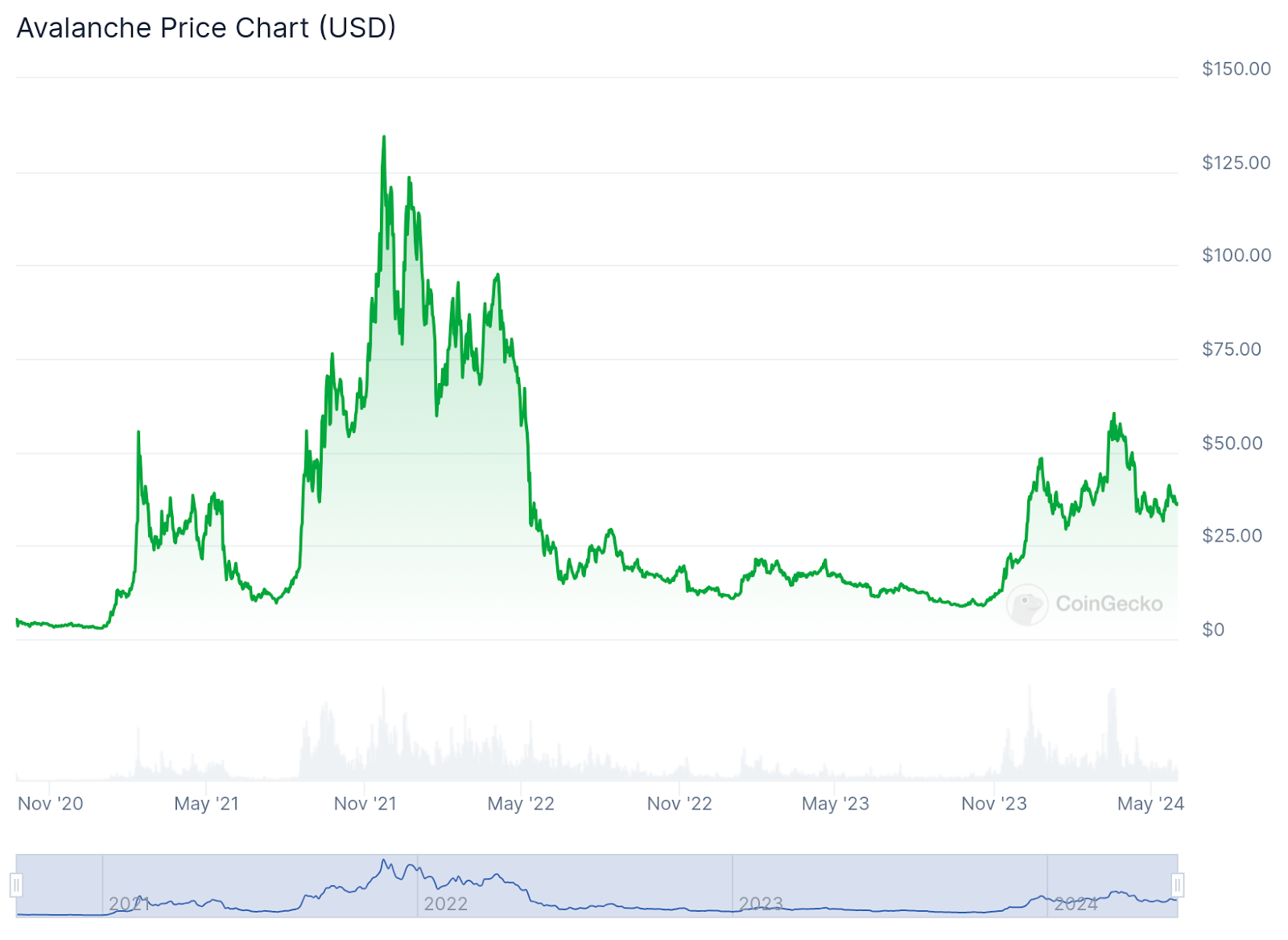

Avalanche (AVAX) is a layer-1 blockchain launched in 2020. It was spearheaded by software engineers Emin Gun Sirer, Kevin Sekniqi, and Maofan Yin. They designed it with smart contract capabilities, positioning it as a challenger to Ethereum.

Over the past year, AVAX has surged by over 156%, thanks to its solid market position, robust fundamentals, and high network performance, often rivaling Ethereum in key benchmarks.

The recent surge in the cryptocurrency market, including major coins like BTC and ETH, has also bolstered AVAX.

At #13 on the list of the largest cryptocurrencies by market cap, AVAX is possibly among the best cryptos to buy and hold. Several factors drive us to this conclusion.

For one, the network has secured partnerships with established projects and companies like Chainlink, BiLira, and Biconomy. This has attracted many users and developers, rapidly expanding its ecosystem. The blockchain is also used for GameFi projects that merge online gaming with decentralized finance.

Avalanche has also teamed up with payment firm Stripe to simplify crypto on-ramping. The partnership, announced in April 2024, is meant to enable users to engage with dapps on Avalanche by purchasing AVAX directly through Stripe within the Core wallet, Avalanche’s native wallet and portfolio application. Analysts have suggested that this integration could give Avalanche a wider reach.

Looking at its roadmap, the network is also poised to introduce further innovations and improvements, enhancing scalability through subnets, expanding interoperability with other blockchain ecosystems, and continuously improving user and developer experiences.

While Ethereum currently operates on a much larger scale, Avalanche’s scalability may offer it a long term advantage, especially if Ethereum delays its speed and scaling enhancements. If that were the case, then it could see Avalanche take away some business from Ethereum, consequently growing its own ecosystem.

Considering all the above, analysts have predicted that the price of AVAX could potentially go up to as high as $478 by 2030, making it a good option for those looking for crypto coins for long term investment.

Conclusion

As we have seen, the allure of meme coins and their astronomical gains might be tempting; however, they come with substantial risks and volatility. So, for those eyeing the best cryptocurrencies to hold long-term, focusing on coins with solid fundamentals, robust ecosystems, and clear use cases is essential.

The cryptocurrencies listed here, from the pioneering Bitcoin and Ethereum to promising altcoins like Solana, Chainlink, and Avalanche, all exhibit characteristics that suggest significant long-term potential.

Keep in mind, though, that this is not financial advice. You should conduct thorough research and consider the value propositions and growth prospects of these cryptos before investing in any of them.

FAQ

What are the best crypto to hold for 5-10 years?

When considering long-term cryptocurrency investments, focus on those with strong fundamentals and significant use cases. Bitcoin, Ethereum, Solana, Chainlink, and Avalanche are five such cryptocurrencies that exhibit the characteristics necessary for long-term growth and stability. However, it’s important to conduct thorough research and consider your own risk tolerance before investing.

What is the best way to hold crypto?

The best way to hold crypto depends on your priorities for security, accessibility, and ease of use. The main options include hardware wallets, software wallets, mobile wallets, paper wallets, and exchange wallets. For maximum security, use a combination of hardware wallets for long-term storage and software or mobile wallets for more accessible, everyday use.