Bitcoin Cash price reached a 10-day peak of $478 on May 17, but compared to the likes of Solana, BCH has underperformed this week.

On-chain data shows that investors on the BCH network have considerably increased the spate of large-ticket transactions this week, raising hopes of an imminent price breakout.

BCH price mirrors market rally with 16% gains in 3 days

Mega-cap crypto assets witnessed a significant demand surge this week, thanks to cooler-than-expected inflation observed in the latest US CPI data reports on May 13.

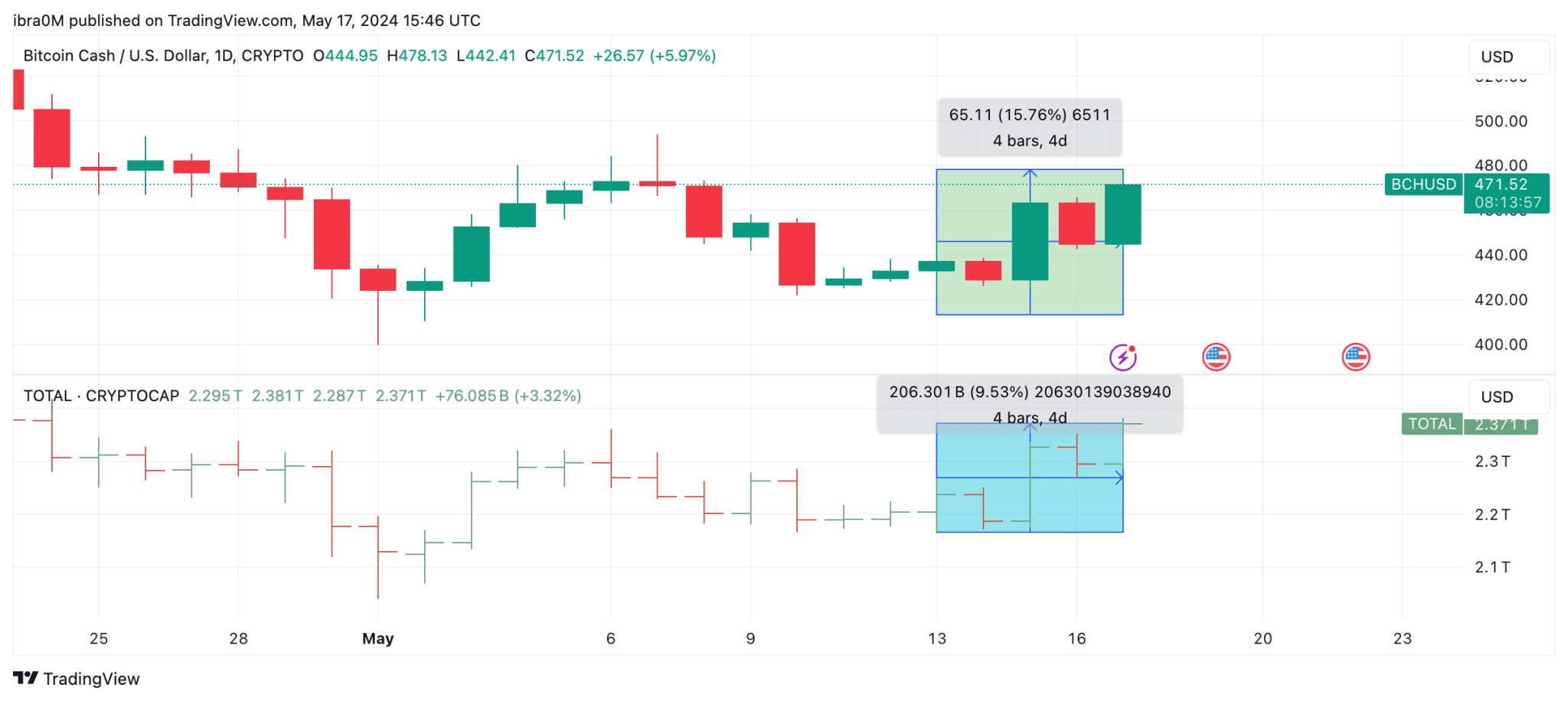

The global crypto market capitalization has jumped 9.5% this week, pulling in $200 billion capital inflows in the process, according to the TradingView chart above. Notably, the likes of Solana (SOL) and PEPE have dominated the top gainers’ chart. However, with a 15.8% upswing in the last 3 days, BCH price action is not far behind.

At the time of publication on May 17, BCH price has surged 6% within the 24-hour timeframe, crossing the $470 mark for the first time in 10 days.

Investors are placing bigger bets anticipating BCH another breakout

Bitcoin Cash’s 15.8% uptick in the last 3 days is nothing to scoff at. However, on-chain data trends suggest investors are making strategic moves to front-run another leg up in the ongoing BCH rebound phase.

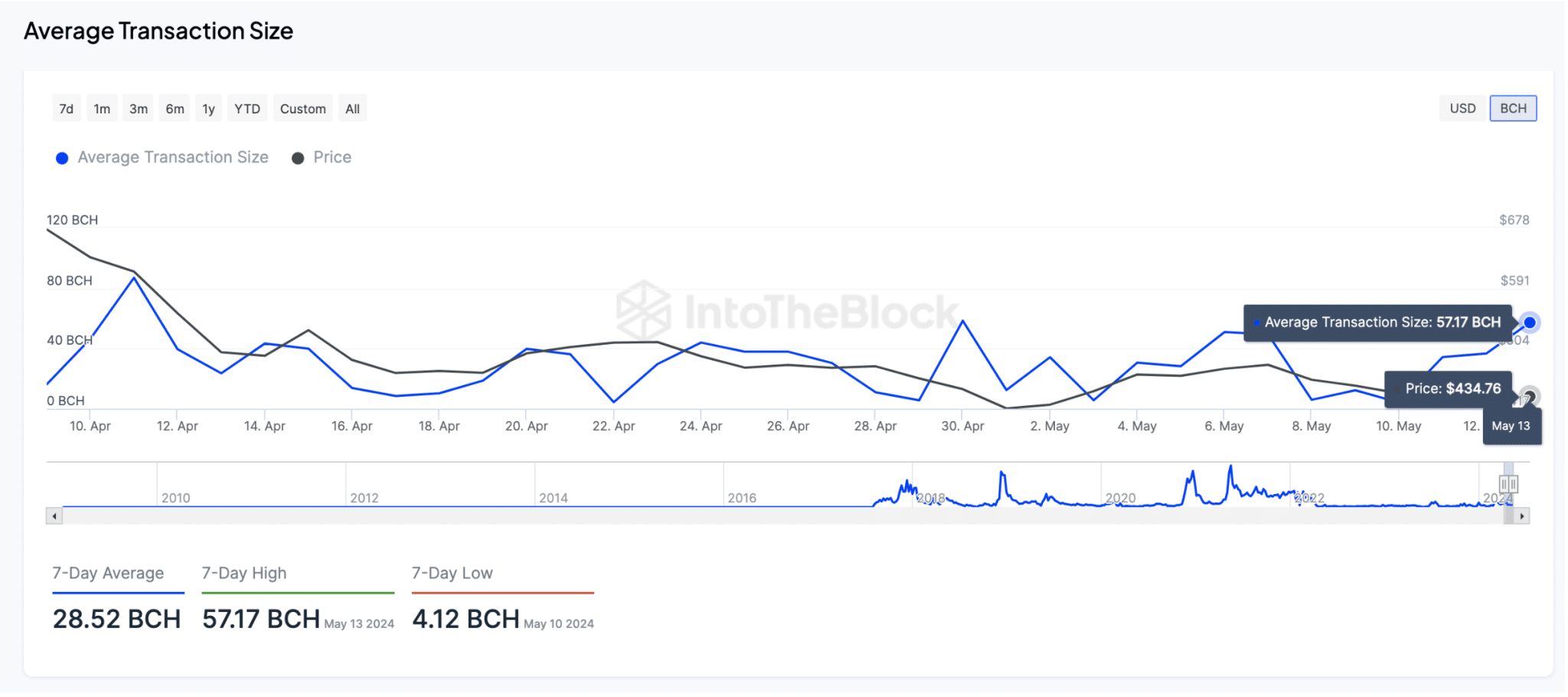

IntoTheBlock’s chart below represents the average size of all transactions executed daily on the Bitcoin Cash network, providing real-time insights into investors’ sentiment towards the current price trend.

As seen above, Bitcoin Cash average transaction has been on the rise over the past week. On May 13, it surged to a monthly peak of 51.2 BCH, reflecting a remarkable 500% increase from the local low of 4.1 BCH recorded on May 10.

Typically, strategic investors may view such considerable increase in average transaction size as a prime bullish signal for two key reasons.

First, larger transactions often indicate the involvement of institutional investors or high-net-worth individuals.

These entities usually conduct thorough market analysis before making substantial investments, signaling their confidence in the asset’s potential for growth. When institutional players enter the market, it often leads to increased liquidity and stability, encouraging other investors to follow suit.

Secondly, a rise in average transaction size amid a market wide rally suggests that Bitcoin Cash is being used for significant financial activities, such as large-scale payments or purchases.

These factors could combine to propel BCH price to new heights in the second half of May 2024.

BCH Price Forecast: $500 Milestone Now Within Reach

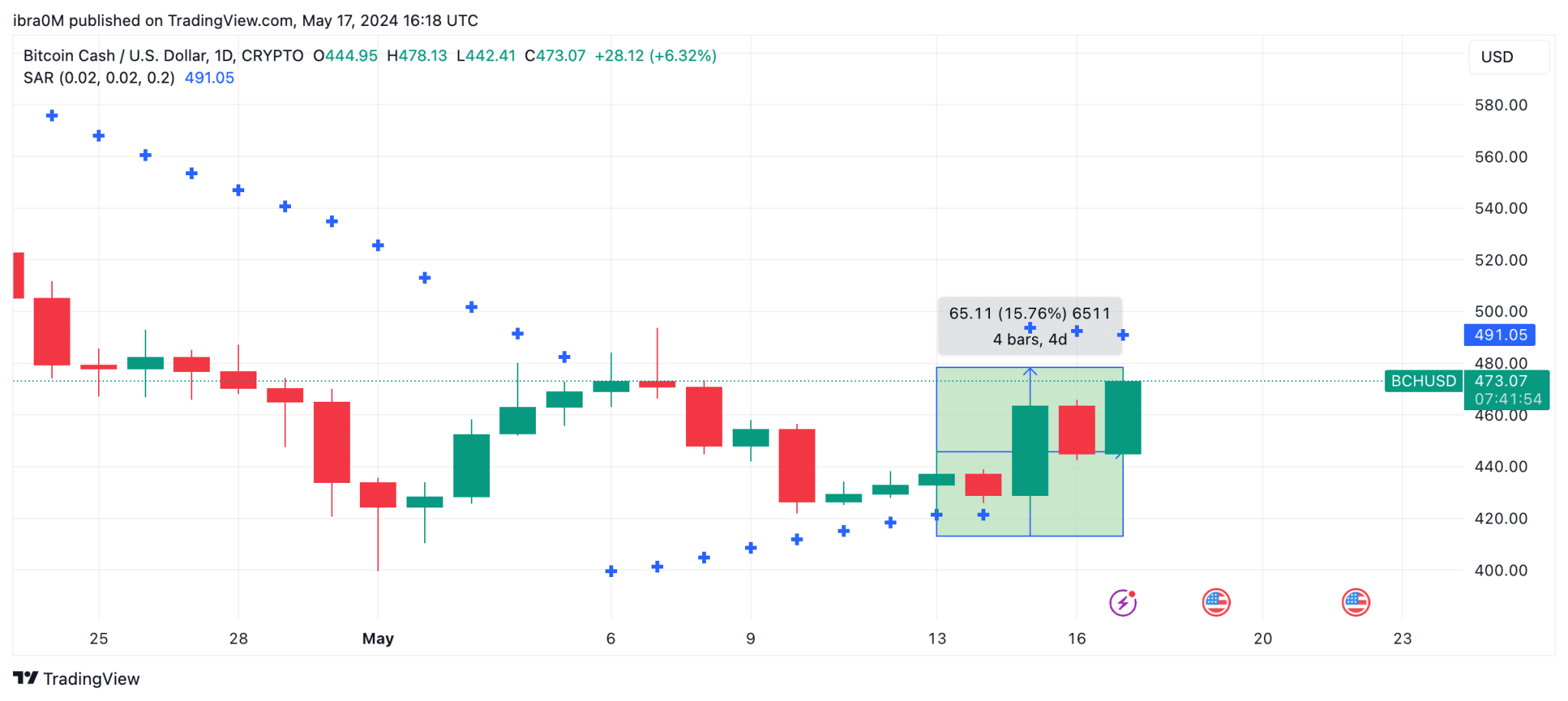

Bitcoin cash price has reached the $472 mark at the time of writing on May 17, up 15.8% in the last 72 hours. However, the 500% surge in the daily average transaction size suggests BCH price is now likely to charge towards the $500 territory in the days ahead.

But notably, the Parabolic SAR technical indicator currently points towards $491, which is higher than the current BCH price at $472.

This alignment suggests that the bears still have significant leverage and could mount a major resistant sell wall at the $491 level. If investors keep executing large ticket BCH transactions, it could generate additional momentum to propel Bitcoin Cash price towards $500 as predicted.

But if, on the contrary, investors opt to take a more cautious approach, a reversal towards the $450 psychological support could be on the cards.

thecryptobasic.com

thecryptobasic.com